Rise of the Platform

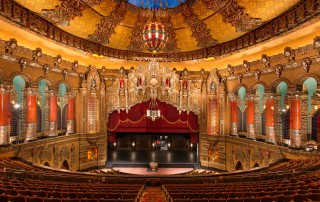

William Shakespeare wrote: "All the world's a stage, and all the men and women merely players." It turns out - more so now than ever before - that there is a business equivalent to this famous line from Act 2 Scene 7 of Shakespeare's play, "As You Like It." The difference, however, is that the "stage" in the current context is known as a platform. And, with each passing day, the strength, agility, intelligence and speed requirements of current financial platforms tend to increase. Putting our key points up front, what we are going to emphasize as we make the case for the validity (and urgency) of this opening salvo are the following: The ceaseless march of innovation, competitive forces and exogenous market factors dictate that players in the modern financial services industry evolve from their initial proprietary technology bias to an expanded supply chain strategy, with focus on certain foundational categories of technical functionality. In other words, for a majority of players, their are certain core technical components that [...]