Those Fees Are No Laughing Matter!

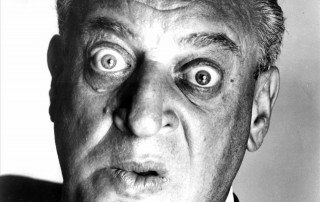

Image Credit: Arpad Busson and actress Uma Thurman attend the premiere of Zulu during the 66th Cannes International Film Festival - Hubert Boesl/DPA/Alamy He pressed "record" on the cassette machine, leaned back and took a long, deep drag from a cigarette. "Let's begin," he said with a heavy accent. In a risky break from protocol, and much to the frustration of my partner - Quantlab co-founder and chief scientist, Ed Bosarge - I asked if I could bum one of his smokes. "But, of course," the Frenchman said with a smirk... Scene: Swanky leather-drenched, art-stuffed office, midtown Manhattan, 1998. Arpad "Arki" Busson, then already at 35 a legendary rainmaker for legendary hedge fund managers, like Tudor Investment's Paul Tudor Jones, had agreed to meet with two of the top geeks from a quant trading upstart to pitch their new strategy to his EIM Group, a prestigious fund of funds (FoFs) platform of the era. In a bizarre twist of unacknowledged credentials, it was difficult to pretend to ignore the fact [...]