Outlook 2021: The Drunk-on-Impunity Mania Arrives

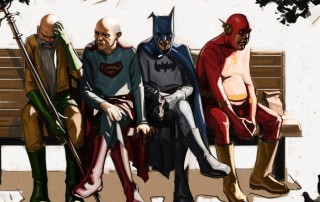

"You cannot escape the responsibility of tomorrow by avoiding it today."Abraham Lincoln With protestors storming the U.S. Capital - some of which breaching the outer doors and freely strolling the U.S. Senate floor - as surreal and unprecedented backdrop, I sit down to organize a sketch of Alphacution's outlook for the year ahead, starting with a very wide lens: The U.S. economy - much like the rest of the other "developed world" economies - is naturally weaker than the meticulously curated employment and productivity numbers suggest. Technology adoption (from workflow automation to social media distraction), growing debt burdens, ossified resource allocation practices, cross-region labor arbitrage, deteriorating infrastructure, and other factors all converge to deteriorate "life, liberty and the pursuit of happiness" for a growing portion of the population. The COVID pandemic of 2020 - and however long it remains disruptive throughout 2021 as vaccines are being rolled out - acts as an accelerant of many of these factors. Ours is a deteriorating version of capitalism. Symptoms emblematic of the stage [...]