Case Study: History of Jane Street

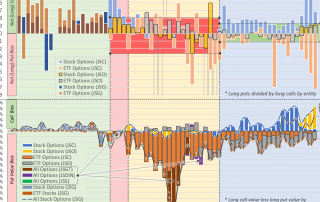

"I don't stop when I'm tired, I stop when I'm done." - James Bond Alphacution publishes its 125-page, 149-exhibit, 26,000-word case study, "History of Jane Street," with notable expansions into regional, US option strategy and revenue estimation details. The following is the Opening to that report with Table of Contents, including download of the full Executive Summary. Access to this report is available to Premium Subscribers. Subscription and individual report purchase inquiries can be directed to info@alphacution.com. NOTE: No representative of Alphacution has been in contact with any representative of Jane Street Group, LLC or affiliated entities for the preparation of this report. This report is solely based on the author’s interpretation of Alphacution’s ongoing assembly of raw, open-access data; library of contextualized modeling; and, internally-developed content. This report does not benefit from, nor include, any material non-public information (MNPI). Introduction Volatility... It’s like the highest-octane fuel in the engine of every proprietary trading and market making firm – and it is very difficult to capture, harvest or [...]