Robinhood’s Trailing Stop Orders: Extreme Profitability, By Design

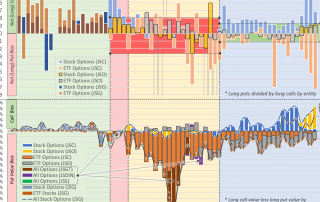

"They make it so easy." - Richard Dobatse, Robinhood user (via New York Times) "A fool and his money are soon parted." - Thomas Tusser, poet Imagine if you knew, ahead of time, exactly what bait to use? Not only which bait to attract and influence the behavior of specific customers, but how to package the output of those behaviors - into an additional form of bait - in such a way as to leverage US listed market structure and maximize the probability of financial windfall. If so, chances are, you would share some of the vision that the founders of retail trading app and rising zeitgeist symbol, Robinhood, did circa 2013... Now, the fact that Alphacution has been beating this drum for four weeks in a row (starting here, here and then here) is unintentional and unrehearsed. Certainly, we much prefer that our riffs come with a level of variety - and we will return to that variety shortly. However, as we have been grinding the numbers around order [...]