Apple doesn’t mention it…

Amazon doesn’t mention it…

Alphabet (aka – Google) does mention it – but doesn’t link it specifically to financial performance…

IBM? You betcha. More than 155 times…

In case you have been living under a rock – which, now that I think of it, has some increasing allure – artificial intelligence (and its slightly less sexy twin, machine learning) has succeeded 2016’s marketing darling, blockchain, to become the blinking-neon-sign-outside-your-hotel-room term for 2017. Sorry, folks. The budgets have already been allocated. Go find predictive analytics (2014) and digital transformation (2015) in the dust bin of over-exposed marketing terms if you are not yet hip to how this game is played.

Now, let’s take a quick step back for a second: This is NOT an anti-AI hit piece. Nor is this an IBM-gotcha piece. I am a fan of both. But, this is simply a commentary based on the convergence of connect-the-dots exercises that have come out of our modeling and research. Yes, AI has an incredibly promising – if not, slightly scary – future with tons of potential to dramatically impact life on Earth.

But, why now?

Today is only a tiny snapshot of AI capabilities; better than yesterday, not nearly as powerful as tomorrow. And, when it comes to pervasive use and adoption of AI in trading, banking and other financial services, new and wonderfully-cool sources of data are simply not clean enough, normalized enough (with traditional sources), nor historically deep enough (yet) to perform close to the way it says on the glossy box. And, yet, trumpets are blowing and flocks of doves circling above the coronation of AI.

Here’s why:

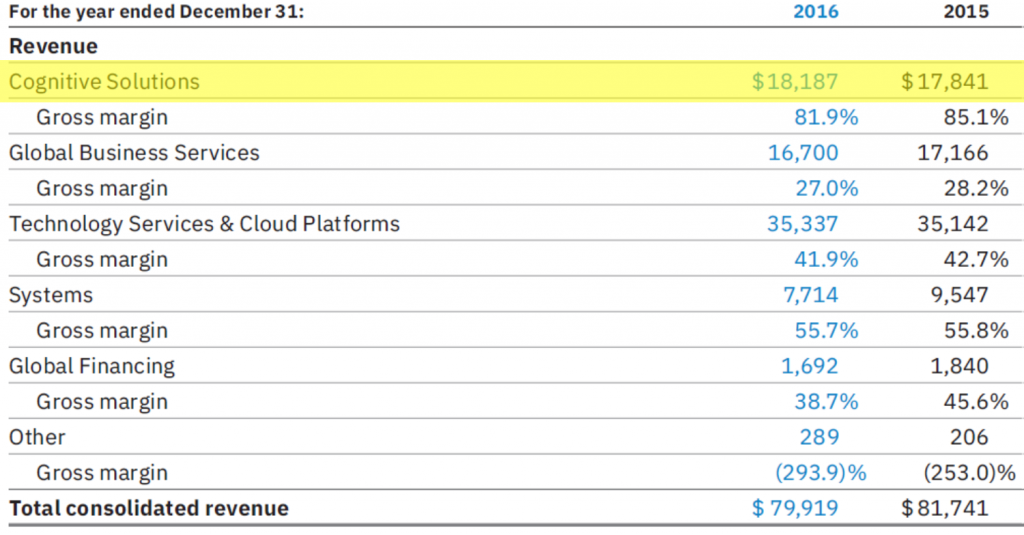

In 2016, IBM reorganized its segmented revenue table to include a new line in the top slot: “Cognitive Solutions.” In this new bucket was allocated more than $18 billion in revenue that had been carved out of the formerly generic and larger “Software” bucket from the 2015 segment taxonomy (see Exhibit below).

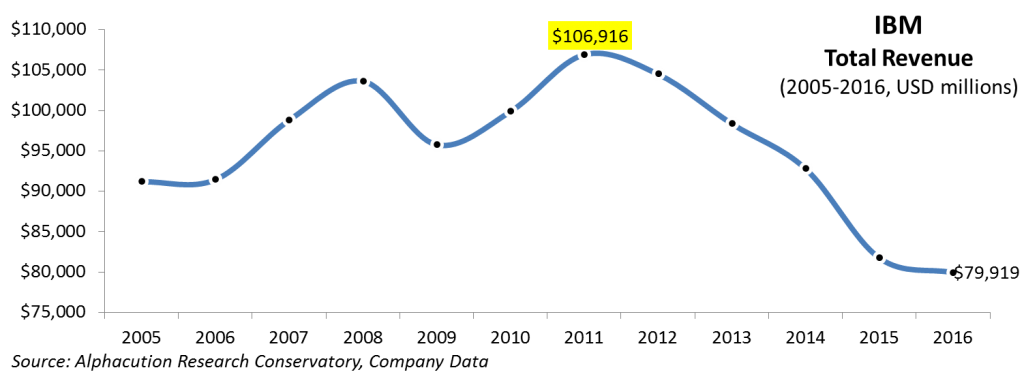

Ok, fine. But, that’s not the whole story. IBM – and others, like HP/E – need some wins. The past few years have been rough (for reasons to be elaborated upon later). The revenue line – that used to be supported much more solidly by the banking sector – is 5 years into a slide (see Exhibit below).

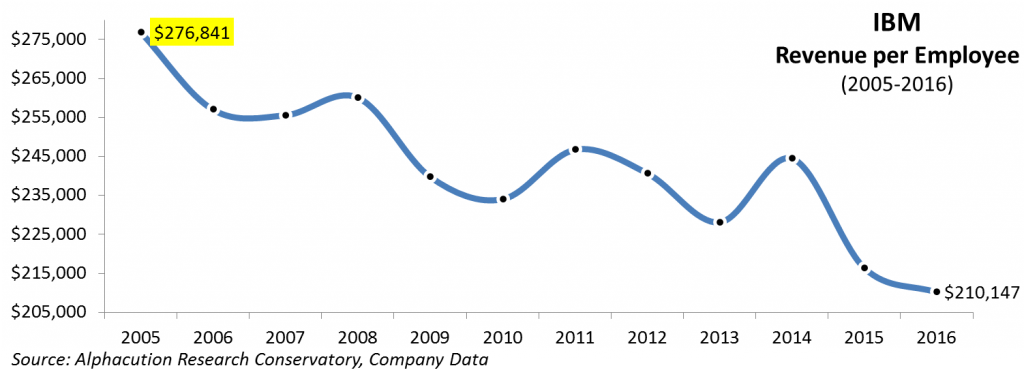

But, what is more pervasive is the productivity line as represented by revenue per employee – RPE (see Exhibit below).

In other words, with more than 155 instances of the term “cognitive” (and others, including artificial intelligence and machine learning) in the 2016 annual report (which is up from 56 mentions in the 2015 annual report), IBM has effectively hitched the bulk of its brand identity to arguably the most prominent AI poster child, Watson.

In other words, with more than 155 instances of the term “cognitive” (and others, including artificial intelligence and machine learning) in the 2016 annual report (which is up from 56 mentions in the 2015 annual report), IBM has effectively hitched the bulk of its brand identity to arguably the most prominent AI poster child, Watson.

This, with more than $18 billion in cognitive solutions revenue at stake coupled with declining hardware-related revenue, increasing pressure on services related revenue, and a marketing bazooka budget of more than $1.3 billion, you have your answer for why AI is lit up like the Vegas strip on the 4th of July…