“The rivalry is with our self.”

Luciano Pavarotti

In honor of the esteemed market strategist Byron Wien’s recent passing – and his annual list of 10 market surprises for the coming year – I have put together a modest set of three surprises within my forte of volatility for 2024. My list will begin with the most probable event and then proceed towards the least anticipated by market practitioners. As a “stocking stuffer,” I’ve added a small bonus prediction that exposes some of my personal views…

Prediction #1

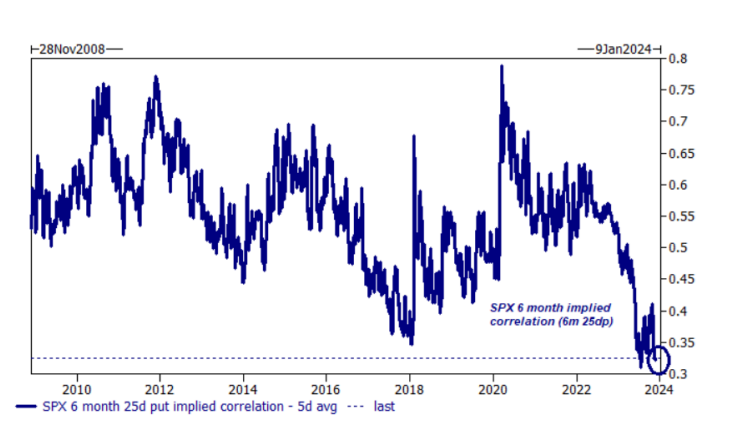

2024 will see a significant increase in equity market correlation which is a key driver of volatility. Now, as most readers will know, this is not hard to understand as we are at multi-year lows of correlation, as shown in the illustration below. Of course, this shift (of correlation going higher) can be catalyzed by a sudden shock in equity prices or an upcoming “known unknown” related to geopolitical issues or economic data.

Prediction #2

My second volatility prediction will be a more frequent occurrence in 2024. It involves upside call volatility shocks in individual equity options – where implied call volatility exceeds implied put volatility.

There were a few examples of this in 2023. For example, we saw this with Nvidia (NVDA) after its dramatic earnings beat and guidance that caused extreme stock chasing. We’ve also seen this play out in the pharmaceutical sector based on the recent infatuation with weight loss drugs. These shifts caused substantial elevation in implied volatility on the call side and a rare flattening in skew.

Extreme Nvidia call skew for 30-day expiration, below:

I believe that the current composition of market participants – such as an increase in active retail and “pro-tail” traders – along with their quicker reaction timing will cause this skew flattening. This skew flattening phenomenon will occur more frequently as disruptive innovations continue to proliferate beyond the tech sector.

Prediction #3

This last prediction will be the least likely and the most difficult to fathom for experienced volatility practitioners. Given the substantial compression of implied volatility in equity market indices over the last 18 months, I now offer up the following nugget of volatility heresy:

I believe that realized 30-day index volatility will exceed trailing implied volatility for an extended period throughout the upcoming year. This all without substantial dislocation in equity levels, but instead because of a steady stream of implied volatility selling that is agnostic of realized.

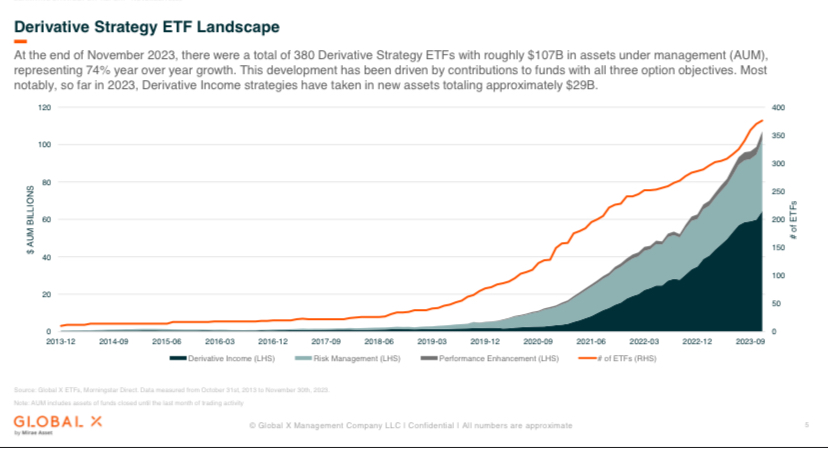

My thesis rests on the dramatic and ever-increasing listings along with notional assets under management (AUM) in the derivatives-based ETF space – as shown in the chart below.

We are now witnessing the shifting focus of options premium writers, and therefore, volatility selling from institutional sources to retail sources. Primarily, this stems from buy-write based ETFs. But, this is also certainly caused by the collared put spread variants, of which there are many.

This activity is markedly less sensitive to selling high implied volatility and is primarily driven by premium collection for yield enhancement. This dynamic is the basis for my prediction.

My bonus prediction: In 2024, we will have a sudden (yet statistically normal) broad market selloff that exceeds the 2% per day limit experienced over the last 18 months. My suspicion is that this will foster a direct drop-off in ultra-short-dated trading (otherwise known as 0DTE) and a recoiling of active participants given their penchant to sell these options.

This alone may not sound farfetched, however, I believe it’s noteworthy given the scrutiny that will likely follow from regulators, et al.

I hope these predictions provide additional food for thought during your holiday feasts…

Happy Holidays

Don Dale