“Don’t fix what’s not broken.”

Robert Atkins

Apparently, there’s a new narrative out there that laments the demise of the CBOE Volatility Index as an accurate indicator of market sentiment. Better known simply as VIX and sometimes known as the market’s best “fear gauge,” many markets cognoscenti can’t seem to string two sentences together without inserting the idea that VIX is broken.

I’m here to make a case that they’re wrong…

VIX is designed to reflect expectations for realized volatility. In common language, this means expectations for what will happen – which is different than historic realized volatility; the level of volatility that has already transpired.

To perform its function accurately and holistically, the VIX measures volatility in a multi-layered manner. Meaning: It measures broad market expected realized volatility in more than one form.

As a reminder, the VIX level is a function of 30-day implied volatility which is derived and extrapolated from the 30-day maturity strike range of options on the S&P 500 index (SPX). This approach incorporates both at-the-money (ATM) and all out-of-the-money (OTM) implied volatility levels from the available SPX options for the extrapolated 30-day maturity that are traded exclusively on the CBOE. Therefore – and here’s the key – VIX levels are a function of both market expectations of volatility and the skew of that volatility.

This skew component has a larger impact on VIX levels than non-derivatives professionals realize…

Meanwhile, market pundits repeatedly cite headlines du jour as their best argument for why VIX is broken: High inflation – and the Federal Reserve’s oft-stated resolve in fighting inflation. An oncoming recession. The impacts of the next earnings season. Bond market volatility. Or, fallout from the war in Ukraine. There’s a long list of reasons why it seems like VIX should be much more elevated than it is today, they claim.

Unfortunately for the “VIX-is-broken” crowd, it’s operating exactly as it should…

But, this still begs the question: Why is there no meaningful lift to the VIX given the seriousness of the aforementioned concerns?

Here’s my case – and it starts with market mechanics: VIX elevates for reasons tied to supply and demand imbalances that cause upward pressure on current levels. This imbalance can result from at-the-money demand, or the amount of skew required by liquidity providers to arrive at a market-clearing price.

Let’s break down the drivers of demand for options in the VIX complex. These include: Increasing demand to purchase SPX options; increasing demand for VIX futures; increasing (or excess) demand for long deltas in VIX options; increasing demand for other options based on SPX-derived products (like the SPDR S&P 500 ETF Trust – or SPY); and indirect demand for long deltas in related VIX-based ETFs. It is true that direct speculation in the VIX options complex – simple wagers that it will go up, or down – do occur, as well.

But, at the end of the day, the drivers of demand for VIX options boil down to some variant of fear over greed. Nevertheless, in my experience, the supply-demand equation is often tipped when there’s concern or fear of market outcomes that drive demand for more “insurance” than liquidity providers can tolerate at a certain price.

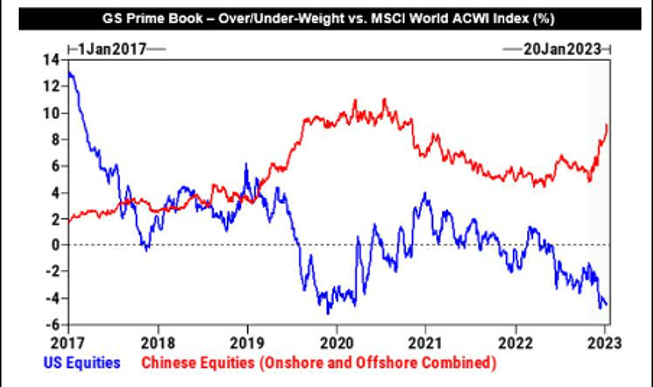

Recently, excess demand for VIX has been absent because market actors are using different tools to express their nervousness about the long list of reasons to hedge. For example, market actors currently have severely underweighted allocations to US equities relative to history.

This creates a lower level of fear and urgency to protect portfolios as seen dramatically (in the chart below) relative to pure speculation in China.

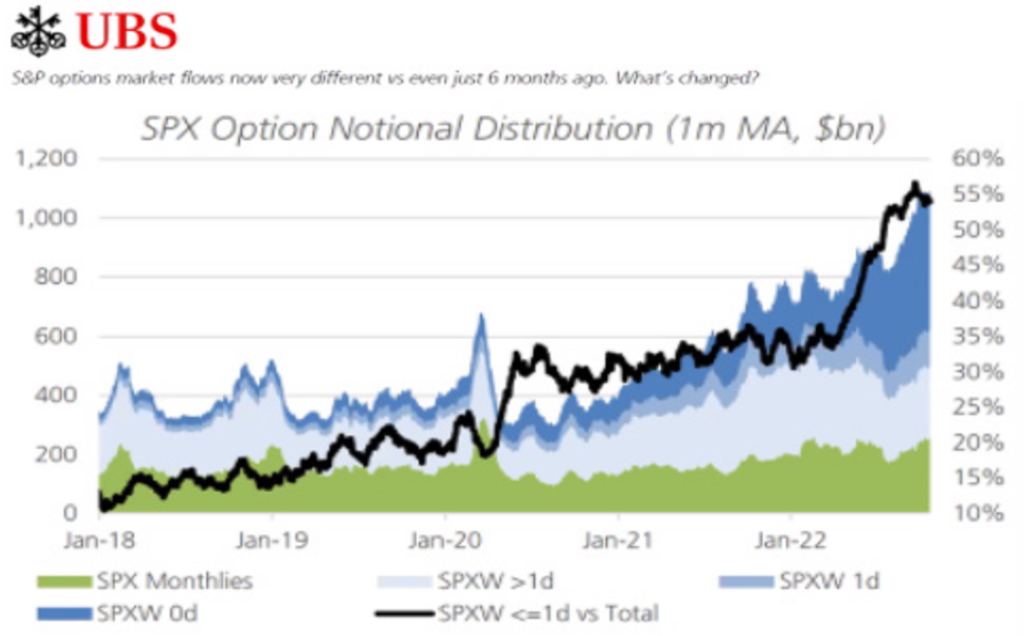

As a sign of the innovative times we live in, there’s another – more mechanical – reason that much of the fear we expect to be reflected in VIX appears to have been diluted: The introduction of, migration to, and subsequent growth of extremely short-dated / daily-expiration options in the SPX index.

This explosion in ultra-short-dated trading dilutes demand for options expiring within the calculation window of 23 to 37 days-to-maturity for the SPX options that are utilized for extrapolation of the VIX level. This shift has also seemed to impact skew levels as we have substantially lower skew of late. Both of these issues are integral to lower VIX levels…

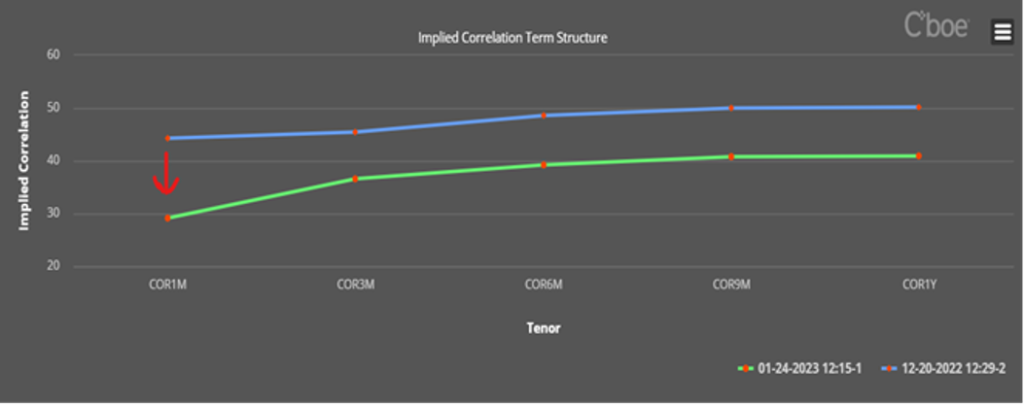

Lastly, there is a cyclical impact from “earnings season” on the S&P500 / SPX / SPY constituency which has just begun. During every earnings season – but particularly this one, given recessionary signals emitted from the last earnings season (for Q3 2022) – there’s a very wide divergence of expectations for company earnings.

This wider range of expectations actually has a volatility-dampening effect on expected realized volatility for broad market indices, given expectations for stock-specific moves.This phenomenon creates a lower expected level of realized correlation versus “pre-earnings-season” expected correlation. This lower correlation brings downward pressure on index volatility as stocks move independently from the market more often given their earnings releases. This lower correlation then, by extension of lower index movements, lowers the VIX level as well.

Note the shorter one-month correlation shift down as we have migrated into the earnings season, below:

These three prominent impacts – underweighted US equities, growth in ultra-short-dated options, and earnings season – are the driving forces behind the lower VIX levels we see today. It’s not broken. It’s behaving exactly as it should in this environment, despite the anxiety generated by the long list of legitimate concerns that constantly bombard market participants.

I am certain that VIX demand will outstrip supply again in the future. However, for that to happen there must be an urgency. Expectations for anticipated catalysts must deviate in an unexpected manner or magnitude, or a new “unknown unknown” must appear to cause an upward “shock” in VIX level. In my opinion, only then will market pundits be satisfied to issue an “all clear” signal that a market bottom has been established.

Most importantly: Be careful what you wish for!

Don Dale

Curved Edge Strategies LLC

Don@CurvedEdgeStrategies.com