When we launched our first trading program at Quantlab in the late 90’s, we didn’t have direct market access yet. We generated an order list (overnight) that was worked throughout the subsequent market session at the discretion of an algo-equipped executing broker; some of whom now roam the halls at Jefferies / Leucadia.

This was the era when 1- to 3-day portfolio turnover was considered fast – SOES bandits were still a thing – and Schwab would soon acquire electronic trading pioneer, CyBerCorp, from Philip Berber – a short drive down the road from our Houston headquarters in Austin, TX.

Of course, everyone had nicknames then – as I suspect they still do now. Ed Bosarge, founder of what eventually became Quantlab (after at least 3 prior related incarnations that began for me around 1996), was known as Dr. Evil. Let’s just say it’s a hair-raising story about a swashbuckling pioneer of applied math involving a hideous toupee…

I was known as Mr. Bigglesworth – or, “Bigsy” for short. No further comment here beyond that, except to say that I’m sure it made Bruce Eames, who started as our COO, a tad jealous. By the way, this was right around the time when the term “alpha-cution” was conceived in a Yellow Cab on Fifth Avenue – thanks to inspiration from a visit to Andy Sterge’s operation at BNP CooperNeff – but that’s a story for another day, as well.

Anyway, I just felt like opening this one with a shout out to Yoda, Billy, Simon and the gang…

We are a long way from those days. In fact, it feels like we are closer to the end of something than the beginning. And, of course, I am well aware that it may seem odd to some of you that we focus so much attention on Virtu, the recently acquired KCG platform (formerly led by my O’Connor & Associates colleague, Daniel Coleman) and all the rest, since it is increasingly clear to all of us that the heady days of HFT are fading away in the rearview mirror.

But, to think of this case study only in those terms – even though it still remains among our network’s most coveted themes – is to miss the point and the broader opportunity to learn something new:

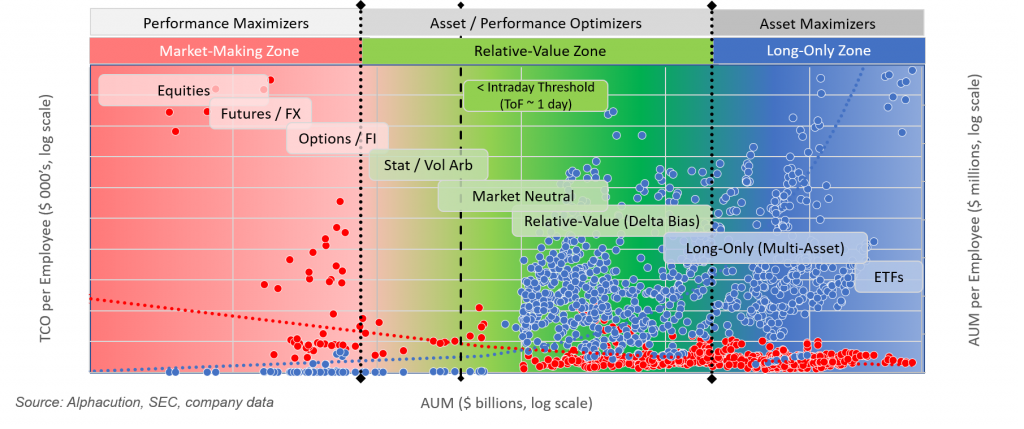

First, Virtu is essentially a publicly-traded “prop shop.” The only one of its kind among the mythological Quant Gods – like Citadel, Jump Trading, or even D. E. Shaw. As a public company, Virtu is required to disclose its financial guts every 3 months. And so, this data is as rare as a sane and Zen-like “10” according to the Universal Hot/Crazy Matrix. In short: We will continue to study this nearly priceless corner of our dataset for as long as it is so easily available because it offers a quantitative window into such a rare space – and anchors one end of a continuum that encompasses ALL other asset managers and their strategy selections.

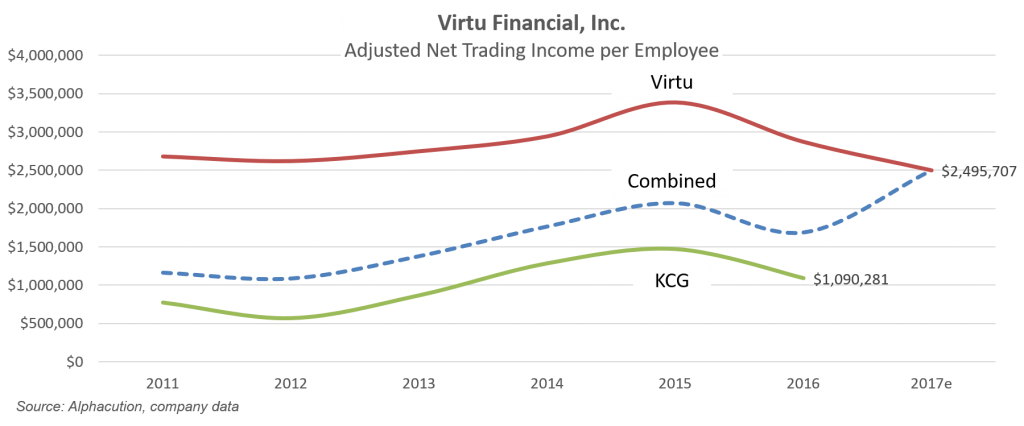

This last sentence dovetails with a second point: Virtu represents the outer extreme of “technical leverage” in our asset manager tech spending framework – and, for that matter, all other tech buyers in the global ecosystem. This means that they generate more revenue per employee – and, more consistently – than any other “asset manager” on the face of the planet, whether we can see their data or not.

Virtu also spends more “per head” on technology than anyone else, too. This translates to the fact that Virtu is at the vanguard of workflow automation across the entire financial services ecosystem – which is a core focus of the research we do here at Alphacution – and among the stronger reasons we continue to pay such close attention to this narrative when most of your other advisory partners have been paid by vendors to turn their attention to crypto-blah-blah or how blockchain cures cancer.

Setting the irreverence aside, and with the previous context and motivations as scaffolding, let’s jump into some numbers, pictures – and the stories that I think they reveal…

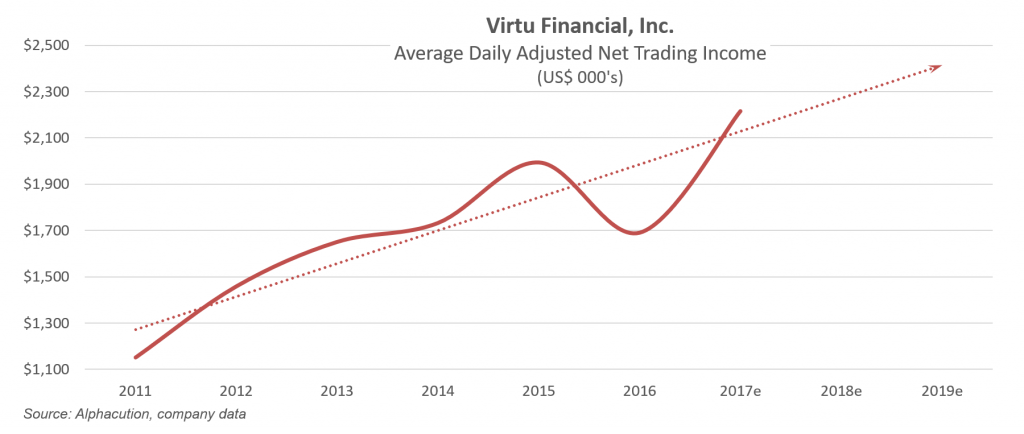

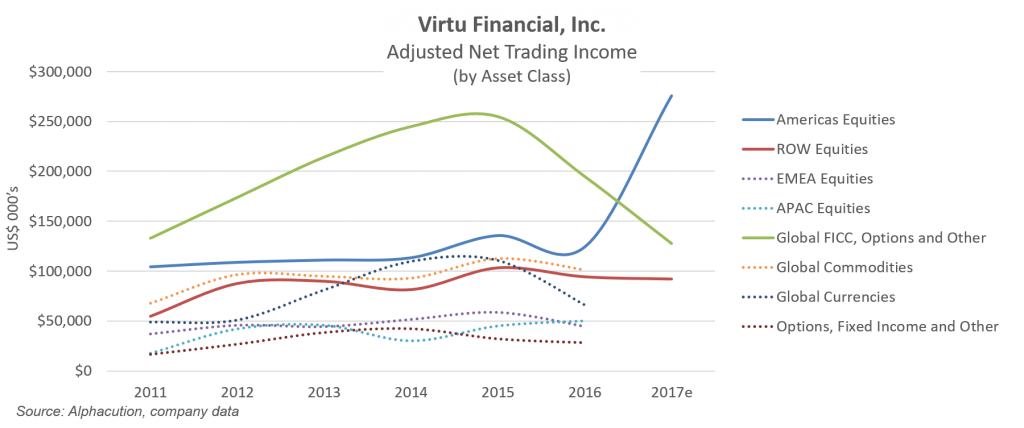

So far, the acquisition of KCG has been a success, period. Many who follow the company closely already know this, especially given punishingly low volatility for most of 2017. As of December 31, 2017 – or, 165 days after the closing of the deal on July 20, 2017 – key indicators like adjusted net trading income or average daily adjusted net trading income are all at their highs. And, even for the few of us who have bothered to model Virtu back to the first point of financial transparency – from their original S-1 filing on March 10, 2014, which is now a 7-year time series beginning 2011 – these latest figures represent all-time highs.

As we implied at the outset of the Virtu-KCG deal announcement here, being able to display a chart like this (for 2017) was symbolic of the main reason behind the acquisition of KCG in the first place: To cause a resurgence in adjusted net trading income and to bolster the perception (or, illusion?) of a more persistently positive trajectory thereafter.

Granted, some of the market intelligentsia – like my former colleague, Larry Tabb – have argued that getting further into the execution services business to face off directly with “the little guy” was the primary motivator here. (I disagree on the priority – but, agree it was a secondary and more long-term factor…) However, given the persistence of low volatility, Virtu had to defend the value of its stock-currency (“VIRT”) in the near-term after the unprecedented declines in trading revenue for 2016. They couldn’t afford to allow another bad year get priced into their stock (which they are keen to use to buy stuff and pay people).

KCG was a ripe “gift” to be plucked, especially since it also came with a publicly-tradable currency… (Plus, Virtu was still sore from losing out to GETCO in the Knight Capital bid back in late 2012.)

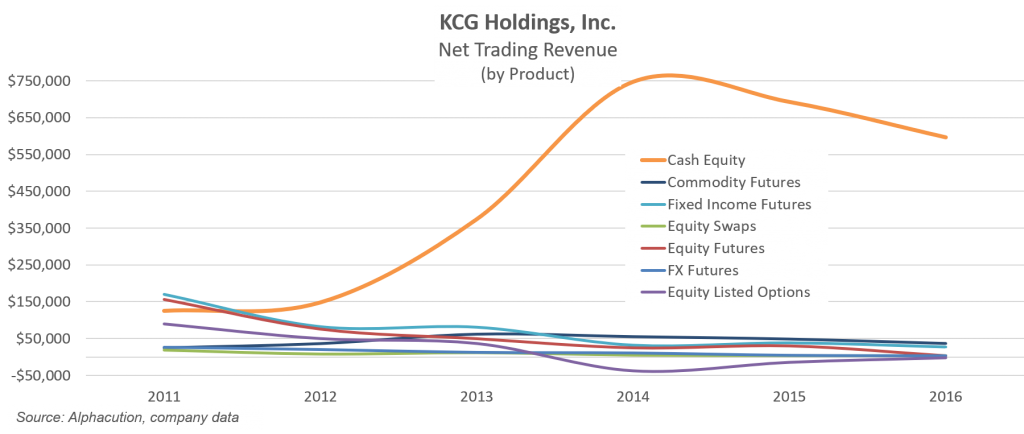

This gift was primarily due to the fact that KCG was never as efficient as Virtu. Call it a less-mercenary culture, like the difference between Chicago and New York; the Midwest and the East; or, a team of 300+ (in the former GETCO market-making group) vs. a team of 150 that make up the entirety of Virtu.

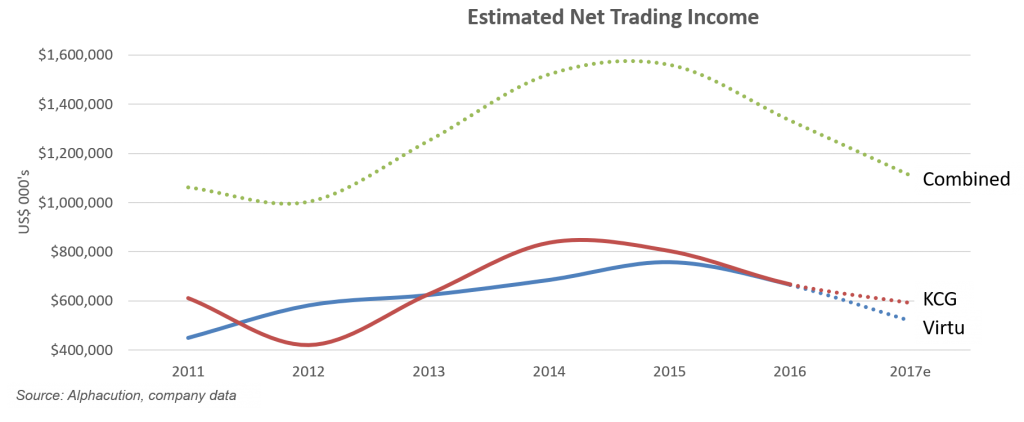

Consider that these were relatively similar trading firms following relatively similar paths: Over the 7-year period beginning 2011, Alphacution estimates that Virtu generated a total $4.3 billion in net trading income while KCG generated $4.6 billion. Except, Virtu accomplished nearly the same feat as KCG with less than half the people.

The short-term opportunity for Virtu was to absorb KCG’s intellectual property (IP), apply it to their infrastructure, and then discard the redundant human and technology capital as fast as possible – thereby causing a return to an upward trajectory of alpha capture.

A quantitative version of this narrative was to take KCG’s “productivity” (which we measure as adjusted net trading income per employee) of about $1.1 million per head for 2016 and then multiply that by Virtu’s level of productivity – which Alphacution estimates was 2.8x that of KCG – or, $2.9 million per head for 2016.

This is exactly what Virtu did: Relative to KCG’s last independently reported figures (for Q1-2017), Alphacution estimates that the remaining KCG-related headcount is now down 55%, from 923 to 410 – and most of those who remain are on the old Knight Capital side of the house.

This move alone created savings in compensation expenses in excess of $71 million for 2017 – in just 165 days. Redundant communications and data processing infrastructure represented an additional $35 million in savings for the same period. And, the combined productivity figure for the New Virtu – adjusted net trading income per employee – vaulted to nearly $2.5 million for 2017 – as we suggested would happen from the beginning, a year ago: “Virtu and KCG: A Tale of Technical Leverage?” (March 21, 2017).

Now, in addition to window dressing and operational efficiencies, there is one other notable benefit to this marriage – and, it can be captured in another fascinating picture: GETCO’s market-making system is more responsive to volatility than Virtu’s with the added advantage of strong controls on downside risks. Translation: GETCO’s algorithms harvest more alpha during periods of higher volatility than Virtu while limiting losses (almost) as much as Virtu’s system does; a variance in tuning that one might expect from the founders of GETCO who grew up in the trenches of derivatives powerhouses, CME and CBOE.

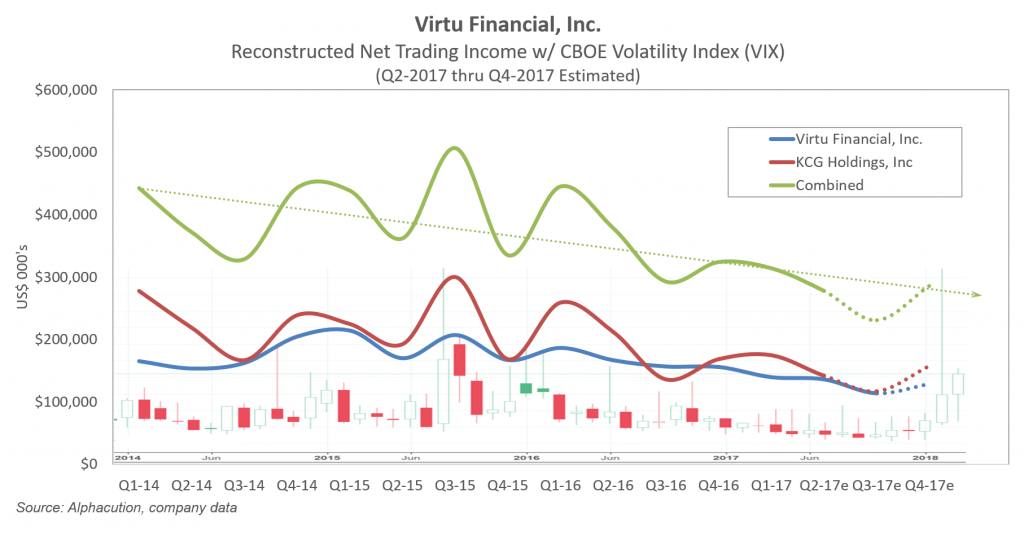

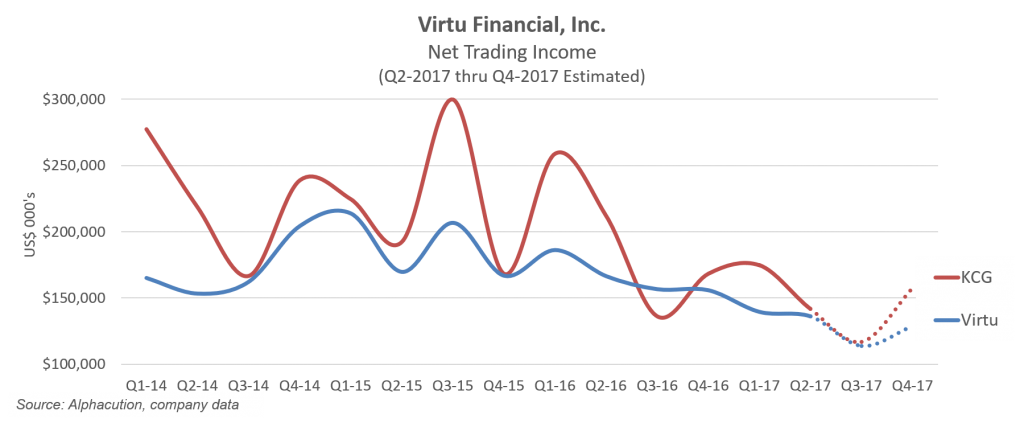

The following chart is Alphacution’s estimated quarterly picture of this phenomenon for the 16 quarters bookended by Q1-2014 and Q4-2017:

When we combine the histories of the individual market-making operations – and overlay that picture on the VIX (CBOE Volatility Index) – we arrive at something even more fascinating, and perhaps also a little troubling for those who are paying very close attention at home:

With the combined Virtu-KCG operation – and, assuming that combination has already (nearly) optimized KCG’s enhanced volatility capture components and migrated that IP onto Virtu’s world-class infrastructure – plus, the heavy concentration in US equities, VIRT has now become an even more highly correlated proxy for the VIX – which, by the way, has recently been the de facto listed derivatives fulcrum for the Fed, et al. Just sayin’.

With the combined Virtu-KCG operation – and, assuming that combination has already (nearly) optimized KCG’s enhanced volatility capture components and migrated that IP onto Virtu’s world-class infrastructure – plus, the heavy concentration in US equities, VIRT has now become an even more highly correlated proxy for the VIX – which, by the way, has recently been the de facto listed derivatives fulcrum for the Fed, et al. Just sayin’.

It’s a good news, bad news thing. Which one do you want first?

With vol up big during Q1-2018 (relative to recent history), I’d bet that Virtu’s numbers for the current quarter will be solid – if not, beat expectations. VIRT has already jumped to all-time highs – and we are not in the business of making picks (yet) – so you are on your own as to what to do with the stock from here.

However, if we widen our lens – and look beyond the quarterly machinations – there are challenges ahead, particularly if you believe that volatility is still going to be suppressed by coordinated central bank interventionism. Here’s why:

As has been said already, the combined Virtu-KCG group is heavily weighted to equities – and US equities, in particular. (KCG doesn’t help this situation, but exacerbates it.) What’s worse is that nothing else – no other asset class or product class – seems to be working well enough over the past 2 – 3 years to make up for the potential for future declines in their US equities P/L (given persistently low vol, regardless of the reason). Until this new level of concentration can be diluted, Virtu has hitched its wagon to equities and may, in fact, have saved itself in the short term in order to become boxed in over the longer term.

The following two charts paint that picture for adjusted net trading income by asset class (Virtu) and product class (KCG), respectively:

The implications of these last two charts are that by whatever prowess Virtu has achieved success in US equities – or, equities in general – it is not entirely transferrable to other asset or product classes. We can certainly debate the reasons, but one thing’s for sure, Virtu has successfully knee-capped many of the most formidable competitors in US equities by consuming their alpha, with the exception – it seems – of Citadel and maybe a few others like Hudson River or Tower Research or Quantlab.

Translation: 1) HFTs have been gradually “eating their own” for several years now (since about 2010), 2) there are no new entrants in the high-speed end of the strategy spectrum because the infrastructure, data, talent and “staying power” are too expensive, and 3) the concentration of players that we have now is represented by a short list of whales and white-knucklers (who will eventually fall away, too)…

Futures – of any asset class or region – seem to require something different; something more than just speed, and options definitely require an enhanced computational element. The leaders in high-turnover futures trading (like Jump) or fixed income (like DRW) or the listed options gurus (like Optiver, IMC, or Wolverine) have not acquiesced to the same fate as the likes of Sun or Allston or others with heavy concentrations in and dependencies on equities.

In short, market-making and other latency-sensitive prop trading groups have largely stayed in their original wheelhouses (the wheelhouses and cults of personality of their founders, with few exceptions), which are now roughly segmented into small groups of leaders defined by product class: Cash (equities), futures and options.

The next layer of powerhouse players (after more purely speed players) are those shops that have achieved multi-product, multi-asset, multi-regional and multi-temporal success in trading precisely because they are not competing so much on speed – but that speed is a component. This is the strategy that Two Sigma and DRW have employed most recently with their acquisitions of Timber Hill and RGM Advisors, respectively – which brings us to this next thought:

One other notable move for significant growth for a firm like Virtu would actually be to add slower turnover, higher capacity, yet lower Sharpe Ratio strategies to the mix. Here, you would be stepping soundly into the wheelhouses of firms like Two Sigma, DRW, D. E. Shaw, or possibly Point72 – and who themselves are up against other powerhouses like Renaissance, Susquehanna, or even Peak 6.

However, this strategy would potentially create the incremental upstream flows for downstream market-making, as if such a firm had gone out into the public market and acquired ITG, Interactive Brokers or – ahem – the husk of Knight Capital…

This is what I perceived Andy Sterge to have done, or tried to do, for BNP and its “prop arm” CooperNeff; a version of the UBS/Swiss Bank-O’Connor play or the NationsBank-CRT play of the same era.

A thought experiment to be performed now is whether there is enough “room”; enough theoretical capacity available to make such a trade (should Virtu ever need to bolt something else onto its platform). Are these upstream players collectively capturing most of the theoretical alpha capacity in those strategies given their cutting-but-not-bleeding-edged turnover frequency?

It’s another deep thought for another day – but, one that you can contemplate on your own for the time being by meditating on our Asset Manager Technology Spending Framework (Map) – “The Context Machine“…

So, here’s the wrap (finally!): If vol stays elevated, Virtu should continue to do well, with or without support from other asset or product classes, and even though a shrinking roster of leading players remains tenaciously competitive. However, if vol returns to extended periods of suppression, the road will return to being quite challenging. And, we believe that under those circumstances; when the trajectory of adjusted net trading income turns south again, that Virtu will look to make another major acquisition in order to continue on its perceived path of empire building.

Lastly, as we return full circle to our opening walk down memory lane, here’s a couple examples of my premonitions on the high-speed trading – and quantitative strategy development – spaces that you might get a kick out of, if you haven’t already had enough – from my days at TABB Group in February 2011 and July 2013, respectively – which are also available in the Paul Rowady playlist on our YouTube channel, Alphacution Riffs.

Hopefully – for your sake and mine – this is all I have to say on these matters for a while. There are so many other pieces of this fascinating puzzle to solve…

As always, thanks for your attention. And, if you find value in this work, please share it – talk about it – and send us feedback…

April 25, 2018 – Point of clarification: I forgot to mention our friends at Flow Traders as being the only other publicly-traded prop shop on Earth (now that KCG has been absorbed). Confession: Given my personal experience, I tend to gravitate to the Chicago players more than any others, and 2) Because their metrics, like “revenue per employee” tends not to be nearly as high as Virtu – thereby providing a strong indication that their “flavor of alpha” (and, likely, their culture, too) is notably different than Virtu’s – I tend not to showcase them as much. This fact does not mean that they are not important in better understanding the market-making / HFT / prop trading end of the asset management spectrum.

Leave A Comment

You must be logged in to post a comment.