“Learn how to see. Realize that everything connects to everything else.” – Leonardo DaVinci

Capital formation…

Price discovery…

These are the primary goals of market structure mechanisms. A place to gather – whether that place be a Buttonwood tree or a bank of caged servers – and a playing field framed with enough freedom for participants to discover and set asset prices based on publicly available information.

Now, as most of you know, this opening salvo can go off the rails and into the complicated (and sometimes angry) weeds rather quickly. And, under most circumstances, I’d be happy to throw a few stones: There are strong arguments to be made that technology and regulation have (permanently) altered the nature of capital formation mechanisms in the digital era, which may be why private market solutions are thriving so much – and why the stock market is actually made up mainly of things other than stocks. Meanwhile, price discovery is no longer real price discovery as long as the price of money – and anything priced off of the price of money, which is most financial products – is centrally managed with such a heavy hand.

Anyway, let’s pretend I didn’t just say any of that – and let’s agree to set aside the arguments for the time being in order to explore a phenomenon that is impacting the constellation of participants in the market ecosystem in a way that I think all asset managers and their stakeholders need to understand far better than they currently do:

The Physics of Market Structure

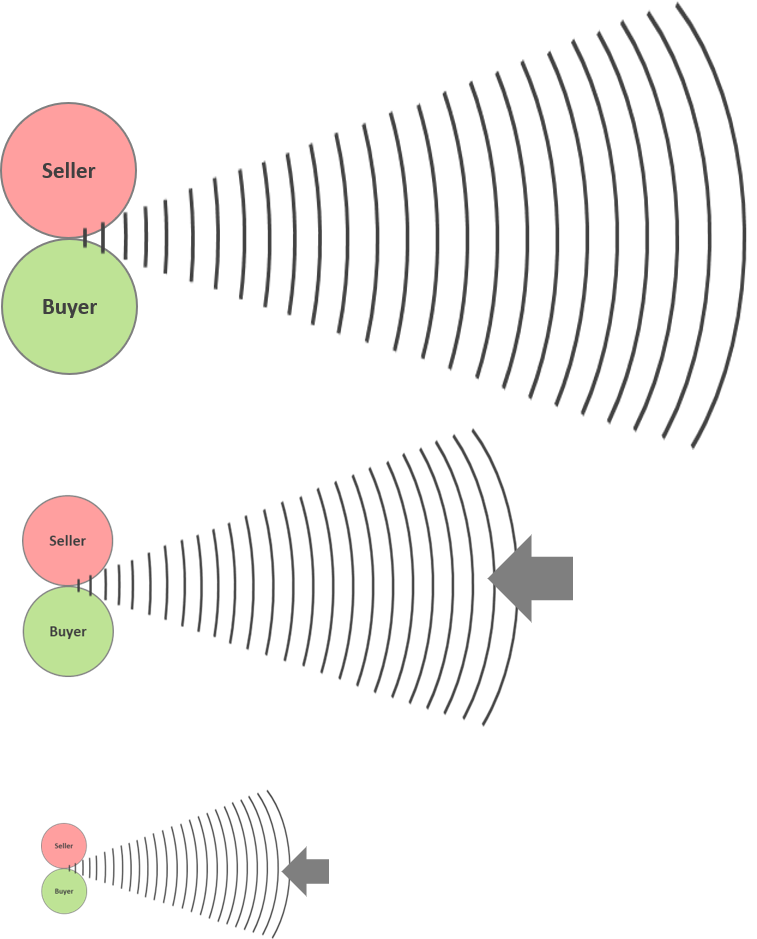

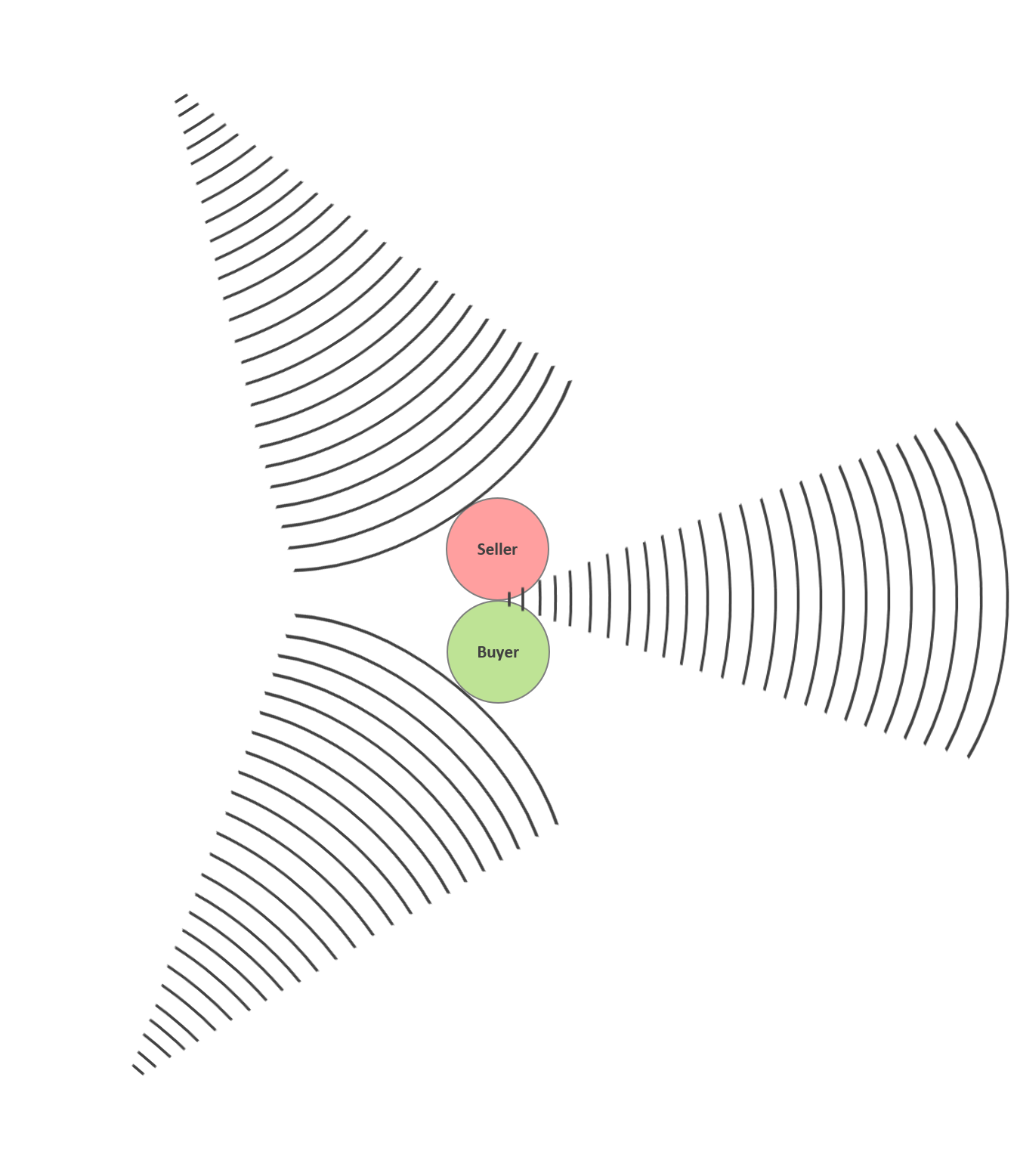

Let’s go back to first principles: Consider that each transaction absorbs information within a buyer and seller – and then reflects that information in price movement after the transaction. The metaphor of throwing a pebble or something much larger into a pool of water – and the waves that each creates – is often used here. Now, consider that this basic mechanism is happening throughout various financial products and transaction venues – like exchanges, alternative trading systems (ATSs), single dealer platforms (SDPs) and multilateral trading facilities (MTFs) to create a multiplicity effect of information transmission:

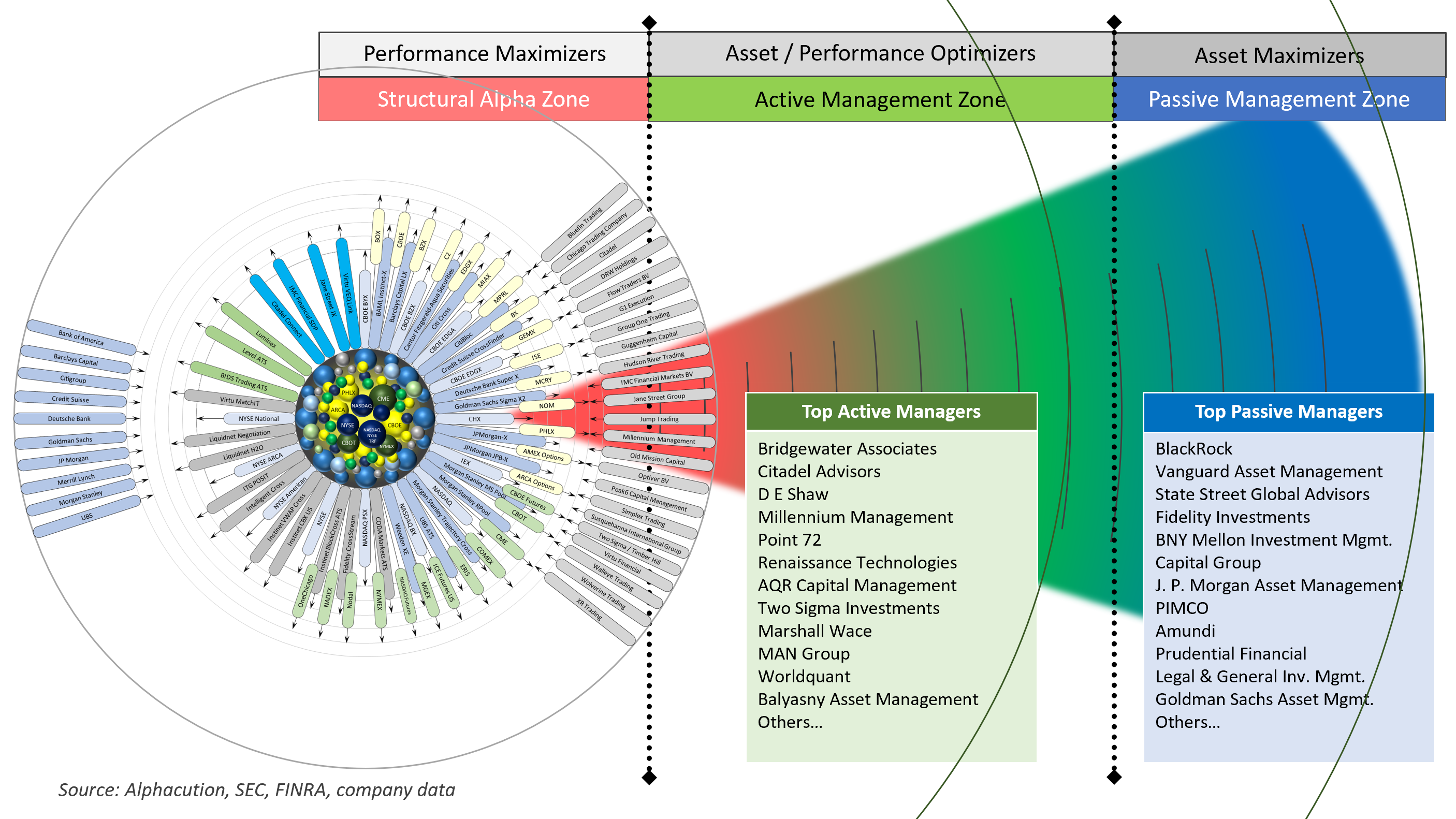

Now, consider that this basic mechanism is happening throughout various financial products and transaction venues – like exchanges, alternative trading systems (ATSs), single dealer platforms (SDPs) and multilateral trading facilities (MTFs) to create a multiplicity effect of information transmission:

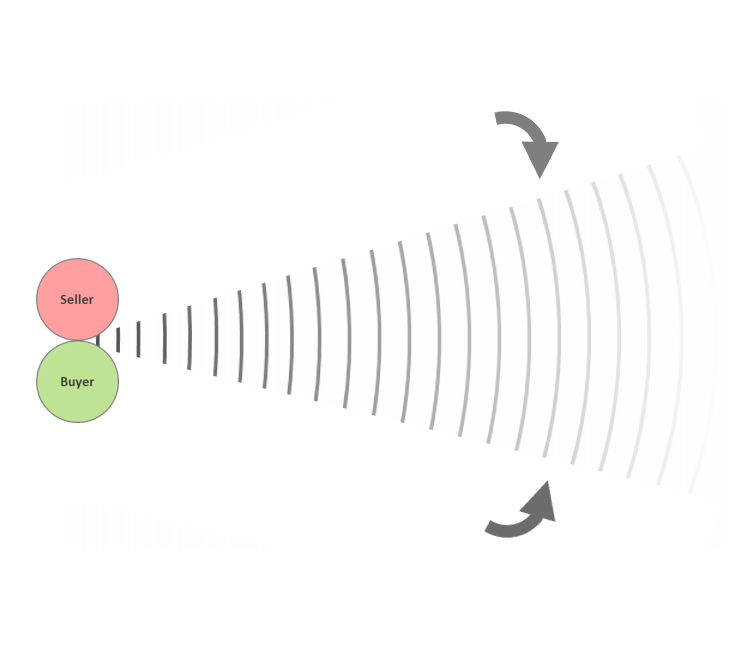

Now, if we were to rewind the scenario to reflect less technology, less fragmentation and less dark liquidity – and then re-run the tape forward from a prior time to reflect increasing workflow automation, increasing liquidity fragmentation and increasing dark liquidity venues – we might see a dynamic where the incremental impact of each transaction ( and the information transmission potential) goes down, much in the same way that throwing successively smaller rocks into a pool of water would have, like this:

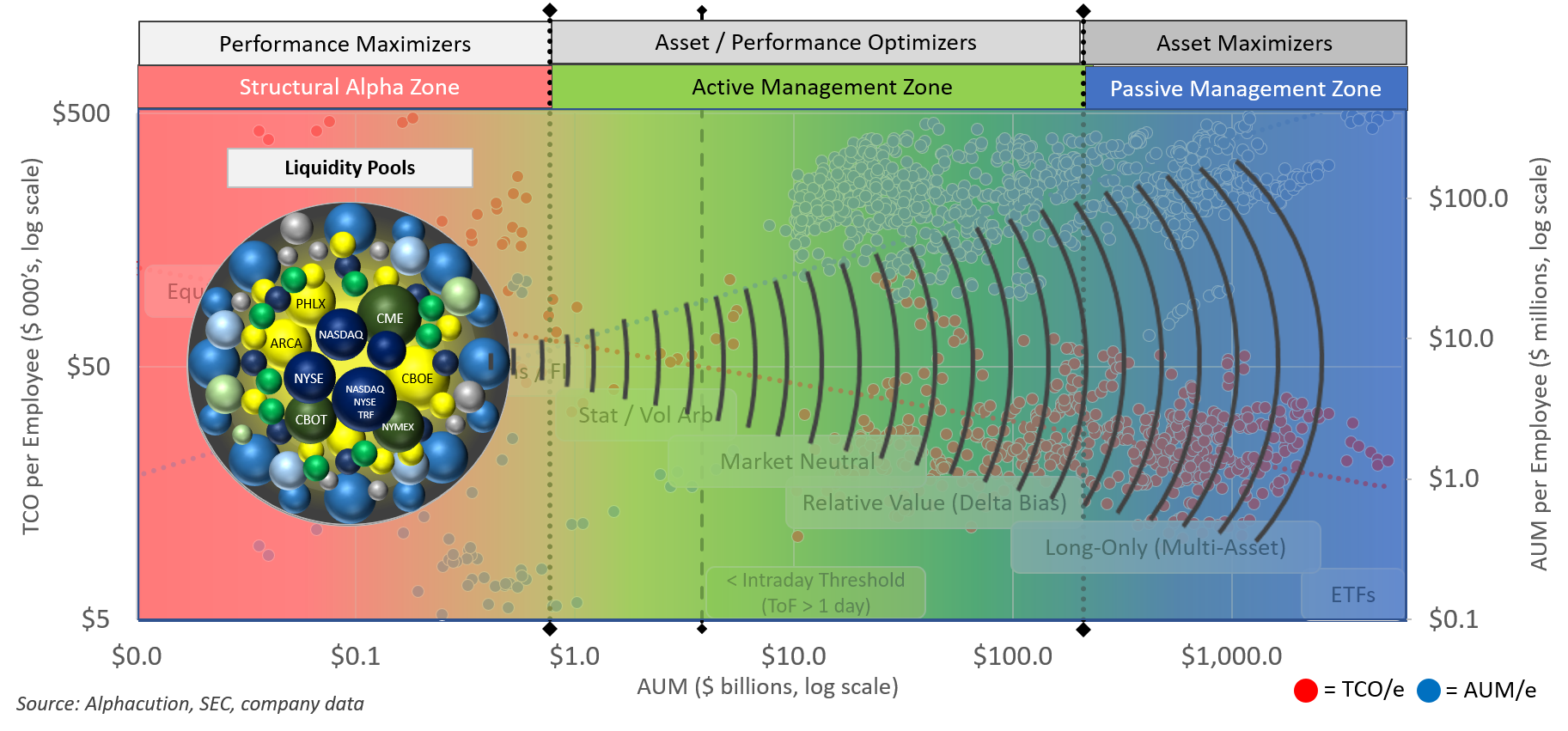

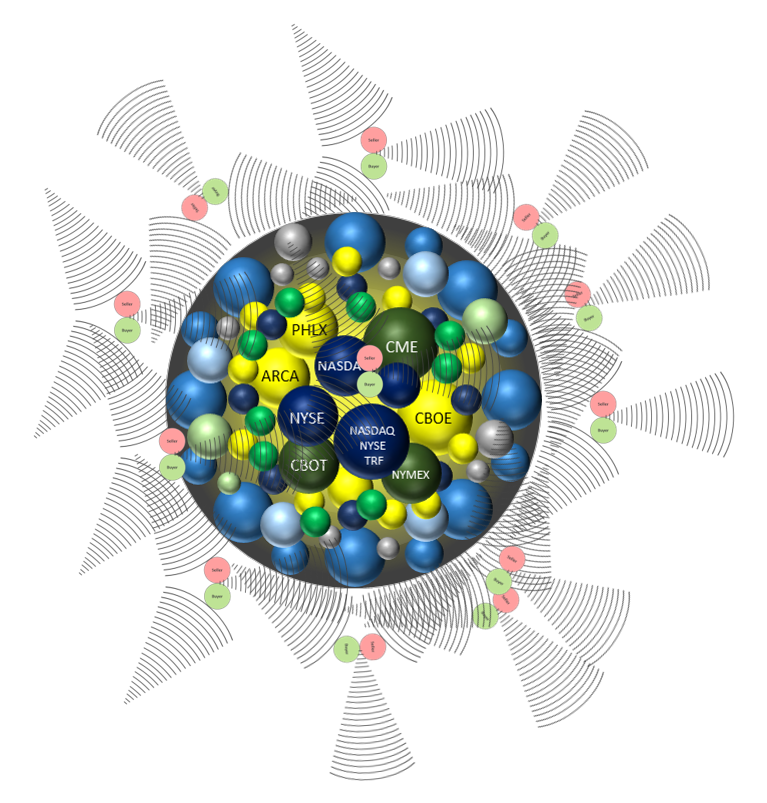

Now, let’s overlay the dynamic of incremental transaction and information transmission impacts on Alphacution’s asset management ecosystem map. In the exhibit below, we illustrate the sources of (listed) market liquidity in the structural alpha zone as the epicenter of information transmission in a strong form – as in, a point in time when there was less automation, liquidity fragmentation and dark liquidity:

Here we are basically saying that the value of the data is not fully decayed by the time it reaches the outer zone of the ecosystem where larger, slower, and longer-term asset managers reside.

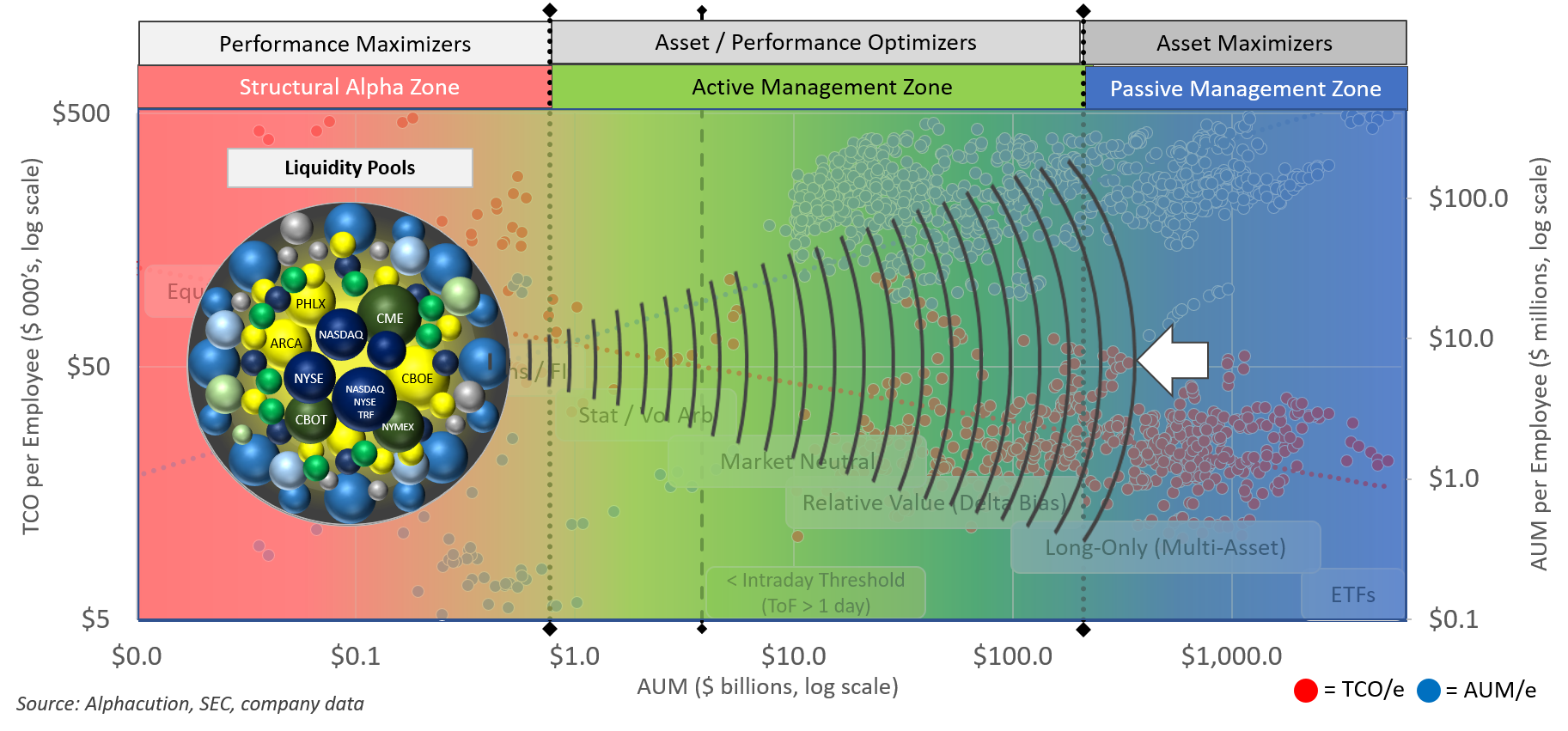

Now consider the aforementioned impacts on information transmission into the outer zones of our map as automation, liquidity fragmentation, and dark liquidity venues are dialed up – and where market makers and a subset of proprietary trading firms and leading quant hedge funds that operate closest to the sources of liquidity are becoming increasingly dominant:

Here we are illustrating that the value of the information is fully decayed sooner than before; that essentially there is little or no remaining information asymmetries that exist at the (slower) reaction rate of the outer zone players.

On May 17, 2019, Institutional Investor published the following:

“History Made: U.S. Passive AUM Matches Active For First Time“

“After a turbulent 12 years for the industry, investors now have as much money in index funds as they do in active strategies.”

Coincidence?

Is the phenomenon we find today between active and passive strategies related to what we have presented above?

Alphacution believes that the capacity of “outperformance” is finite – and, measurable.

Alphacution also believes that that capacity is being harvested by a declining roster of tech-wielding leaders.

What happens when information transmission becomes altered from the flanks as well as the horizon? Think about it.

Think about it.

These tech-wielding leaders operate closest to the sources of liquidity.

This is why we are being so maniacal about modeling and quantifying the impacts of the Top 100 Players in Market Structure; the leading players in our structural alpha zone.

With a few exceptions (that we will eventually be able to detail), this Top 100 list may ultimately contain the last of the active managers.

We’ll be back with more in Part 2…