“A trillion here and a trillion there and pretty soon you are talking about real money.”

J P Morgan

Since the end of the Covid lockdown, there has been a sea change in the landscape of equity derivatives users and use cases. The convergence of mobile and frictionless trading platforms for those with excess resources brought new participants to the market ecosystem. In furtherance of this dynamic, there have also been new product offerings to further excite interest and foster additional use cases for more sophisticated retail traders…

In specific, I am speaking of the additional weekly option products that converted every trading day into an option expiration day for certain US equity indices. These product introductions occurred on different dates for different products, but the exercise became more complete over the past year for the primary broad market US indices and their corresponding ETFs. These product introductions were the source of what has become a boom in zero days to expiry (0DTE) options…

The recent spotlight on 0DTE option volume growth should be expected given some well-publicized commentary on sudden intra-day market movements that coincided with large – and ultimately, destabilizing – trades in ODTE options. JPMorgan (JPM) estimated recently that roughly one trillion dollars of notional exposure is traded in 0DTE on an average day. This level of exposure certainly seems like it has the potential to become a problem in a choppy environment.

Needless to say, the majority of the commentary has been fixated on the demographics of the increased 0DTE volume. In an internal research note from Mar 2023, JPM estimates that less than 10% of new 0DTE volume is originating from pure retail traders. By contrast, Alphacution’s most conservative estimate of retail activity in that new 0DTE volume – based on recent data found in the notes of Form 606 reporting – is at least 20.7%. I expect that debate to linger for a while. In any case, this leaves the remaining 0DTE volume to institutions (and other professional traders) who’ve become enamored with the potential use cases for option products with weekly expiries…

There has even been some discussion around the downstream impacts of dramatic 0DTE volume growth on longer-maturity option volumes as well as changes in institutional hedging behavior. However, given the nature of this puzzle – secretive proprietary traders, a retail-inspired mania, and complex interdependencies of trading products – it’s difficult for anyone to isolate the most significant impacts from these developments.

Here are a few thoughts on what I think has been missing from this story:

The 0DTE volume explosion impacts tactical trading by professional derivatives traders, institutional hedgers, and other advanced market participants – such as retail traders who have gained access (via their brokers) to professional tools and techniques – now known as “pro-tail.” Yes, this is a thing now.

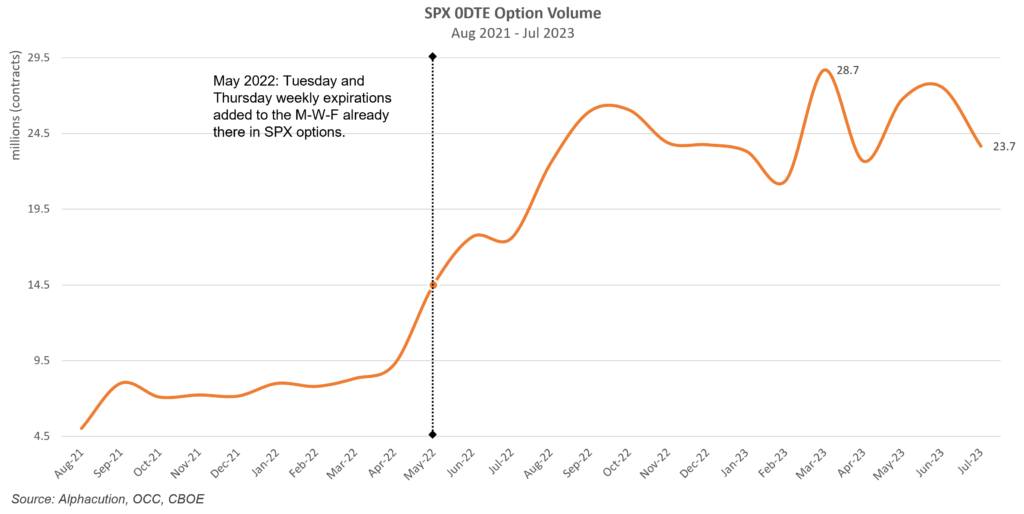

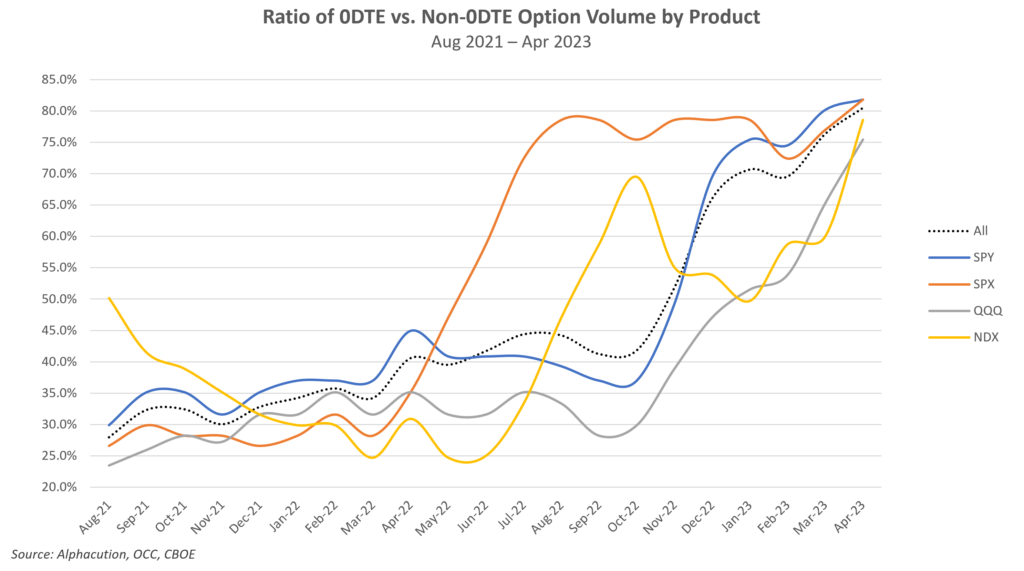

The specific 0DTE activity over the last two years has primarily been related to the S&P 500 index – including SPY and SPX options – although it’s technically correct that all the symbols with weekly expirations – including NASDAQ 100 index (QQQ / NDX) and the Russell 2000 index (IWM / RUT) – contribute to 0DTE volume on relevant dates. The chart below illustrates Alphacution’s estimate of the trajectory of SPX 0DTE volume as it represents the largest notional exposures, although not the largest contract activity (which is found in the SPY ETF)…

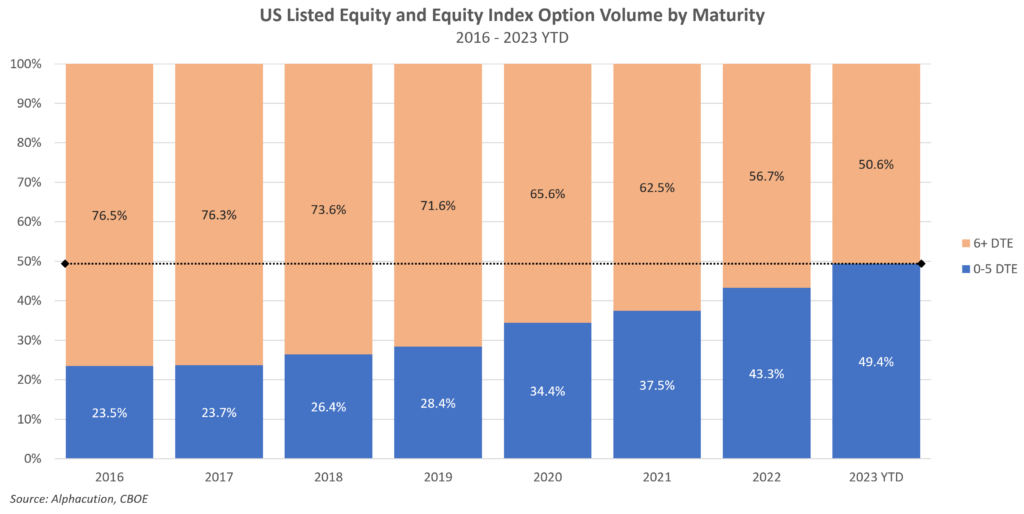

One item to point out is that although the total listed options volume has grown, the more traditional expiration maturities have declined as a portion of the total volume. The chart below shows that 0-5 DTE volume has grown to be nearly equivalent to 6+ DTE volume as a percentage of total volume, thus seemingly bifurcating the US-listed options market into two markets.

I believe that the decline in traditional maturities volume is due to a shift in behaviors caused by the inherent accessibility (i.e. – liquidity begetting liquidity and lower transaction slippage) and enhanced granularity (i.e. – date- and/or event-specific targeting) represented by extreme short-dated maturities relative to longer maturities. The breakdown below clearly illustrates this shift in behavior toward 0DTE as additional daily maturities are introduced to the list of weekly option products.

Let’s look a little deeper at additional options activity that can benefit from this high level of liquidity in 0DTE:

Transaction costs and bid-offer execution slippage are the “Achille’s heel” of every active trader’s brilliant trading strategy implementation. This slippage is reduced in 0DTE – and other ultra-short option maturities – given 1) the compressive impact of naturally lower time premium on bid-offer spreads, 2) they are constrained by the total option price, and 3) deeper liquidity due to the knock-on effect of more active trading.

Furthermore, given the extremely low bid-offer spreads inherent to very low premium 0DTE, substantially less friction is present for active trading of option spread positions than in the past. There is evidence to suggest that this fact is driving some of the 0DTE volume increase by pro-tail traders using automated spreading engines. Moreover, several brokers are now offering this type of spread automation; allowing users to more easily open and close multiple positions in 0DTE.

But, the foregoing makes me wonder: Is it possible that this increase in 0DTE volume has an inverse impact on bid-offer spreads for longer maturities? If so, do wider spreads for longer option maturities exacerbate the migration of liquidity? In other words, does the dramatic increase in weekly options volume become a feedback loop that drives more and more volume into the short term?

From my seat, the currently bifurcated environment – between short- and longer-term maturities – is likely to become more biased towards the short-term. The potential to leverage 0DTE liquidity in a tactical manner – for instance, to target “known unknowns” like Fed meeting days, important economic release dates, high-profile earnings dates, and many others – offers a clear path to expect continued enthusiasm for more targeted hedging and speculating by institutions, especially as they begin to appreciate the impact of extra costs associated with excess time premium embedded in longer-term option prices.

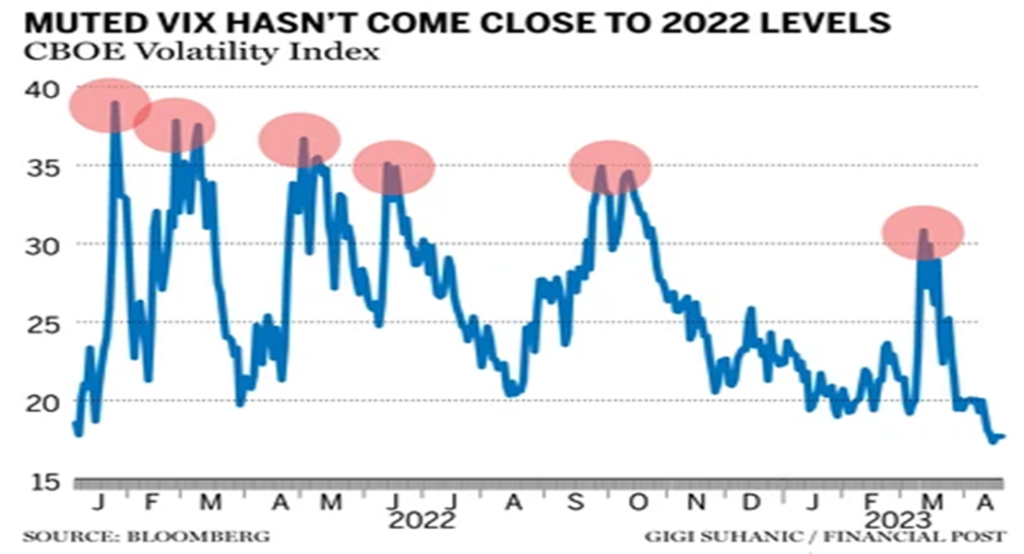

We can see an example of this with a secondary impact: The VIX index – based on 30-day forward implied SPX volatility – appears to have become less responsive to events thus potentially reflecting a migration of focus away from SPX 30-day exposures and more towards 0DTE. As of May 2022, the SPX option complex included an expiration on every trading day of the week. And although 2022 was indeed a bad year for broad market indices, you can see a declining response by VIX to various events, as illustrated below.

I believe this lack of responsiveness is due to behavioral shifts toward 0DTE as opposed to the activity which would be transposed into the 30-day maturity VIX calculations. Confirming this belief, CBOE Global Markets recently created and launched a 1-day VIX index (VIX1D) to reflect this behavioral shift.

One more thing: The issue of option Greeks on 0DTE versus longer maturities…

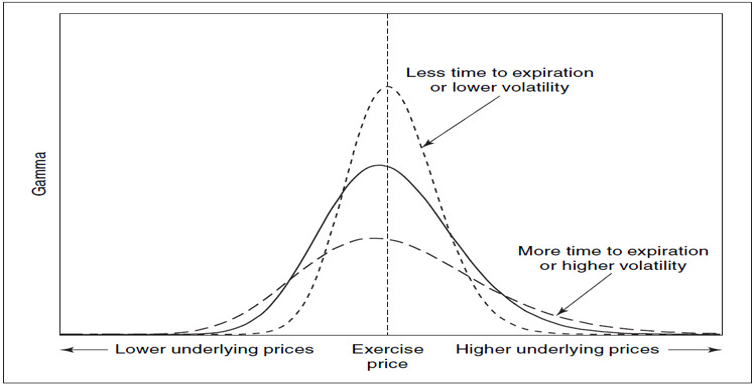

As all professional derivatives traders are aware, the impact of shortening the time to expiration to one day or less dramatically increases Theta to reflect the entire premium over the few remaining hours of the life of the 0DTE option. Gamma for at- or near-the-money strikes also dramatically increases as a reflection of the potentially significant Delta change caused by small moves in the underlying.

However, farther out-of-the-money strikes see Gamma fall dramatically to represent the much lower probabilities of finishing in-the-money along with the correspondingly lower Delta and Theta values (since the remaining premium can be almost nonexistent). Importantly and conceptually, professional options traders know that 0DTE options are not Vega or Vol in the traditional sense and treat these options accordingly. Moreover, all active option traders are very well-schooled in the dynamic aspect of time decay with 0DTE on Delta. All options rapidly converge to either 0 or 100 deltas by the expiry.

As I have always liked to repeat, the speed of change in life is increasing at an ever-faster rate. This certainly holds true with 0DTE option Greeks…

Given the new potential for ideal, just-in-time tactical deployment of options, there seems to be no slowing of the growth from traders (and trading firms) who have found comfort in low transaction slippage and low excess time premium for targeted, event-based implementations using 0DTE and other ultra-short-term maturities. With these new option products, it certainly seems as if there will be no shortage of opportunities to exploit known unknowns on the calendar in the immediate future.

I will follow up with a deep dive into the strategic impacts of the 0DTE phenomenon soon. Until then, enjoy the boom in 0DTE with a side order of exploding gamma…

Don Dale

Curved Edge Strategies