“Entrepreneurship, you will only understand it if you experience it for yourself. It’s not something I can explain in words.” – Masayoshi Son

On September 4, the Financial Times was first to report that “SoftBank is the ‘Nasdaq Whale’ that has bought billions of dollars’ worth of US equity derivatives in a series of trades that stoked the fevered rally in big tech stocks…” Since then, a consistent drumbeat of other articles and podcasts have been published; some of them tying SoftBank in with Robinhood and other retail brokers as leading factors that may explain the (concentrated) run-up in US equities from the March lows to the early September highs.

For those of you who don’t speak options as a first or second language, the logic of SoftBank’s potential impact on cash equity markets based on equity derivatives positions goes like this: Derivative markets are zero sum. For every unit long there is a unit short. Customers, like SoftBank, typically buy options – outright or via spreads – to be long deltas of the underlying security. Market makers typically sell options – and are short deltas – unless customer orders can be matched. Furthermore, market makers hedge short deltas (primarily) with long stock.

So, in this case, SoftBank is believed to have established extremely large (long) call option positions, which caused market makers to be short those options which further caused them to hedge by buying the underlying stocks; otherwise known as delta hedging...

Now, since Alphacution published a ranking of a selection of US option market makers (by 13F gross values) in December 2019, we have seen renewed interest in this Feed post off the back of the Nasdaq Whale news because a concise list of US option market makers is not widely known, nor easily found. It seems that our plans for updated modeling of these (and additional) players along with a comprehensive case study on the options market making segment of the trading ecosystem before year-end 2020 will be timely. Stay tuned for that…

SoftBank represents a new and fascinating piece in a much larger puzzle. Nearly everyone knows about the WeWork disaster – the impacts of which on SoftBank’s fortunes (and stock price) were compounded by the coronavirus – that led to asset sales and share buybacks. Alphacution believes that this apparent stunt in US options markets is another – yet unusual and risky – mechanism to claw back both treasure and reputation.

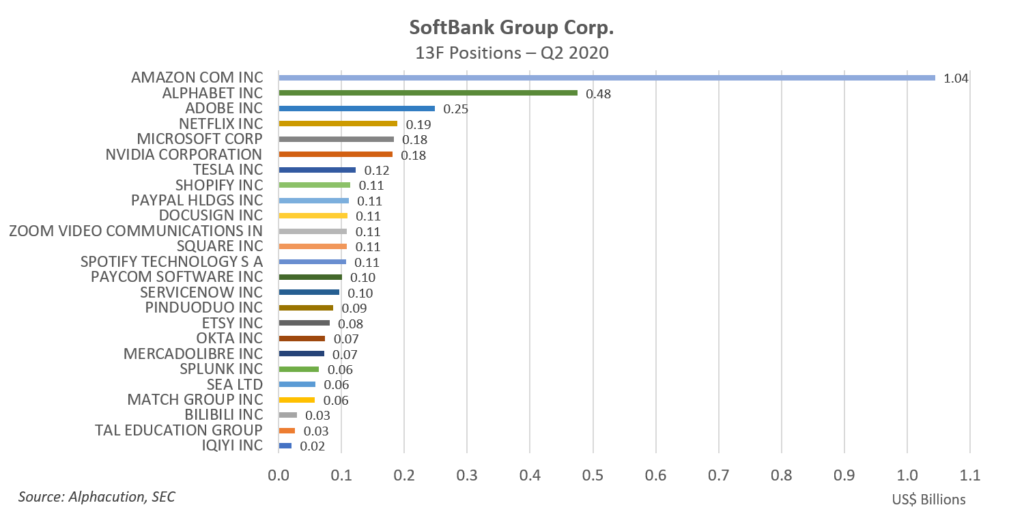

During Q2 2020, SoftBank’s founder, Masayoshi Son, personally funded a new asset management arm. By mid-August, SoftBank was required to file its first ever 13F report. It contains 27 positions with total holdings value of $17.5 billion. Two of the positions – held by two affiliates of SoftBank – are in one stock; representing 77.9% of this value: T-Mobile US, Inc. In aggregate, this allocation appears to be part of a core business strategy.

The other 22.1% – or $3.9 billion – is allocated among the remaining 25 positions; part of a new – uh – gunslinger strategy, as follows:

Assuming this report is accurate (because they aren’t always accurate), there are no option positions as of June 30, 2020. If you’re going to try to spark a market melt up with options, it likely helps if you own the underlying securities first…

By mid-November, when the Q3 2020 13F-HR report is due, we may find new pieces to this puzzle.

Until next time…