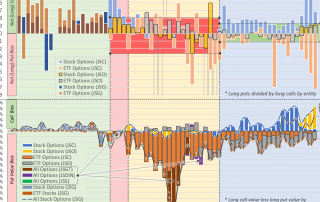

"The mind is not a vessel to be filled but a fire to be kindled.."Plutarch The comment has been made here before, likely more than once: As we go along the path of our research, our ability to see - to interpret the data, and the shapes that are formed from that data - tends to improve. This is not only true of newer shapes forged from amalgamations of newer data - and additional sources - but of older shapes, as well. Recently, I stumbled over a series of charts first published in July 2019 in the Feed post, "Ranking Strategy Speed for Top Quants, Market Makers," which remains among our more fascinating discoveries. Therein, we compared average stock position sizing for a list of notable trading and hedge fund firms, from Renaissance Technologies (RenTech), D. E. Shaw, and Two Sigma to Jane Street, Hudson River Trading (HRT), and Tower Research Capital (TRC). Citadel Securities and Susquehanna Securities were in the mix, as well. The rankings were roughly delineated between [...]