If you’ve heard of the term operational alpha, then you likely know that it is a trending concept – similar to digital transformation – that seeks to leverage the latest digital-era tools and methods to foster increasing operational agility and resilience, particularly among asset managers. (Think: Citadel, the creator of the term – and one who arguably walks this walk as well as anyone.) Moreover, if your current job is related to implementing tools and methods that are designed to foster operational alpha, then you are likely working with or for a leading, forward-thinking player that is culturally tuned to navigate real change.

The problem with alpha of any kind is that you can’t really have alpha unless it is measured in relation to something else. Beta. In any case, we have some illuminating news for you: It turns out that operational alpha does have something relative to it – which makes it more than a concept. It’s also a number. And, that number is based on another number that Alphacution is naturally defining as operational beta.

Here’s the logic behind our claim: Alphacution has developed a framework that, in part, measures and benchmarks total technology spending (aka TCO) by asset managers. However, since most asset managers are private companies, there is no disclosure of operating costs, like technology spending – which is a big problem when you are trying to answer a question about how much company X spends on technology.

So, in the course of developing our modeling and research for the asset management universe, we discovered that there is an alternative path to the estimation of TCO and it relies on answering a different question: How do asset managers scale? With this question, we are essentially asking about the change in the human capital allocation as assets under management (AUM) grows – which allows us to use data that should be easier to find: AUM and headcount.

Moreover, this approach is useful across the entire continuum of managers and strategies; even in cases where the most highly-automated methods are being deployed. All strategies need people, but all strategies don’t need the same allocation of people for each new dollar of AUM. Asset scaling is strategy dependent; human capital scaling is process dependent. Therefore – as our hypothesis goes – the nature of strategy workflow will be related to the ratio of AUM and headcount. That ratio – “AUM/e” – should be indicative of the level of automation – or lack thereof – in the underlying strategy. We call this phenomenon human capital leverage.

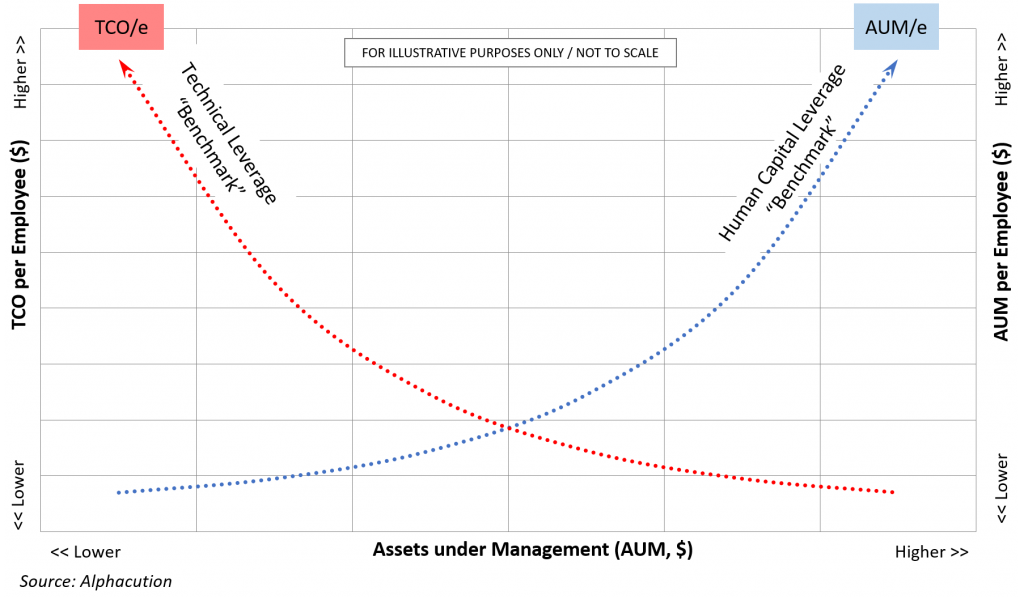

Similarly, we should be able to measure the change in technology capital allocations as AUM grows with the ratio of TCO per employee (TCO/e). In this case, TCO/e should be indicative of the technology capital intensity of a strategy’s workflow – or, technical leverage.

Lastly, because information technology and human capital are the engines of production for service businesses like asset management, quantifying one of them defines the other, by default. They are two pieces of a whole, and their proportions should move inversely to one another as AUM grows. (When AUM/e goes up, TCO/e should go down – and vice versa.) And, since accurately quantifying TCO/e for private companies is very difficult without proper context, we can use the more easily observable AUM/e ratio as a back door to deduce TCO/e, thus identifying the answer to our original question about tech spending.

This chain of logic brings us home to the claim that the strategy attributes of AUM, technology spending, and employee headcount are all related in a persistent manner. Therefore, empirical evidence should allow us to define the change in both technical leverage and human capital leverage with changes in AUM in the form of “benchmarks” (see Exhibit below).

So, when do we get back to operational beta? Think of the aforementioned benchmarks as representing the average mix of technology and human capital for each level of AUM. (In our asset manager study, we use data from 158 managers and related companies over a minimum of 5 years to define the initial technical leverage and human capital leverage benchmarks.) This means that there is a measure for operational beta at each level of AUM that is based on the sum of TCO/e and AUM/e (for that level of AUM).

With that, the calculation for operational alpha is the (positive) difference between a manager’s specific TCO/e and AUM/e levels relative to that of the corresponding benchmarks of its peers. And, for those of you paying very close attention, we would call a negative difference: operational theta.

Now, we are cutting some sharp and important corners to over-simplify this explanation. First, while Alphacution has not completed its final definition and calculation of operational beta, we are clear that it is a number that is most likely to show up as a score – rather than a dollar value. Second, we may need to generate strategy-specific benchmarks to improve the accuracy of manager-specific scoring for operational alpha – rather than compare a manager against an overly diverse grouping of “peers.” To take a simple example, relative-value strategy managers should not be scored for operational alpha against long-only strategy managers.

In any case, building out clarity on these concepts and calculations is where we are headed. Why should you care? Asset management is undergoing mass transformation, like all areas of financial services. Chances are that the way most strategies are managed today is going to change. Even certain strategies may cease to generate enough performance – or cease to exist altogether. If you are starting fresh, that’s one thing. If you are already managing a large asset base, you need to change carefully. We suggest better measurement tools to assess levels of operational efficiency against the costs of those workflows.

As always, stay tuned…