“Capitalism has defeated communism. It is now well on its way to defeating democracy.” – former HBS professor, David Korten

“The most important question facing humanity is this: Can we reach global empathy in time to avoid the collapse of civilization and save the Earth?” – Jeremy Rifkin, principal architect, “The Third Industrial Revolution

“…Bizarre…” and “…inscrutable…” is how one notable content aggregation platform has recently described Alphacution’s work (after we maxed out their popularity scores with the articles in question – and while being the youngest research and advisory group to be competing for attention with the likes of the Wall Street Journal, Bloomberg News and the Financial Times, among many others). On that score, I’d say we’re punching well above our weight class. But, with this – uh – compliment, it seems like as good a time as any to pause for a minute and perform a few extra Mark ‘The Bird’ Fidrych moves on the mound before making the pitch for today’s (1st Mad Lib here) and (2nd Mad Lib here) story…

All of what you are finding here on our Feed is by design. Our content is purposely developed to cut through the noise and distractions; tickle your sense of curiosity about that which has historically been secretive and mythological or just plain complicated – and maybe even make you laugh from time to time; keep your attention hooked with a kind of irreverent and technical poetry; provide new perspectives on how markets and strategies actually work with our visualizations; and – ultimately – demonstrate how those markers are connected to and impacting the exact spot where you are sitting right now, no matter where that is…

Yes, some may get it, some may not. That’s perfectly fine. We won’t change the approach, though. It’s simply too much of a blast to create this way…

After all, by latest count, of the 66,682 visitors to our site since launch, 99.9% of you have been enjoying this content free of charge – and, hopefully, more as a result of the content than the price tag, thousands upon thousands of you continue to return for more. That’s a signal for something, no?

So, as long as that continues to be the case, I will invite you to indulge me in the occasional digression to detail what is actually going on here. Alternatively, I could keep the language completely milquetoast and pedestrian. But, I can’t have any fun doing that – and neither can you…

With that opening riff, here’s the wind up:

Based on real operational data – not the survey data relied upon by our peers – Alphacution is carving out a new category of research. A desire to satisfy unmet intelligence needs with attention-grabbing topics notwithstanding, we didn’t plan it that way from the beginning, necessarily. It’s just what fell out of the modeling efforts, once we turned from the original global banking tech spend modeling to tackle that of the buy-side in mid-2017. Modeling technology spending patterns for a spectrum of market makers, proprietary trading firms (or, “prop shops”), hedge funds, and traditional asset managers – thereby validating our hypothesis for the persistent relationship between the two, and only two, engines of productivity – this phase of our research effort originated with the report “The Context Machine” and ended up becoming the foundation for our often-referenced asset management ecosystem map.

From there, we stumbled over 13F data, including the substantial archive of 13F reporting from some of the world’s all-time most successful and secretive prop firms, and figured out how to credibly reverse engineer certain key aspects of their trading and operational strategies – along with the historical twists and turns of growing those strategies successfully, while navigating the natural undulations of the market landscape. We didn’t plan it that way from the start, necessarily. It’s just what fell out of the modeling…

Then, when we realized that the FOCUS reports required by broker-dealers (on SEC Form X-17A-5) were being filed by some of the very same mythological prop firms that were also filing quarterly long positions corresponding to a list of 13F securities, we realized that we could estimate the fair value of the short side of the book (that is not included in the 13F reporting) and get an unprecedented (yet, still high-level) look at exposures to non-13F products, like bonds, futures, options on futures (OOFs), OTC derivatives, mortgage-based securities (MBS) and other exposures. We didn’t plan it that way from the start, necessarily. It’s just what fell out of the modeling…

And now, as we begin to peer out across the horizon from our current US-centric vantage to explore cross-market, cross-regional and multi-strategy vectors of notable – and notorious – firms, there are numerous additional datasets that can be used to breathe more vivid direct and contextual intelligence into our integrated modeling architecture. The UK’s Companies House account reports; CBOE’s data on volatility; SIFMA’s and the World Federation of Exchange’s (WFE) various datasets on global exchange volumes and daily average dollar volumes by region; the CME’s and CFTC’s and Bank of International Settlement’s (BIS) data on futures and OTC derivatives; among others, are all examples of additional puzzle pieces waiting in the wings to augment an expanding roster of individual company models that now allow us to look across segmentations of firms, markets, product classes and themes, like fees, payments for order flow (PFOF), and the morphing of exchange businesses into data and technology firms, just to name a few of them…

As much to our amazement as to anyone else’s, the insights continue to pile up – and the evidence continues to become deeper, richer and clearer. So, say it again with me now, one more time: “We didn’t plan it that way from the start, necessarily. It’s just what fell out of the modeling…”

Market Macrostructure Research is the new category that Alphacution appears to be chiseling out of an expanding block of data that – so far – just so happens to be lying around in plain sight for free. We have demonstrated an ability to tell detailed and fantastical never-told-before stories about key market actors across the entire trading and asset management ecosystem. But more than that, we have discovered that there is a symbiotic relationship between the players and the field: Certain players influence the field which changes other players which then influences the field again, and so on. At the base of it all is technology…

What follows from here is a story Alphacution started with the completely nerdalicious Feed post, “The Physics of Market Structure – Part 1.” (After all, we did promise a Part 2.) Feel free to return to that piece, but we will summarize the key points from that and other prior research as we round the horn, and then perform the trick of stealing home by having something new to say about a common thread that runs through Citadel, Bridgewater and BlackRock.

Here’s the base of what you need to know: Alphacution has established in prior research that 1) market players are aligned on a “map” or “field” in such a way that corresponds to a persistent relationship between AUM, technology spending and headcount (given a selection of mature managers), 2) this relationship is a proxy for average workflow automation embedded within each of a spectrum of strategy selections, and 3) the capacity of alpha is finite and elastic at any point in time. (On point #3, Alphacution further believes that the capacity of alpha is measurable.)

Information Asymmetries

Now, let’s build upon these concepts by adding what we presented in the “Physics – Part 1” piece (June 2019) plus what we’ve developed since then:

A capitalistic market ecosystem is designed to promote capital formation and price discovery. As such, it simultaneously serves as a massive information consumption and dissemination mechanism. Because of the diversity of objectives and variance in capabilities of market participants, a significant byproduct of this apparatus is information asymmetries. The act of discovering and capturing the value of information asymmetries is the source of all alpha. In other words, in listed markets, leveraging an arbitrage between what a trader knows now relative to what other traders (or, “the market”) will know later – even a microsecond later – is often known as a trader’s “edge.”

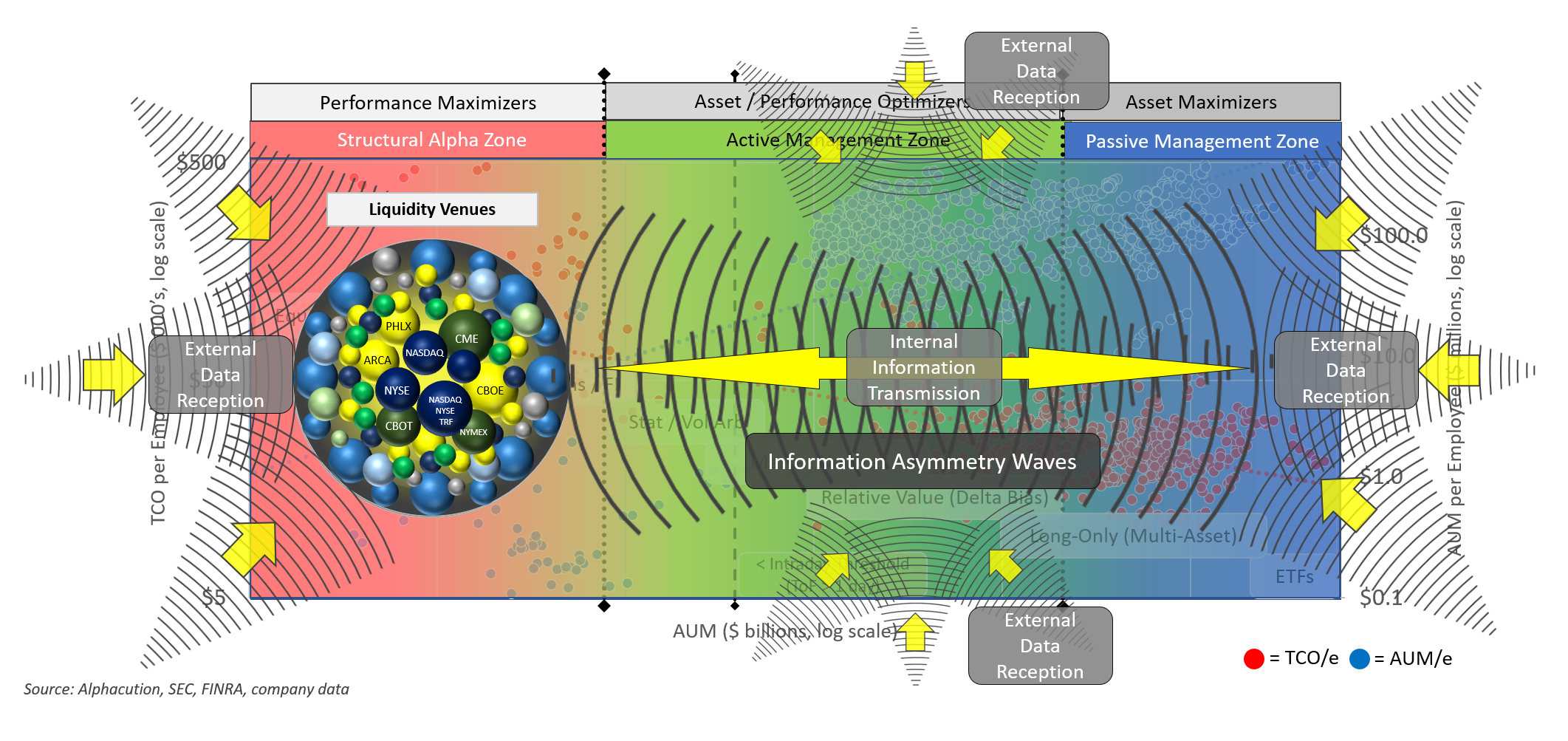

In the exhibit below, Alphacution presents new annotations on top of its original construction of the asset management ecosystem map to represent our interpretation of the market’s information consumption-dissemination mechanism, and the “information asymmetry waves” that are the result of market participants’ diversity of objectives and capabilities.

Here, we are attempting to illustrate how market participants from all zones – and all strategies – are consuming raw and refined data – from both inside and outside the market ecosystem – to formulate and transmit investment decisions, including scalable trading and investment strategies. Transactions on exchanges and other liquidity venues (i.e. – market data) are like a feedback mechanism for all those decisions.

As a sidebar, note that there is another important story here about the implications of an eternal data explosion; the “big data” phenomenon of recent years that has matured into the intensely explored theme of “alternative data” in the market ecosystem. We will bookmark that topic for now, but definitely return to it later because it’s critically important.

Anyway, at any point in time, the value of information asymmetries – translatable into the value or capacity of alpha – is finite. Now, when we couple that claim with the idea that those who wield the combined power of technology and human capital are essentially industrializing the discovery and “harvesting” of finite alpha, what do you think happens to the capacity of residual alpha (after these players have taken their bite out of it)?

It shrinks…

Alpha Capacity Elasticity

Now, let’s slow the pace here for a minute to let this sink in by way of some additional explanation:

In the heyday of new products, fat spreads, growing volumes and low automation – otherwise known as the 1980’s – floor traders and traditional investors alike could discover and capture consistent sources of outperformance – like picking plump, ripe apples; the proverbial low hanging fruit – because information asymmetries were so plentiful and resistant to decay. At least, it seems that way relative to the nature of the landscape today.

With that, let’s expand our perspective on these thoughts with some specific vernacular: Despite lots of descriptions that would suggest otherwise, there are actually only two core types of alpha, structural and asymmetric. Structural alpha is comprised of bid-ask spreads and the ever-fleeting intra- and inter-product class mispricings, as discussed in the recent post, “A Brawl Breaks Out in the Futures Market – Part 2.” Market makers and other purveyors of hyperactive strategies (mainly, prop shops) – who, in aggregate, represent the members of our structural alpha zone – capture 100% of the value of spreads and structural mispricings in listed markets, thus leaving the residual value of asymmetric alpha for their neighbors…

Furthermore, Alphacution has developed evidence – in large part by way of its detection and description of the nested alpha architecture – that a short list of leading players in the structural alpha zone are capturing some portion of asymmetric alpha (or, at least, aiding their internal nested alpha architecture counterparts in capturing asymmetric alpha), as well.

Meanwhile, in the neighboring active management zone (which contains all hedge funds) – and with a majority of leading players deploying various forms of automated and quantitative relative-value or statistical arbitrage strategies – much of the value of asymmetric alpha is being captured by just a few players. Alphacution detailed this phenomenon in the Feed post, “The Privatization of Alpha,” and noted that for year-end 2017, five of the top six hedge funds (as measured by AUM) were quant funds; a ranking that still did not account for Millennium, Citadel and a few other leading quant specialists.

Now, we cannot yet quanitfy the value of residual alpha that may exist after the market makers, prop firms and leading quant hedge fund managers harvest their (increasing) cut of the total. However, given the roster of notable fund exits, and the exodus of money, people and energy from traditional, discretionary market strategies into just about everything else – passive management vehicles (like, ETFs), private equity, venture capital, crypto markets, cannabis and real estate, to name a few of the obvious ones – we may not need more than anecdotal evidence at this stage to confirm the trend: The capacity of finite alpha in the ecosystem has been shrinking at the same time that leading tech-wielding firms are growing by capturing more of it.

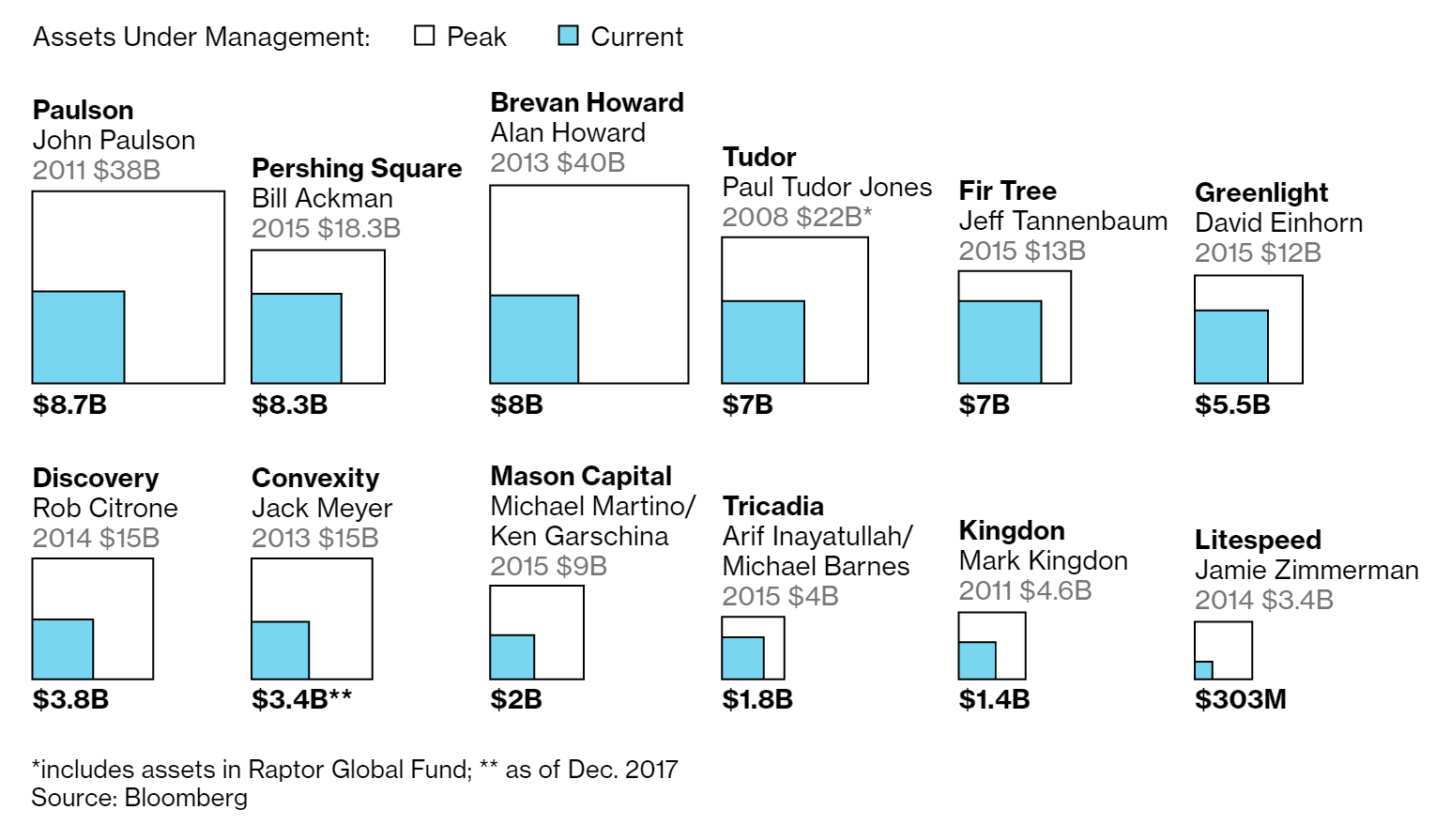

Here’s a quick reminder from Bloomberg on what has happened to some of the more notable discretionary hedge fund managers, as of December 2017:

What’s potentially more cautionary, this trend – or, at least, a key component of it – may be self-reinforcing: A preponderance of mean-reversion strategies naturally limits the deviation from the mean, by default; and therefore, has a tendency to dampen volatility. In other words, the increased adoption of mean-reversion strategies ultimately gives more power to those players to define the mean. As the balance of automated vs. discretionary strategies tips towards the automated, the “mean” – (i.e. – liquid, major market indices that are entrusted to track the health of the stock market, and sometimes naively, the broader economy) – need no longer be as strictly connected to fundamentals nor traditional valuation parameters. If so, the implications from the phenomenon of self-reinforcement are enormous…

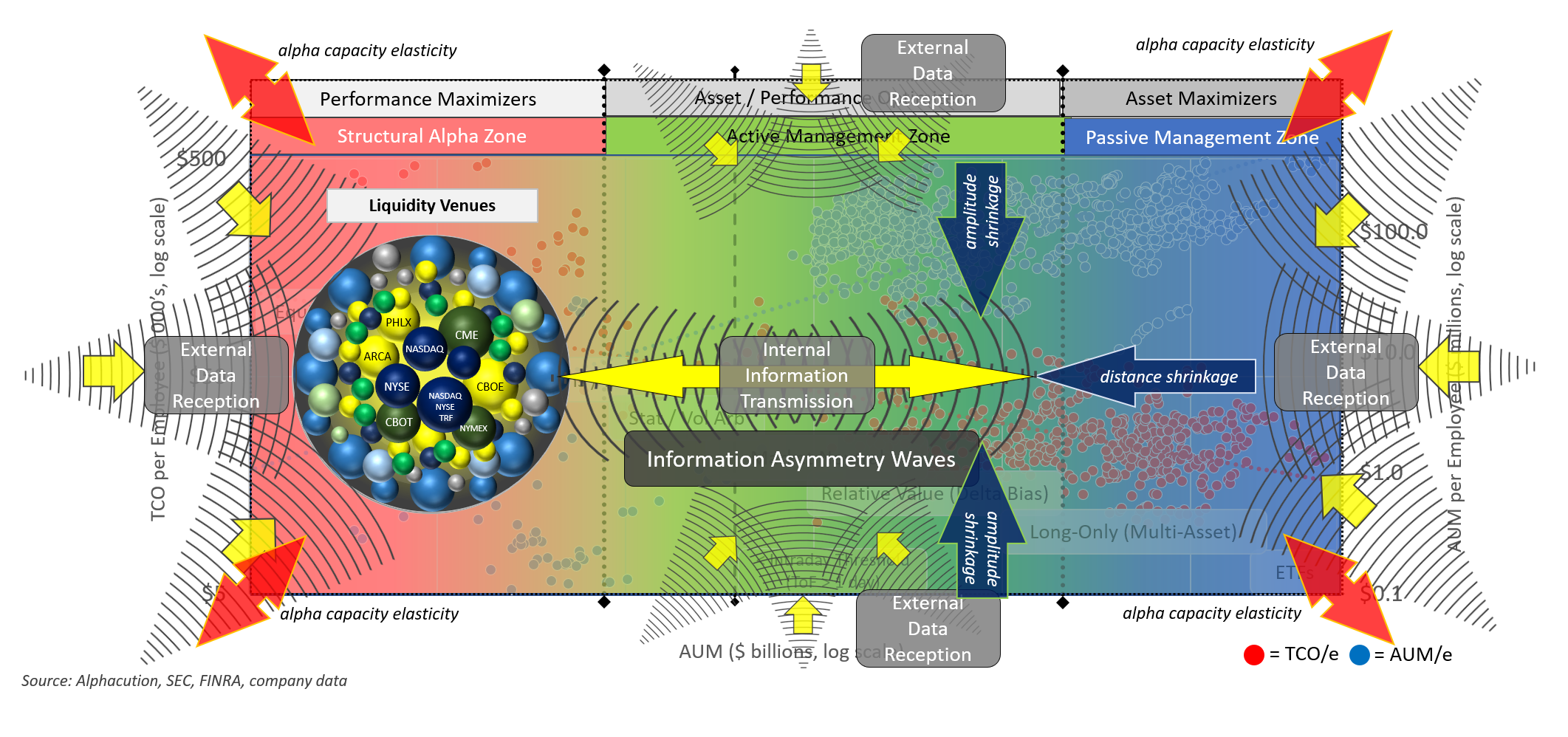

Long story short, in the chart below, Alphacution presents the prior ecosystem chart, except this time with its initial interpretations of the condition of alpha capacity elasticity.

Here, what we are trying to illustrate is a compression of the information asymmetry waves; metaphorically shrinking due to the totality of structural alpha being absorbed in its native zone without leakage into the neighboring zones, plus an increasing portion of asymmetric alpha being captured by the growth in industrialized relative-value strategies. In truth, what is happening here is a contraction in the total capacity of alpha – this is alpha capacity elasticity – which shrinks the “boundaries” of the entire map. Shrinkage in information asymmetries is merely symptomatic of that contraction…

Now, couple contractions in total alpha capacity with certain industrialized players growing as they capture more of it: According to our thesis, the upshot of all these bites at the proverbial apple along the way by automated players is making it increasingly difficult for traditional, discretionary managers to detect and capture whatever residual asymmetries remain – particularly those traditional shops that operate at the junction of the active and passive management zones. For all intents and purposes, they’ve lost their edge, and now they’re (at risk of) losing their businesses. To wit: According to estimates from Hedge Fund Research, money flowed out of the $3.25 trillion hedge fund industry in 11 of the past 15 quarters, resulting in little growth over the past two years…

Hence, we see instances of lower than expected performance, discretionary strategy AUM shrinkage, passive strategy AUM still swelling, and outright exits from the category. Queue the asset manager job cuts here, here, here, here and here. Granted, there will be outliers, exceptions and those occasional discretionary players who manage to swim successfully against the tide. But, you need to ask yourself: Is that a temporary, accidental or persistent form of alpha?

Strategy Type Concentration

In summary, there are three core strategy types that correspond to each of our ecosystem zones:

- Hyperactive strategies that are designed to harvest structural alpha in the structural alpha zone, which include market making and other high-frequency trading techniques;

- Active strategies that are designed to harvest asymmetric alpha in the active management zone, which include various automated and quantitative relative-value and active, discretionary stockpicking techniques; and,

- Passive strategies that are designed to replicate beta returns in the passive management zone, which includes ETFs and other indexing techniques.

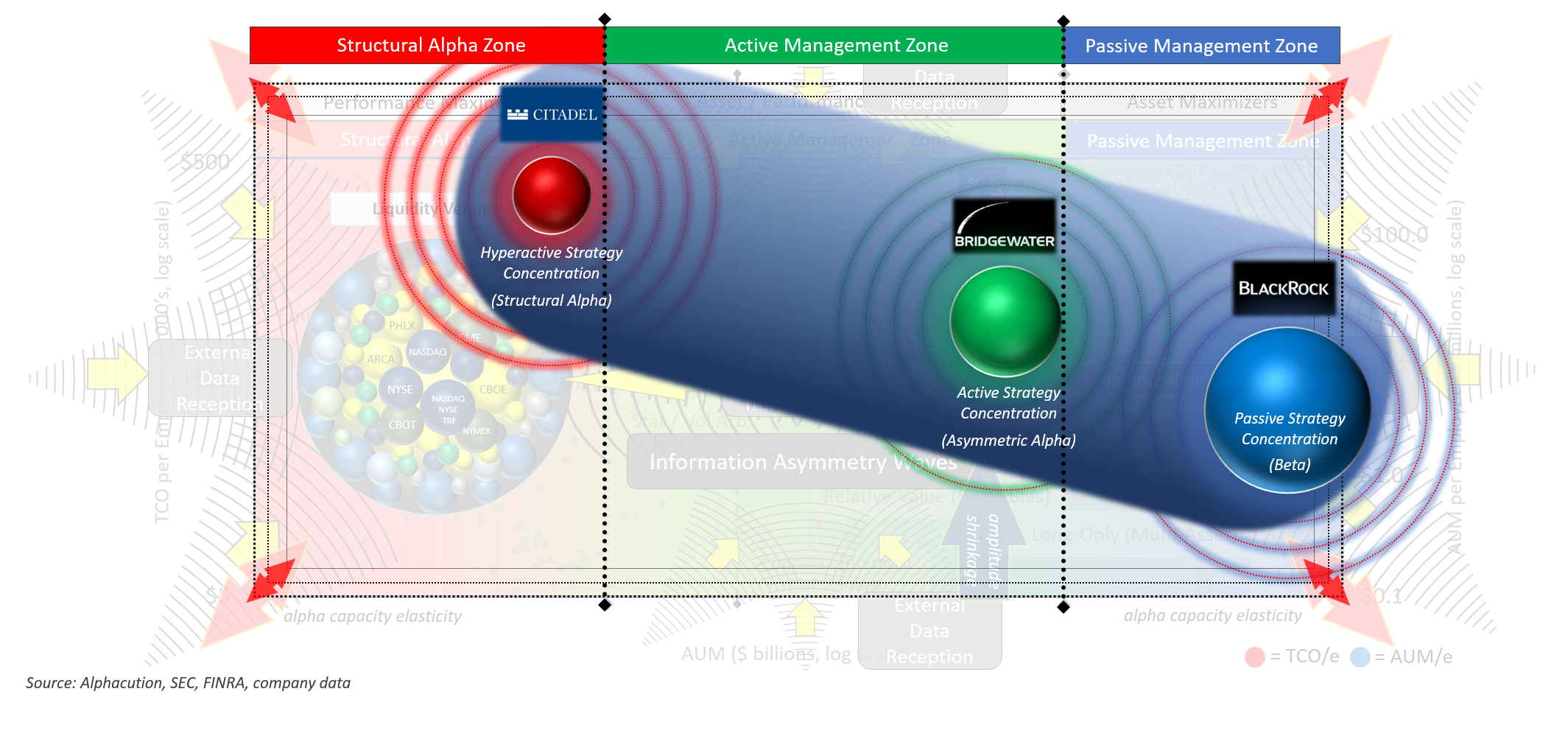

Each of these categories has a roster of leadership. According to Alphacution’s modeling and analysis to date, the leader – and possibly, dominant player – in the structural alpha zone is Citadel for its multi-product leadership in market making; in the active management zone, the leader is Bridgewater Associates for its leadership in applying quantitative methods to the largest base of assets (thus defining the outer AUM boundary of this zone); and, in the passive management zone, the leader is BlackRock for its leadership in attracting the largest, multi-trillion-dollar base of assets dedicated to exchange traded funds.

Note, for extra special distinction, that the only member of this unique triumvirate that is operating at the highest levels in more than one zone – the structural alpha and active management zones – is Citadel. This is due to their #1 market making position via Citadel Securities and their #3 ranking, by net gains since inception, among the all-time top hedge fund managers, (behind Ray Dalio’s, Bridgewater Associates and George Soros’ eponymous, Soros Management). In terms of aggregate capabilities, Citadel is a singular breed of champion on this field…

In the chart below, Alphacution presents its interpretation of that leadership positioning in the context of our map:

Now, this is not to say that other players in each of these categories aren’t worthy of praise and distinction, particularly for their prowess in applying technology to the global markets. There are several, like Susquehanna (SIG), Jane Street, Two Sigma, D.E. Shaw, Millennium, Renaissance Technologies and several others, who belong in some kind of super secret Hall of Fame along with those that Alphacution has dubbed as leaders in their various categories, above. Moreover, we expect most of them to – at best – continue to grow and thrive, and – at worst – be competitively well-positioned to withstand disruptions.

Implications

But, here’s a potential problem; the other side of the proverbial coin: In the world of listed markets, where the boundaries of our map – as theoretically defined by a constrained, yet elastic, capacity of alpha – are more likely to remain compressed or further constrained than they are likely to expand anytime soon, the ongoing success of the leading players mentioned above are most likely to come at the expense of other players on the field…

This expectation has implications for both precision micro-impacts and huge geo-macro-impacts. In other words, the success of leading players today and going forward is both a blessing and a curse. As a guy from the Motor City, I see parallels in the maturation of the auto industry with that of the trading and asset management industry, where the former is a leading indicator for the latter. With leading players essentially eating their own, the total roster of players on the field are more likely to become more concentrated than not…

Now, in terms of geo-macro-impacts, and as a foreshadowing for where we may be headed over the long term (in a bid to eventually make this research more mainstream), let’s attach a virtual line to a virtual dart and shoot that dart in any direction, outside of our market ecosystem. It really doesn’t matter where that dart lands, because we already know – thanks to da Vinci – that everything is connected to everything else.

What we have presented here is essentially a schematic for the inner-workings of the beating heart of a capitalistic, market-based system. The thing that sits at the heart of whole economies, and the place where capital and data converge, in theory, to establish free market price discovery (at least, in Western-styled democracies). So far, Alphacution’s map just so happens to be a version of that beating heart in the US, which still retains its status as the world’s largest national economy – but we expect that it is roughly representative of something global.

With all this said, I want to leave you with one question to ponder for now: Is the concentration of players in capital markets today – and for the foreseeable future – a harbinger for the improving or declining health of a free market, capitalistic system?

Because the planets are aligning for something historic…