“The most cost-effective way to trade options. Instead of paying to trade, you get something back.”

Public.com website, February 8, 2024

Open to the Public Investing, Inc. (OTTP) – better known as “Public.com” – has tried to brand itself as the anti-PFOF alternative for retail investors. In the early aftermath of the Gamestop-led meme craze that erupted in Jan 2021, Public.com ran to their megaphone to solidify this position by proclaiming, “We’re Officially PFOF-Free!”

An optional tipping feature became Public.com’s replacement payment mechanism for stock trading in a bid to distinguish itself from its embattled competitor, Robinhood Markets, and to show what the “democratization of finance” actually looks like without the obvious conflicts of interest represented by the most aggressive version of the PFOF mechanism embedded in a highly gamified “influence engine“…

But here’s the news: At that time and throughout its history – since its launch in 2019 – Public.com did not facilitate option trading; the type of instrument that generates roughly two-thirds of all PFOF revenue…

That fact has now changed…

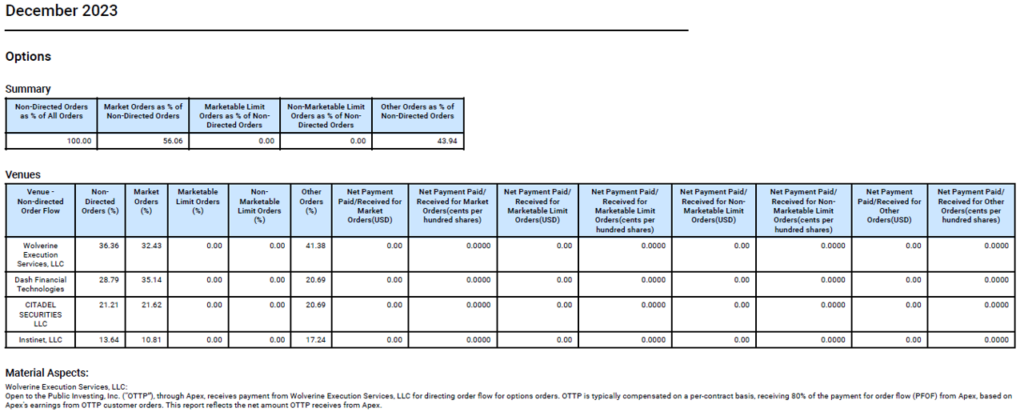

Flashing forward to the present – and thanks in no small part to a clutch assist from option specialist and guest contributor to the Feed, Don Dale at Curved Edge Strategies – Alphacution was able to determine that Public.com initiated option trading during December 2023. This was a result of the discovery that Public.com had produced an archive of 606 reporting beginning Q1 2020, which is consistent with the disclosure timing of many other retail brokers.

Until recently, we didn’t know that this archive existed…

Furthermore, a fascinating factoid about this disclosure is that each of the quarterly 2020 filings where not generated until May 2021 for some reason, long after they were due. This is partly why we missed these disclosures…

Nevertheless, it’s also fascinating to note that Public.com’s Q1 2021 606 report clearly shows the transition – in February 2021, as announced – from sending stock orders to the leading equity wholesale market makers who engage in the PFOF mechanism – like Citadel Securities, Jane Street Capital, and Virtu Americas – to exclusively sending stock orders to agency broker, Instinet, LLC…

Now, it’s clear from our initial review of these documents that Public.com has been experimenting with alternatives to the brokerage model that Robinhood forged into a mainstream standard in late 2019 without totally abandoning the commission-free framework. Given some observed changes in the disclosures over the past 4 years, they don’t always get things right on the first try, but the effort to operate in closest alignment with investors is apparent…

The question is whether prevailing market structure and liquidity dynamics – particularly in options – are such that market makers / liquidity providers need certain incentives from retail brokers to optimize for “best execution.” In other words, maybe retail brokers can’t avoid “playing the game” as it’s been established unless they’re willing to recoup lost commission / PFOF revenue in other areas of the business model. Needless to say, this will be an ongoing discussion…

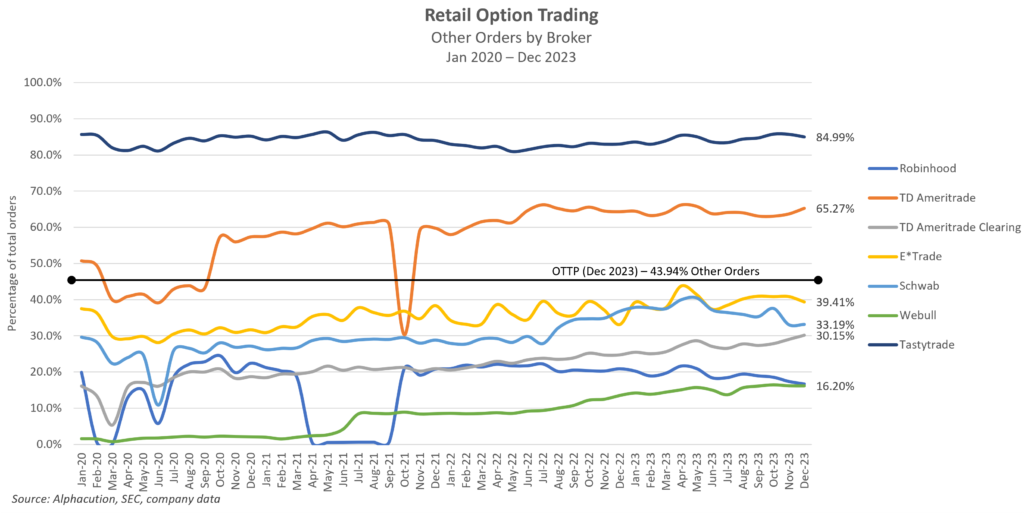

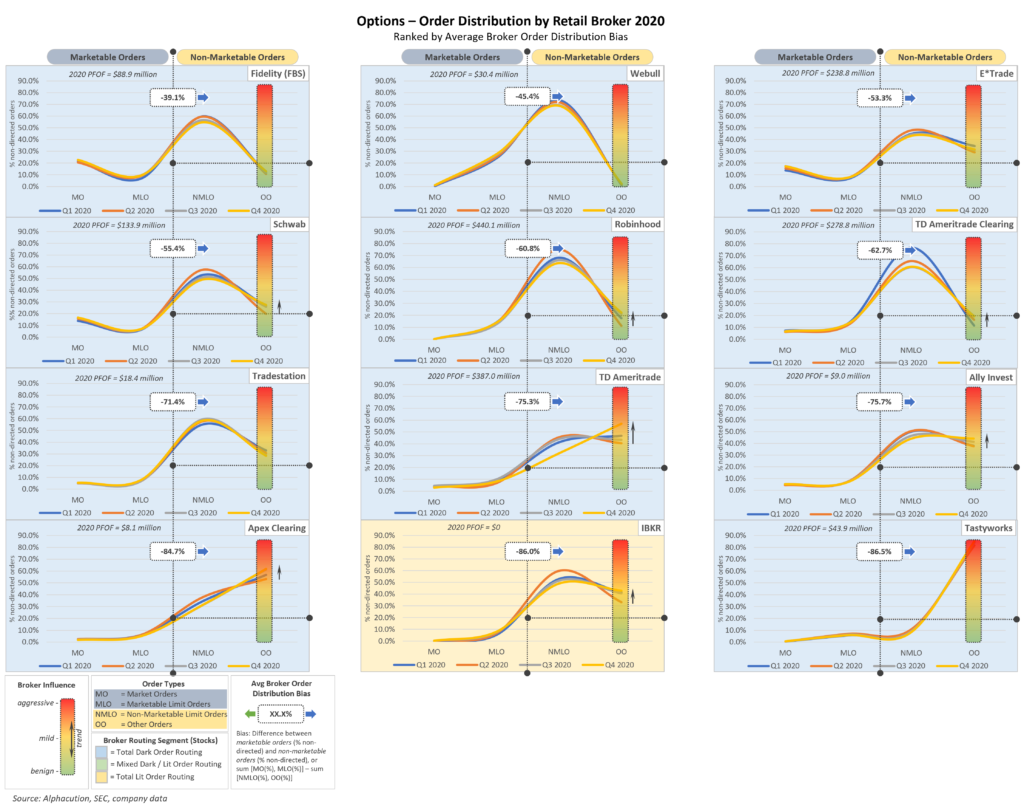

Anyway, when Alphacution conducted its first deep dive into the mechanics and economics of retail trading during the height of the “Robinhood Effect,” one of the key concepts that we developed was called “broker personas.” A primary mechanism we used to evaluate the nature of different broker personas was based on the unique distribution of order types for each retail broker over time. Within that, the idea of broker influence was measured by the portion of “other orders” in that distribution, which was based on the belief that these are mainly stop limit and trailing stop limit orders; the kind that brokers teach or recommend to their clients to influence their trading behavior…

In one of Alphacution’s all-time most elaborate exhibits, below, Alphacution presents its ranking of option order distributions by broker for 2020. By that measure of order distribution bias, Fidelity, Webull, and E*Trade exhibited the most benign level of broker influence of the group and Tastyworks, Interactive Brokers (IBKR) – which Alphacution considers to be a hybrid “pro-tail” broker that does not use PFOF, and Apex Clearing (the clearing broker for front-end platforms like Public.com and M1 Finance) exhibited the most aggressive level of broker influence of the group during 2020…

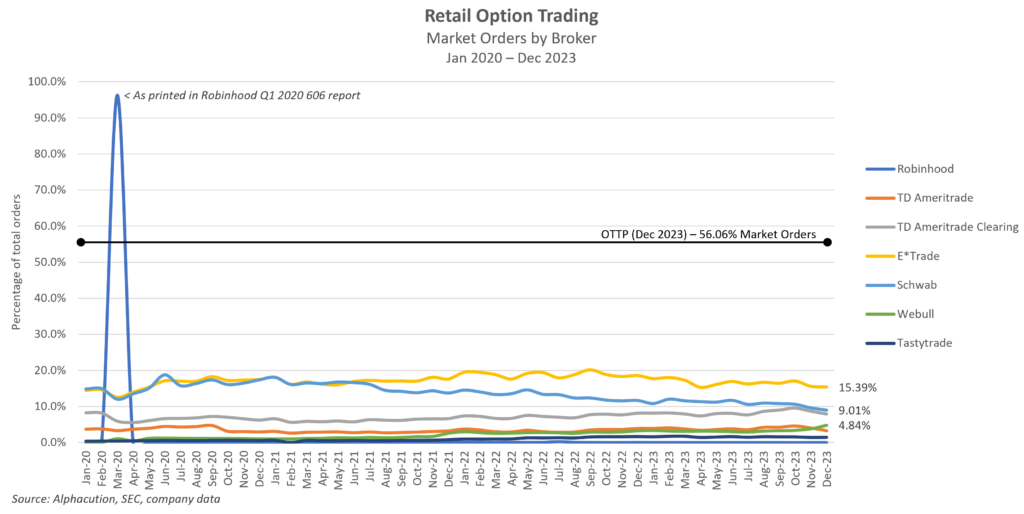

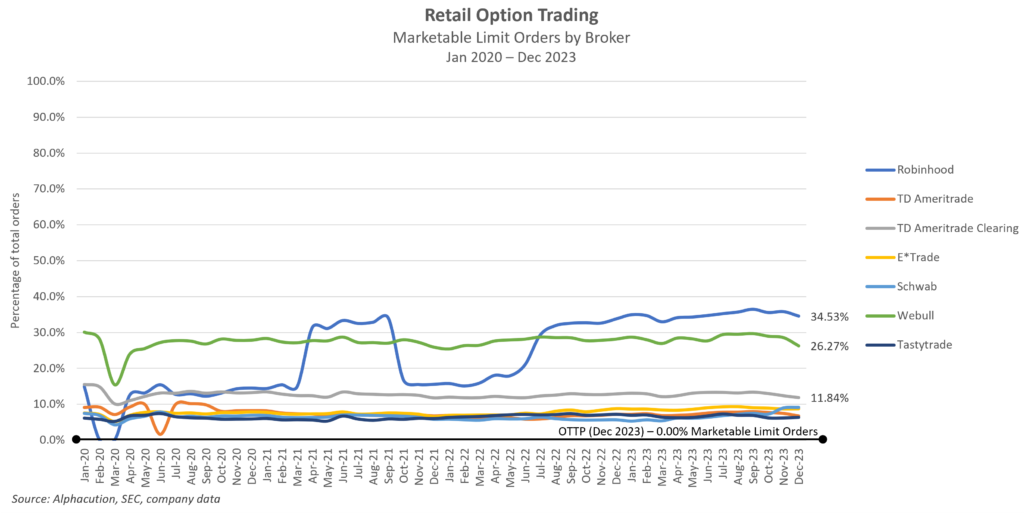

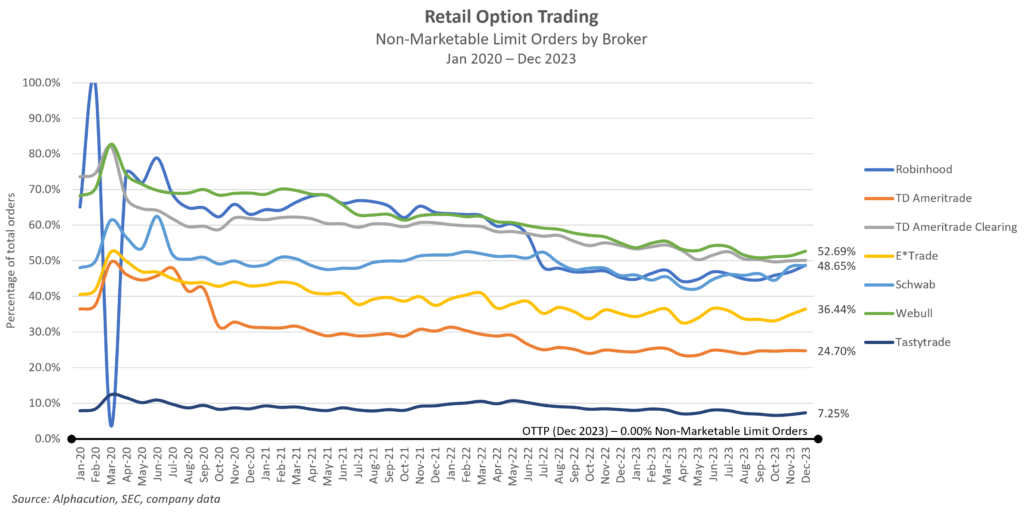

When we 1) extend the prior analysis to include the 48 months beginning Jan 2020 and ending Dec 2023; 2) break it down by order type; and, 3) add the relevant Dec 2023 levels for Public.com, we arrive at the following 4 charts…

Basically, it appears that Public.com is strictly allowing market orders and strictly preventing limit orders (marketable or otherwise) on its platform; both of which are significant deviations from prevailing brokerage models. Note: Alphacution believes that “other orders” are primarily fixed stop loss limit and trailing stop loss limit orders. The important distinction here is that these order types convert to market orders when stops are tripped…

When it comes to options, you will notice from the charts above that market orders are the LEAST prevalent across all retail brokers. For instance, in the case of Robinhood, the 4-year average proportion of option market orders is almost nonexistent; never more than 0.05% (with the exception of the aberrant mark for Mar 2020). And, in the case of Tastytrade, the 4-year average proportion of option market orders is never more than 1.0%. Alphacution considers Tastytrade – with its trading celebrity founder, Tom Sosnoff, spending a lot of time in front of a camera – to be the most aggressive retail broker in terms of trader education and potential to influence trading behavior…

By further comparison with its overall routing strategy, for Oct, Nov, and Dec 2023, more than 98% of Public.com’s S&P500 stock orders were market (including “other”) orders, and more than 95% of their non-S&P500 stock orders were market (including “other”) orders. In all cases, 100% of Public.com’s stock orders for Q4 2023 were routed to Instinet…

Anyway, the reason market orders are rarely used in option trading is because most options are liquidity constrained, and therefore, prone to wide bid-ask spreads. In other words, option market orders typically lead to poor executions, or at least higher potential for less-than-best executions relative to limit orders because the option market maker possesses much more discretion to complete the fill. The advantage, however, is that this discretion maximizes – if not, guarantees – the market maker’s opportunity to capture liquidity rebates (which apparently flow back to Public.com and are split with users)…

Now, the potential weakness of Public.com’s brokerage model / routing strategy may be mitigated by the zero-day-to-expiration (0DTE) phenomenon because a higher proportion of overall option liquidity has become much more concentrated in a short list of highly-liquid, extremely short-duration options. This dynamic tends to mitigate the relative costs of market orders, assuming users are trading in this highly concentrated tail of the optionable universe…

Furthermore, the fact that Public.com does not appear to “gamify” its platform in ways that promote maximum trading activity also represents a potential safeguard for users. They appear to be promoting a bias towards longer term investing. A novel concept these days…

Plus, active users with larger account balances are encouraged to upgrade to Public.com’s subscription-based program, “Public Premium,” which runs $8-10/month. Fun fact: As far back as Dec 2019 – shortly after the commission-free framework went mainstream across the retail brokerage landscape (Oct-Nov 2019) – Alphacution published the Feed post, “Ch-ch-changes: A Subscription to Charles Ameritrade,” wherein we estimated that the monthly commission-only “replacement fee” breakeven point for TD Ameritrade was about $10/month. Jussayin’…

With all that said, the essence of Public.com’s brokerage model appears to (quietly) forgo PFOF for execution quality. And, like the marketing value of “price improvement” touted by most wholesale market makers in stocks to distract from the fact that they are being influenced to trade as much as possible, Public.com’s strategy of sharing liquidity rebates with users likely creates goodwill – when, in actuality, the tactic is compensation (and some distraction, too) for the likelihood of less-than-best execution…

Problem is, there’s one more significant wrinkle of complexity and confusion that we need to address: In the 606 report snapshot, below, from Dec 2023 – which represents the entirety of Public.com’s option disclosure to date – the notes say that “OTTP receives 80% of the payment for order flow (PFOF) from Wolverine Execution Services, Dash Financial (which is typically associated with IMC Financial Markets), and Citadel Securities for directing order flow from options orders through its clearing broker, APEX Clearing…”

Note, by the way – in case you’re having trouble holding all the threads of this story at once – that APEX Clearing is owned by one of the world’s most prominent proprietary option trading firms, Peak6 Investments…

Clearly, this information would appear to be at odds with the concept of “PFOF-free.” However, to be fair, the words “through / from Apex” are likely doing most of the work here. And, we don’t know for sure to what degree any streams of PFOF and liquidity rebates have been conflated. Also, since this is only the first month in which Public.com has disclosed option order routing figures, we don’t known to what extent its framework will evolve in the months ahead…

The next batch of fresh 606 data is due to be made public at the end of April 2024. We will likely have something more to say shortly after that…

Until next time…