A charitable assessment might have called it an experiment, really; an experiment to find out if the headwinds on the hardware and infrastructure services side of the house could be mitigated to some meaningful extent by perceived tailwinds on the software side of the house. A less charitable assessment might have called it a gamble…

But now, with the (Sunday evening) October 28, 2018 announcement that it will be acquiring open source software leader, Red Hat for an astounding multiple of nearly 12x FY2018 revenue, or $34 billion, IBM signals that the promise of the high-profile experiment / gamble within their software group – relabeled, Cognitive Solutions in 2015, and where “Watson” became the poster child for the recent hyperbolic expectations of artificial intelligence (AI) – was not likely to arrive soon enough to stem the internal bleeding caused by competitive threats within the cloud infrastructure services market.

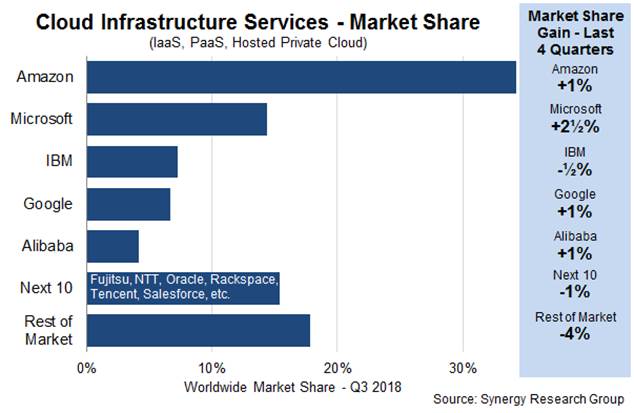

With Red Hat, IBM now turns to defend its 3rd fiddle position in the cloud market (just ahead of Google) – which includes hybrid cloud and other infrastructure-as-a-service (IaaS) offerings – where primarily Amazon Web Services followed by Microsoft Azure have staked out formidable beachheads that threaten IBM’s core on-premises and hybrid cloud businesses, and furthermore where the likes of HPE, Dell EMC, Cisco and others have also been cooking up new moves to become more competitive in this overall market.

The following is a diagram from Synergy Research Group that illustrates these market dynamics, as of Q3-2018:

The potential of this new move into cloud infrastructure services was succinctly summed up by IBM CEO Ginni Rometty shortly after the Red Hat announcement: “…only 20% of enterprise workloads have been moved to the cloud” thereby implying that up to 80% of enterprise workloads remain untapped for migration. However, this claim may have been yet another example of IBM’s penchant for exaggeration – or, wishful thinking. In an Uptime Institute survey of 1,000 IT professionals and datacenter workers conducted in early 2017:

“65% of enterprise workloads were running in data centers owned or operated by those enterprises, and that that number is just about the same as it was in 2014. A total of 22% of workloads were being run on collocated or multi-tenant data centers, while 13% were in the cloud…”

These statistics may suggest that new workloads are more easily “born in the cloud” whereas legacy workloads are brittle and intractable.

To be clear, IBM wasn’t wrong about software, in general, and the potential for cognitive solutions, in particular. Evidence suggests that it’s just that the timing and evolution of the AI-fueled software business is going to grow more slowly than hoped because the configuration and implementation challenges are greater than expected. After all, at the core of this adoption trajectory is process re-engineering, behavior modification and legacy technologies; three of the most challenging change management categories among all business transformation efforts (ironically because people are involved). This is not to mention that AI-powered use cases in the corporate world currently require a ton of customizations.

Meanwhile, the tipping point of adoption of cloud services over the past five years – where enterprise workloads have been re-engineered to operate on top of a concentrated selection led primarily by the two aforementioned companies (Amazon and Microsoft) – has created an even more severe level of urgency for IBM (and others) to make such a significant investment in this space. Of course, Red Hat was so eager to leap into IBM’s arms that it only demanded a 63% premium (or, $117) on its Friday, 10/26 stock closing price of $116.6.

With all that as prelude, the following Alphacution analysis – which we first began speaking about in mid-2017 – showcases our interpretation of the AI “hype cycle” caused, in part, by IBM’s goal (and significant marketing budget) to expedite adoption of AI solutions, plus the recent evidence we believe contributed to the seemingly desperate bid for Red Hat.

Let’s start here:

As exposed in our April 2017 post, “The Source of #AI Hype,” we leverage a relatively new, yet simple, analytical technique, word count comparison, to demonstrate how, starting in 2015, IBM had hitched its marketing wagon and brand identity to the exuberantly rosy outlook for cognitive solutions – otherwise known as AI, machine learning, and other related terms. That analysis is expanded upon in the video blog of our friend, Jim Jockle, Chief Marketing Officer, Numerix (below) wherein we emphasize that while AI represents an important transformational development, it is not likely to “move the needle” of revenue in the near term to the extent that the marketing efforts would imply:

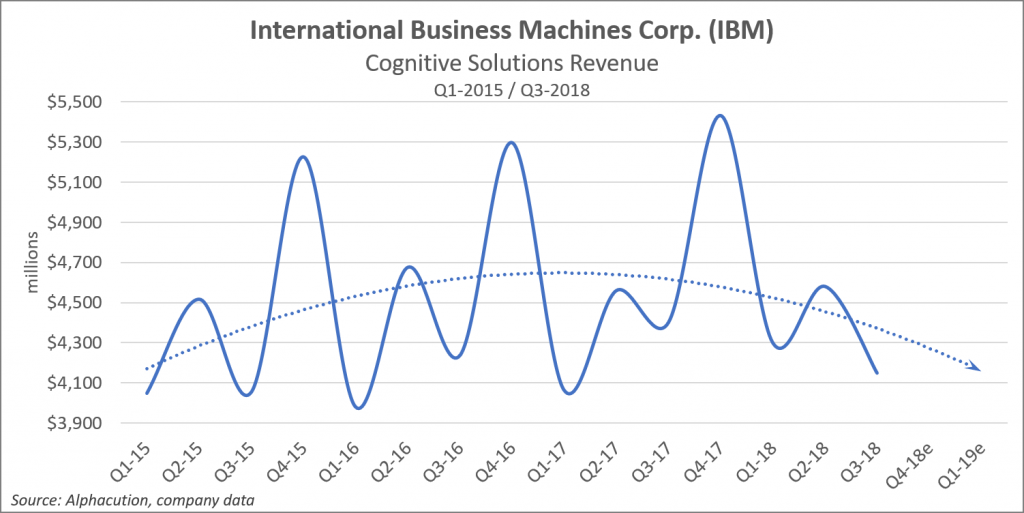

From there, note that IBM’s 2017 annual report mentions the term cognitive 80 times as compared to the 155 and 56 mentions in the 2016 and 2015 annual reports, respectively. As is illustrated in the chart below, the big marketing push that occurred mainly in 2016 to support the accelerated growth of the Cognitive Solutions group in 2017 and beyond did not materialize as expected.

This is not to say that cognitive solutions based on “AI” and other automation methodologies don’t have a bright future. Alphacution believes they do. Ours is mainly a distinction between perception and reality (that we use regularly to showcase our core use of empirical data, modeling methodologies and visualization techniques to support our research).

As it turns out, we were not alone in making this distinction. From TechCrunch (10/28/18), “Forget Watson, the Red Hat acquisition may be the thing that saves IBM“:

“With its latest $34 billion acquisition of Red Hat, IBM may have found something more elementary than “Watson” to save its flagging business.

Though the acquisition of Red Hat is by no means a guaranteed victory for the Armonk, N.Y.-based computing company that has had more downs than ups over the five years, it seems to be a better bet for “Big Blue” than an artificial intelligence program that was always more hype than reality.

Indeed, commentators are already noting that this may be a case where IBM finally hangs up the Watson hat and returns to the enterprise software and services business that has always been its core competency (albeit one that has been weighted far more heavily on consulting services — to the detriment of the company’s business).

Watson, the business division focused on artificial intelligence whose public claims were always more marketing than actually market-driven, has not performed as well as IBM had hoped and investors were losing their patience.

Critics — including analysts at the investment bank Jefferies (as early as one year ago) — were skeptical of Watson’s ability to deliver IBM from its business woes.”

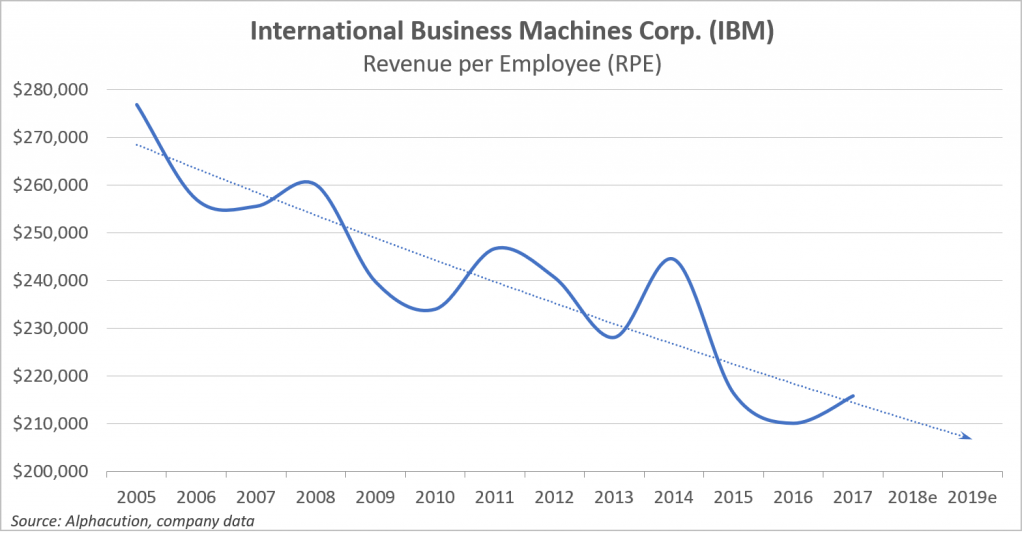

The chart below is Alphacution’s version of the picture of those business woes: A decline in the pricing power and productivity (aka – “technical leverage”) of IBM’s business mix brought on by an increasing dependence on labor-intensive consulting services and yet-to-be-standardized (cognitive) software solutions.

Now, to close: Despite the cost of the move (which IBM will have a tough time absorbing), Red Hat is a fascinating play for IBM because it provides some expectation of internal competitive boost to its position in the hybrid cloud segment, while also indirectly hitching its fortunes to that of AWS via the 2017 Red hat – Amazon partnership (assuming that continues as is).

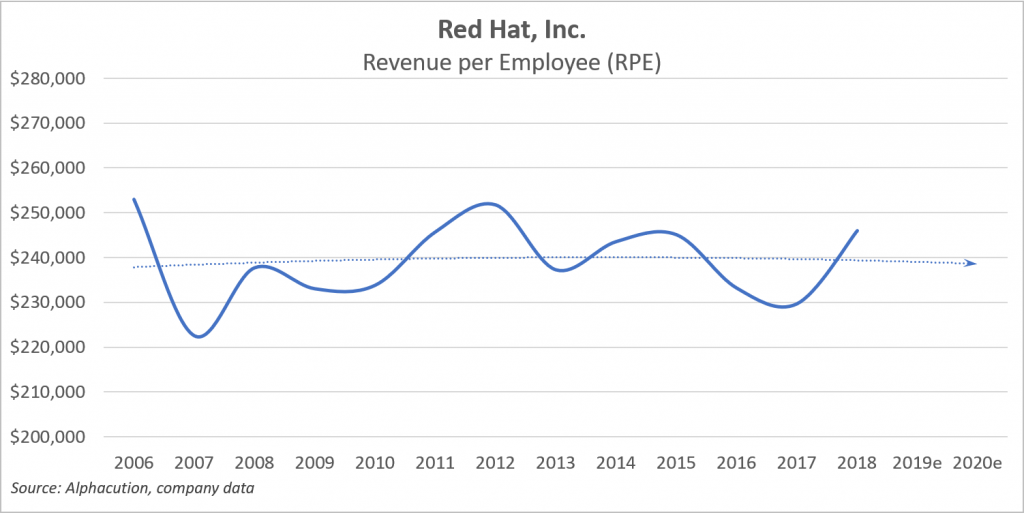

Nevertheless, this pairing is not likely to have much impact on our favored productivity analytic, RPE (see below).

As of FYE 2018, Red Hat grew revenues at a blistering 12-year CAGR of 21.9%. The problem is, over that same period, headcount grew at a nearly identical 21.6%. We have seem this same pattern – and RPE range – with the analysis around our BigFinTech Index, which is heavily weighted to the largest financial software solution providers – and therefore, returns us to the main question we asked in that case: Does Big FinTech innovate?

Our conclusion here with Red Hat, for now, is that it continues to rely enough on labor-intensive customizations to support its revenue growth that its impact on IBM earnings may be limited. Perhaps, these days, that will be secondary to the maintaining – if not, winning a larger – share of the still highly promising cloud infrastructure services market. While there may be discrepancies between CEO Rometty’s figures and independent research providers estimates of enterprise workload penetration by cloud solutions, the fact remains that we still have a long way to go.

Stay tuned…

As always, if you value this work: Like it, share it, comment on it – or discuss amongst your colleagues – and then send us feedback@alphacution.com.

As our “feedback loop” becomes more vibrant – given input from clients and other members of our network, especially around new questions to be answered – the value of this work will accelerate.

Don’t be shy…