“I don’t know where I’m going from here, but I promise it won’t be boring.” – David Bowie

For someone who has spent a career scanning the landscape for cataysts – as if in perpetual “sentry mode” – it’s damn near impossible to consume the latest news and not become introspective. Perhaps that is merely the occupational disposition of someone who regularly commits thoughts to pixels. It’s difficult to conjure up this week’s musings on the state of play without a corresponding level of seriousness and mood to risk opening Pandora’s Box with a brief flurry of thoughts that are worth writing – and reading.

Anyway, here we go:

With the scent – and evidence – of economic upheaval in the air, I thought it would be a good time to revisit one of our older themes, the Investment Bank Headcount Index. The last time we touched on this topic was a year ago in, “How Many Heads Does It Take To Run A Bank?” It’s never been a wildly popular topic – hence, its infrequency of late here on the Feed – even though it’s easy to draw a direct line from it to the topics that light up our pageviews: The success of those who traffic in the private realms of trading and asset management.

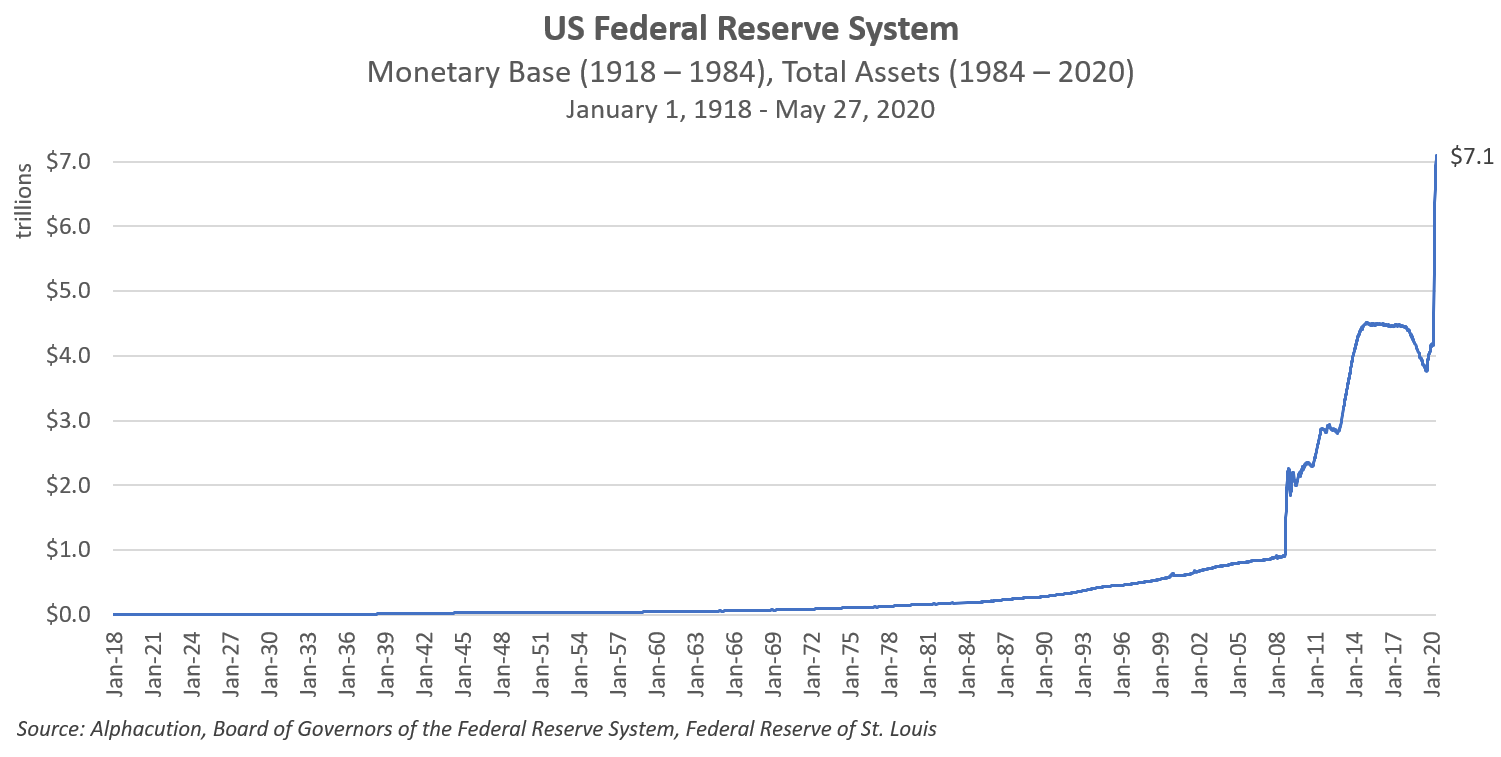

Before we get to that picture, let’s remind ourselves of the one – maybe only – thing that is delaying something I am purposely sandbagging as “upheaval” from more accurately being defined as outright “devastation.” With the VIX now approaching the realm of “normal” (now down to a 25-handle) largely because Fed assets have skyrocketed to north of $7 trillion as of last week (below), the ongoing mix of tequila and Quaaludes that generally feeds our belief system of late continues to perpetuate its intended illusion…

Now, frankly, maybe there’s a perverse purpose to that illusion. If you were to mash the worst parts of 1918, 1931, and 1968 into one period, you just might arrive at mid-2020 – and so maybe it’s better that we all don’t arrive at that realization all at once.

Still, if our go-to response to anything with material economic consequences – which is, arguably, everything material that happens at a public scale – is to turn the money printer up to 11, then something about our framework is doomed. It’s just a matter of when…

Of course, when the players own the field and the referees, it’s no wonder that our ability to respond intelligently, responsibly and quickly to disaster has become completely ossified. It’s much easier to print money and ignore the glacial accumulation of consequences. That is until “we” are the Titanic, or – dare I say – the South Tower…

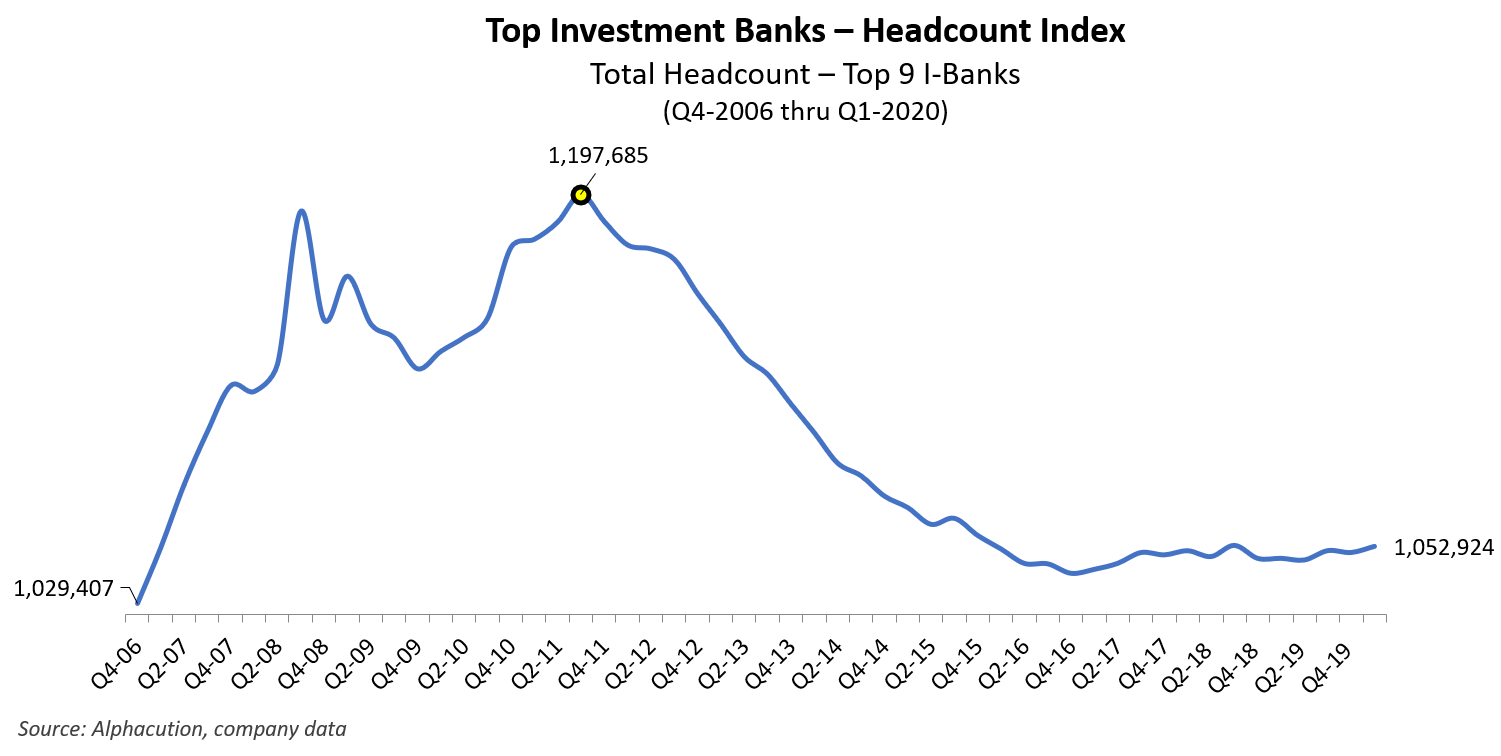

This brings us to the latest Investment Bank Headcount Index, below. Since bottoming in Q4 2016 (at 1.042 million) in the post-GFC period, this “index” has been as boring as Wolf Blitzer’s “Situation Room” on loop; now standing at 1.053 million 13 quarters later, an infinitesimal change of 1.07%…

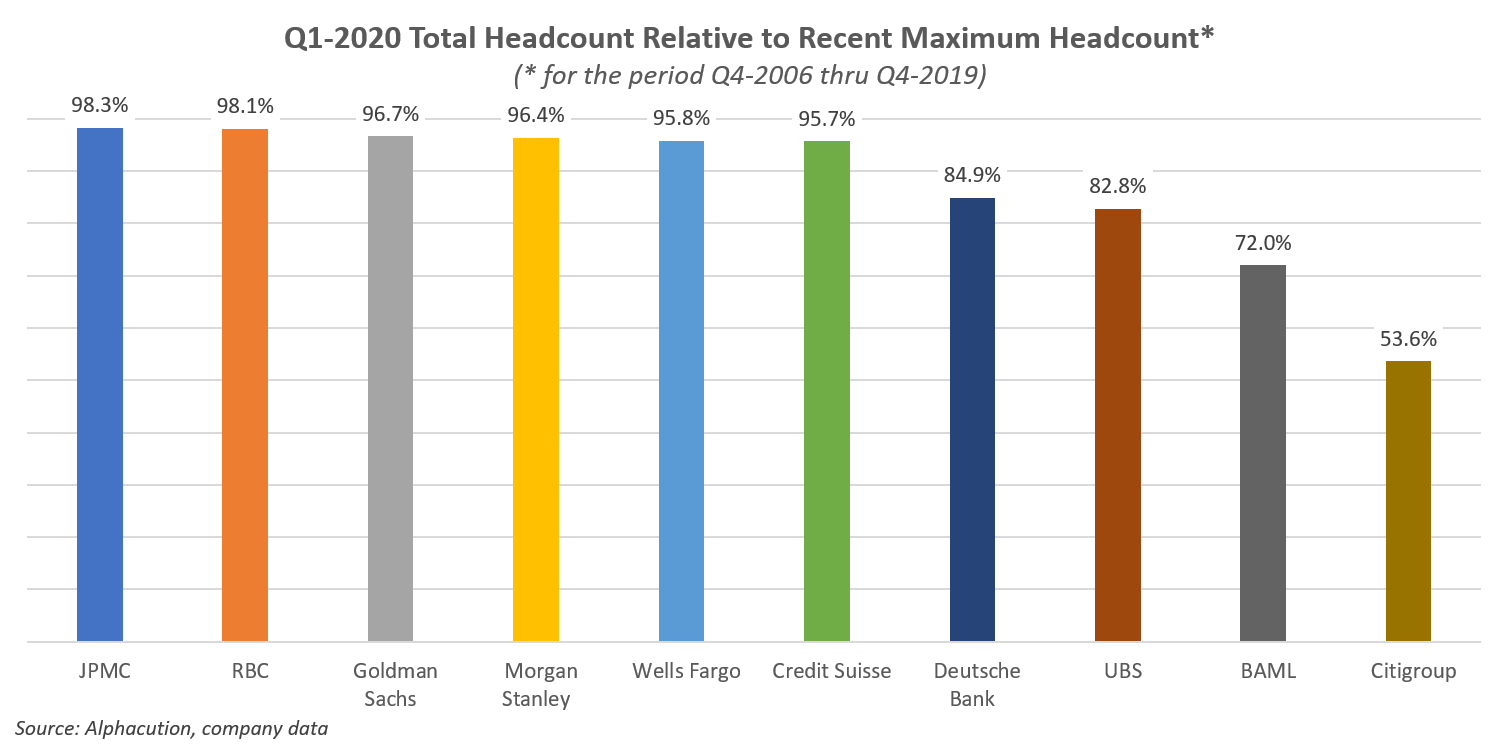

Now, admittedly, there is much going on below these headline figures. By location. By workflow function. By business unit, and so on. Furthermore, this recent “status quo” does not occur by fluke of one or two outliers. Six of ten of the banks in this index currently have total headcount within 5% of their 54-quarter maximum (since Q4 2006), see below:

But, no matter how many times we trot out the idea that the bots are invading Wall Street, the topline headcount numbers appear to be incredibly resilient. In fact, strangely and suspiciously, far too stable given the times we live in. Maybe this is about to change…

Here’s the hard pivot: When you look up the benefits of capitalism, you get consensus around attributes like “economic freedom” (lack of government intervention / lack of centralized price controls) and “competition” (creative destruction), among others like private property ownership and profit motive. This is the Pandora’s Box that’s difficult to open in a short piece, but for those who are joining me in a bout of introspection:

- Is it still “capitalism” if the Fed supports more and more of the economy with monetary interventionism and the price of assets with aggressive interest rate policy? (No.)

- Is it arrogant to operate as if the “market” won’t eventually find its real equilibrium no matter what the Fed does? (Yes.)

I’m a capitalist. I don’t believe the US is operating within a capitalistic framework anymore – with those in favor of the current non-capitalistic system blaming current problems on socialism, which is deranging. (BTW, technology and automation and the impact of winner-take-all market dynamics have played a huge role here.) A better capitalistic model might benefit from better-equipped referees and more socialistic safeguards for people and the environment, among a number of other achievable improvements.

However, if the human race does not finally learn to operate as if none of us played a role in the circumstances of our births (thus re-validating the wisdom of our founders), society will not be teleported back to some phantom golden age of the 1950’s, but – I fear – to a digitally-dystopian version of the 1600’s…

Until next time…