“Our comforting conviction that the world makes sense rests on a secure foundation: our almost unlimited ability to ignore our ignorance.” – Daniel Kahneman

Chances are, “global pandemic” wasn’t in your bag of quantamental factors; at least not by any name other than slippage. But now that that cat is out of that bag – and, rightly or wrongly, the wheels of a response strategy have largely been set in motion – the least we should do against a backdrop of historically significant uncertainty (aka – risk) is widen our lens as to the new spectrum of future market contagions that have suddenly become more probable…

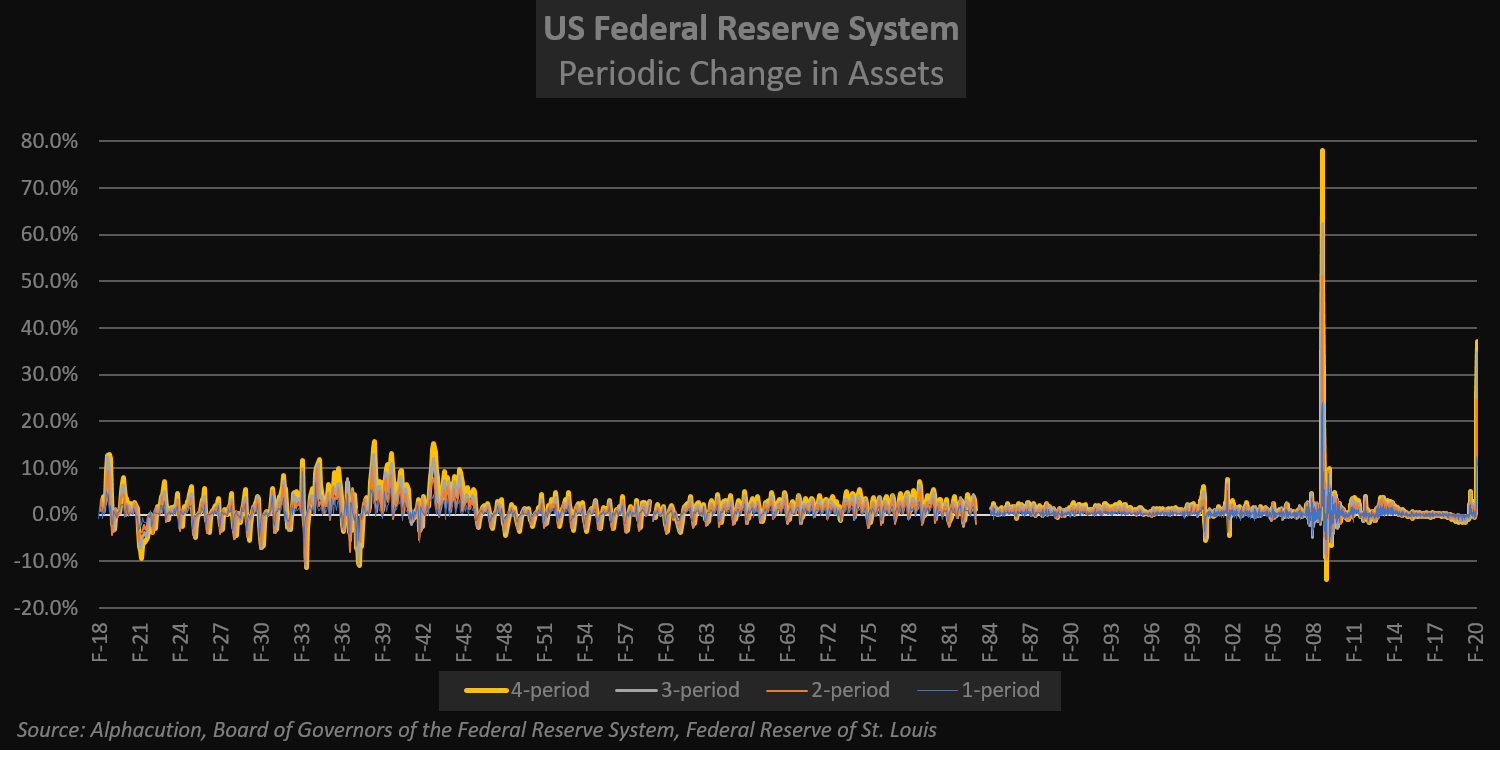

Of particular note, keep your eye on a little thing that isn’t widely discussed in polite society: the Fed’s balance sheet. As of April 1, the chart below illustrates over a century of total assets for the US Federal Reserve system – ironically, since around the time of the last global pandemic (in 1918). What you are seeing there at the recent end of this time series is a 37% increase since March 4, 2020.

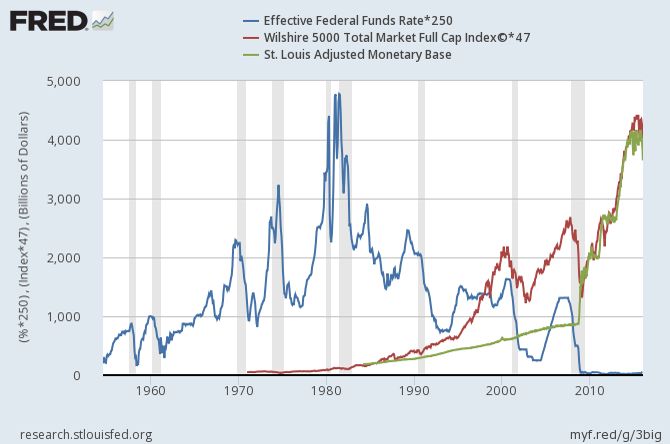

Now, this picture might be vaguely familiar to those of you who were closely tracking the Global Financial Crisis (GFC) that began in 2008 and resulted in the Troubled Asset Relief Program (TARP) and at least 3 rounds of quantitative easing; a chapter in US financial history that resulted in more than $3 trillion being printed into existence and warehoused on the Fed’s balance sheet, most of it still sitting there to this day.

Of course, we are still in very early innings of the fiscal component of the strategy response to COVID-19, with no clarity on the duration and nature of its impacts. And, while the Fed’s balance sheet will continue to balloon with more newly printed assets to be warehoused (presumably ad infinitum), the comparison with the GFC – a 78% increase in Fed assets from September 17, 2008 to October 15, 2008 – looks like this, over the same period:

One more picture worth sharing: In the chart below, monetary and fiscal policy conspire to directly and indirectly lift stock market asset prices from the perilous trough of the GFC, thus further rendering it more a tool of public psychology than of capital formation and asset pricing…

Although it is the tool with the path of least resistance and greatest speed, there are a long list of problems with the Fed’s continued spraying of freely printed money into the economy. Here are two: 1) Unlike the GFC, the Fed has now become the lender of last resort for more than one or two sectors of the US economy (including a broad swath of citizens), and 2) this comes with the backdrop of a long term deficit spending regime that is about to see its deficits explode on the basis of dramatically decreased tax revenue. In other words, the idea of printing our way out of this mess without breaking some other part of the framework is a scenario whose probability is shrinking by the day – and being replaced by the increasing probabilities of other scenarios…

Hint: You should (calmly and methodically) be preparing for scenarios that have not been previously contemplated in your lifetime…

Until next time, please stay safe…