Alphacution Press: Forbes on Robinhood

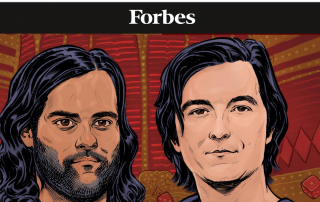

“The perfect stock trading app for the videogame generation was supposed to “democratize finance” with zero-commission trades. But the primary plan was to get rich by selling customer trades to the market’s most notorious operators.” – by Forbes Staff Writers Jeff Kauflin, Antoine Gara, and Sergei Klebnikov Alphacution contributes to Forbes development of story on Robinhood, “The Inside Story Of Robinhood’s Billionaire Founders, Option Kid Cowboys And The Wall Street Sharks That Feed On Them” (August 19, 2020).