Take a deep breath…

Focus your attention…

And then consider:

How bad do you want it?

As a fellow #fintech entrepreneur, the reason I pose the question is that mass disruption and disintermediation (of status quo business models and “analog” workflow processing methods) is already here, and accelerating. In fact, chances are, you are involved in developing a digitally-savvy venture – likely related to #AI or #blockchain or #bigdata or #IaaS or even #cryptocurrencies – right now. We are living in a truly amazing and unprecedented period in history.

And, should that venture be successful, your efforts will add to that disruption, winning you and team an invitation to the “other side” of fear, uncertainty and doubt (FUD), but also further perpetuating the ongoing skills mix shift to a more globally-diversified STEM workforce (weighted towards lower-cost regions), and continue the displacement of non-STEM personnel, many of whom are middle-aged, mid-management market veterans (some of whom with a woefully under-appreciated cache of rare, indigenous knowledge).

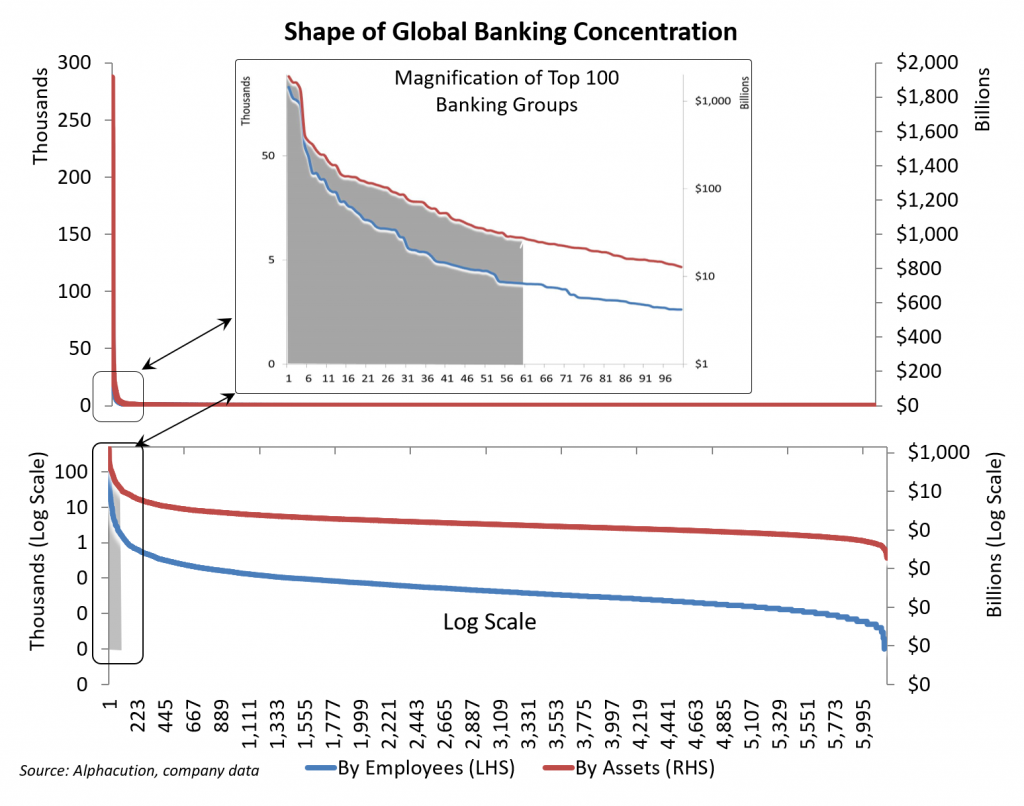

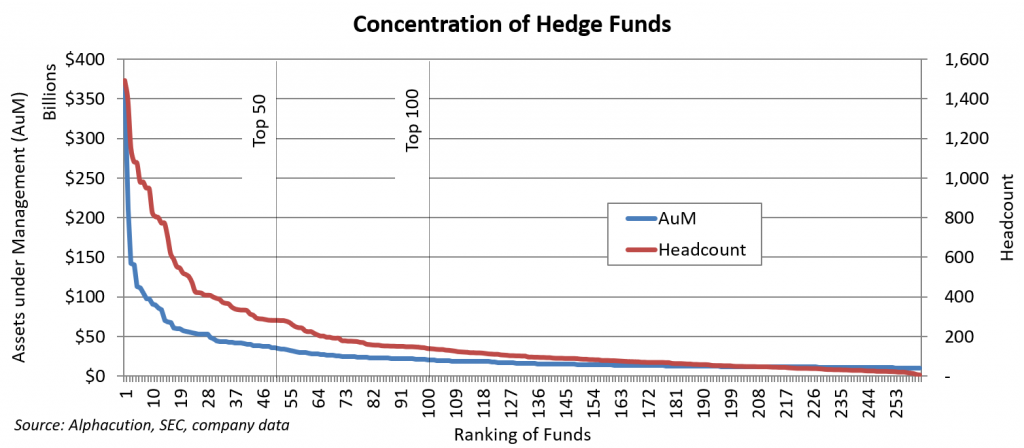

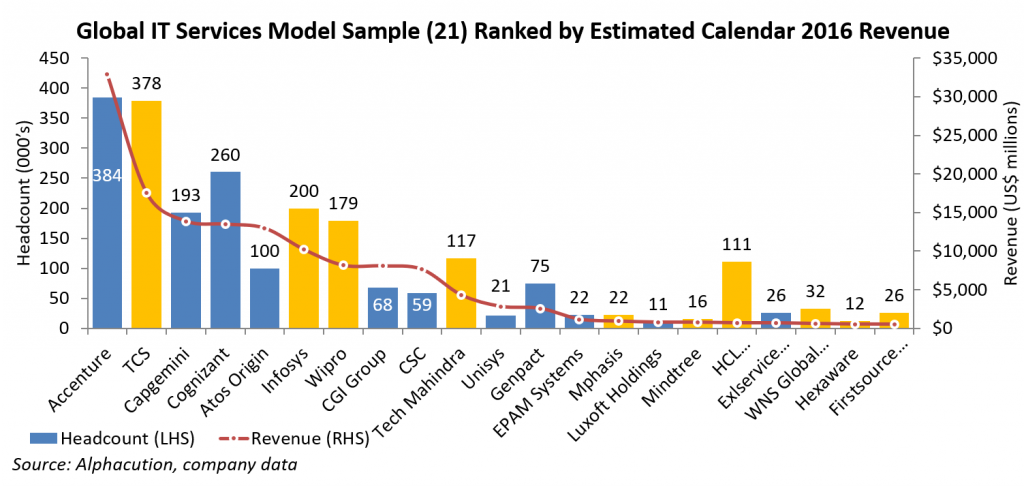

What’s more, our current techno-economic paradigm favors an increasing concentration of power; an incumbency of incumbents. Speaking of the broad spectrum of financial services, in particular, everywhere you look – banking, asset management, hedge funds, market-making, and their solution providers – the list of who controls the space is surprisingly short. We think the world is such an expansive place, but it is not. The top 50 banks, top 50 asset managers, top 50 hedge funds and top 50 financial services (FSI) solution partners control most of the action, like the 80-20 rule. Market-making is worse, especially in equities, where the concentration is represented by fewer entities than you have fingers.

The following exhibits for global banking, hedge funds and IT services are symbolic of these claims.

Anyway, if your venture is successful, you will likely be absorbed in some way by one of a surprisingly short list of incumbents like these – and you may ultimately enjoy the wild and unimaginable fruits of your efforts…

But, here’s the joke (which you already know, but push to the far reaches of your mind): The playing field is global. Some of your fiercest competitors are in very strange places these days and cannot be seen or even detected. If you are operating in one of the aforementioned over-hyped and over-crowded digital spaces, chances are quite high, your venture – at least in its current iteration – will not be successful this time around. Depending on the figures you might cite, chances are quite high you will fail…

And then, you will join the ranks of those who have already been disrupted and be forced to overcome those disruptions – suffer the consequences of those failures – and participate in one way or another in re-inventing your goals, your vision; re-inventing yourself…

Let that sink in for a second while we pivot to the next thought (which is much more personal). Here’s the setup – and stick with me:

I’ve been leading Alphacution’s research efforts for almost three years now, focused primarily on technology spending behaviors and the operational impacts of those investments – executing on our so-called 360-degree modeling methodology that is designed to extract value – uncommon, navigational intelligence – somewhat like solving a Sudoku puzzle. In order to benchmark these spending patterns amongst banks, asset managers and others, we normalize absolute tech spend by headcount in order to create apples-to-apples comparisons.

So, a funny thing happens when focusing on headcount as the key normalizing factor: Like the two engines of productivity – one for process automation, the other for more cognitive and collaborative tasks – focusing on technology in the way that we do ends up yielding insights about the fate of human capital – and vice versa, because they operate like mirrors of one another. Like the ancient yin-yang concept, technology and human capital are symbiotic twins of a broader, holistic productivity exercise.

Now, maybe these thoughts have something to do with my own evolving view of the world (as influenced by our research). Or, they are a result of the belief that I must grow further into the person that I might be in order for Alphacution to become the success that I desire it to be. But, I have found myself spending time in front of a camera recently – during the development of our Alphacution Riffs video series – feeling increasingly compelled to say some things out loud in hopes of counter-balancing this perceived fate of “human capital” during what always starts out as a talk about some facet of the economic impacts of technology…

Hint: The T-shirt in the Riffs episodes gives it away…

Those statements related to human capital (and which ring of a call for personal development) need to be clarified because they intersect with something that I have been cultivating on the private side of my life – and maybe this is as good a time as any to begin to merge some of that with the original objectives of Alphacution: I have been wondering lately if the subset of competitive threats from technology, and therefore, the predictions for how, for example, #AI will wipe out some large X% of some workforce over the next Y years will eventually cause something else – perhaps something as profound and revolutionary – to happen: A broader renaissance in the exploration of untapped human potential…

Certainly, I speak this from an entirely personal perspective because I am so focused on overcoming challenges, failures and heartbreaks to discover my own untapped potential. So, the topic is definitely front-and-center with my own entrepreneurial goals here.

Now, I know this already sends out a strong whiff of an oncoming Jerry Maguire moment, but keep sticking with me a little longer and decide for yourself: Technology is advancing in unfettered ways. There isn’t much, if any, “dogma” slowing the march of technical innovation, which is why it can have such swift, disruptive impacts. We never seem to ask if we should; we just do because we can – without considering much, if any, preventative measures. And, yet, human capital – somewhat like legacy technology – is weighed down by ancient wisdom – like an outdated programming language or an abandoned version of software – some of which is timeless and still serves us quite well, and some not so much.

Certainly, I am not the only one raising these issues. The Center for Humane Technology is on to it. And, others closer to home, like my friend, Brian Martin – Director of Technology – Cognitive Architecture Lead, AI + Data Practice, Publicis.Sapient – who wrote one of my favorite pieces, “Raising the Digital Golem” back in Feb 2017. I figure he might know a thing or two…

The idea here is basically that the “competition” between technology and human capital may – if one were an optimist, which I choose to be – cause people to become more motivated than ever to “up our game…” And, there seems to be growing demand for wisdom about upping our game because so many of us are in a state of FUD about our personal and professional lives in ways that we never expected to be.

Today, YouTube is littered with incredible motivational and inspirational wisdom. Podcasting and audio books allow folks to crowdsource the best intelligence on just about any topic, on demand. Whole Foods and Trader Joe’s provide access to better sources of nutrition. Even Peloton – a revolutionary product-service combo that I own and love – is making it so convenient to get a high-quality workout whenever you want, it pretty much eliminates any excuse you might have not to do it (other than the cost of the thing).

Of course, for Alphacution to effectively ride the parallel rails of cutting-edged technology oriented research and thoughts about the “advancement” of human capital, we need to be quite sensitive to the messaging and methodologies. In comparison to our core, data-driven and quantitatively-based research on techno-operational economics (or “techonomics” – the study of trends in technology and their resulting economic effects on organizations), this other part of the communication needs to be handled differently. The methods and messaging for the advancement of human potential are quite different than the technology narratives – at least that’s the sense I get in these few early steps.

The “disrupted” – and the entrepreneurial – need to learn to change themselves, re-invent themselves, and adopt new perspectives to overcome obstacles. Great coaching is readily available; more so than ever before. But, no one else can do this work but each of us for ourselves. Like the examples above, this gets us into the realm of philosophy, psychology, metaphysics, spirituality, fitness, nutrition and other schools of personal development – which is an odd juxtaposition with our prevailing narratives on technology. But, like the aforementioned yin-yang wisdom – and our “context machine” framework concept – I believe they fit together; actually, belong together – and so, I’m going to try to run with that (as long as I can figure out how to balance it properly).

Skeptical that I am off my meds?

Let’s finish with an experiment: You must commit to watch Riffs Ep4 – What Do Hedge Fund Managers Spend on Tech? – towards the end (around 11:15 – where I have been placing these so-called “public service announcements”) just to get some tangible flavor for what I’ve been referencing here…

Done? Now, ask yourself: What is the likelihood that you would believe that the guy in that video also has had the following “adventures”:

- Within 3-4 years after the original launch of Alphacution in 2004 – to develop a (still) unprecedented volatility prediction platform for traders and analysts – I ran out of runway, my investors lost their stake, and the venture failed;

- I was awarded a patent for the design of the system around the time I was plunging into personal bankruptcy, foreclosure, and the thugs were at the door to repossess my cars;

- Then came Medicaid and food stamps;

- Then, the State of Illinois looted my bank account (all but $300) to cover child support arrearages for wife #1 (which is the exact day I found gratitude);

- Then came wife #2’s brain tumor and subsequent brain surgery, while on Medicaid and food stamps;

- A few years after that, now ex-wife #2 passed away – and I have been raising our daughter as a single/sole parent since 2009 from Grosse Pointe, Michigan (while occasionally keeping a professional face in Chicago, New York and London).

- If all that weren’t enough – and just when I thought all was right in the world, including a great girlfriend with long-term potential – July 2017 came along, delivering a very special gift, of sorts: emergency open heart surgery to repair a congenital defect I never knew I had; a guy from Detroit had found me collapsed in the street and dragged me home…

- And, of course, the girlfriend-to-end-all-girlfriends bolted shortly after that – causing heartache far worse than the surgery… (The irony!)

You just can’t make this shit up…

Now, of course, this is a concentrated recitation peppered with lowlights – or, are they? – for effect. There have been other challenges and failures – and lots of successes, victories and other highlights to balance out what might seem like a very dark and painful road of suffering. No, actually, its been an amazing series of adventures so far – with profound purpose in each of the challenges – and, I believe that much of the best is still yet to come…

The point?

The days of coasting, phoning it in, punching a clock, or resting in the cozy comfort of personal and professional security are over for most of us. The disrupted will need to be far more creative, skilled, mentally-flexible, physically-fit and entrepreneurial to enjoy the comforts of recent generations. Growing from here to there will be challenging, to say the least. Much effort will need to be targeted at learning how to get out of our own way…

As Rocky Balboa said: “It ain’t about how hard you’re hit. It’s about how hard you can get hit, and keep moving forward.”

See for yourself:

Here’s the wrap:

My goal is to lead Alphacution to the point of dominance in the emerging field of #fintechonomics because we deliver reliably impactful results for our clients. We are off to a solid start on that score. I’ve found something that I’m excited about, good at, and that has proven economic potential (the key ingredients in Jim Collins’ Hedge Hog concept from his book, Good To Great). In short, I’m having a blast…

“We don’t get what we want, we get what we must have…” – Tony Robbins

“Our deepest fear is not that we are inadequate. Our deepest fear is that we are powerful beyond measure. It is our light, not our darkness that most frightens us.” – Bruce Lee

“Find gratitude. Use that to develop new perspectives. Work hard. Don’t give up, ever. Learn. Repeat.” – Paul Rowady

Why do I open my Kimono this far, out here in the open? Because I’m at the point where I am proud of everything that’s under it – even with the flaws and scars… It’s taken me 52 years of personal adventure, and nearly 30 years of professional adventure, to arrive here – working hard each day, watching very little TV, playing very few video games, eating my veggies, juggling life’s responsibilities and inevitable turbulence, having not nearly enough extra-curricular fun (yet); sacrificing for something that keeps tugging at me…

So, if I can use this accumulation of whatever – wisdom? – to try to inspire beyond my kids, family and friends – then maybe that’s the real payoff…

And, maybe just maybe, that girlfriend-to-end-all-girlfriends will find the courage to choose love over fear someday… Who knows? Crazier things have happened…

With that, let me ask again:

Whatever it is – a goal, or better yet, a vision…

How bad do you really want it?

* And, anyone else who cares to take the time to notice…

As always, thanks for your attention (especially on a long one). And, if you find value in this work, please share it – talk about it – and, most importantly, send us feedback to feedback@alphacution.com…