Ever wonder what the global financial services ecosystem spends on technology? I have – obsessively. The size and shifts of this market – and the tapestry of moving parts within it – is extremely valuable intelligence for all players in the FSI ecosystem. Moreover, with the intense focus in recent years on topics like “XaaS”, clouds, solid state memory, Hadoop clusters and so many other symbols of fintech innovation it is abundantly clear that this is the one puzzle that needs to be solved. Problem is: crossing the bridge from here to there while keeping a credible process intact is sufficiently complicated to dissuade most sane contenders from attempting the feat. Of course, that is unless you are someone who thrives on solving insanely complex puzzles that defy common temperaments.

Simply put: It all starts by following the money, which by the way is also a decent proxy for following the data. My Uncle Lewis was a stockbroker in Detroit for most of his 89 years. He was the kind of guy who simultaneously owned Friday-night call options on the most coveted tables at the finest restaurants in town – in the 1960’s. Or, at least, that is the prevailing family mythology. Anyway, he was magnetic. Among the most impactful pearls of wisdom that he would bestow upon me and my brothers was, simply: Follow the money… (In short, don’t lose sight of the numbers for the words.) Holding that thought in mind, it turns out that there is a way to cross the bridge to a credible estimate of “Global FSI TCO” – by following the money. We start with the banks.

Not only do we know – empirically and anecdotally – that the largest of banks represent FSI’s big spender profile on technology, we also know that much of their financial and operational data is publicly available. (All of the largest banks in the world are publicly-traded somewhere. Or, at minimum, they publish annual reports. Even the Chinese banks offer a surprising amount of transparency via annual reports.) Also – and this is a nuanced fact about the banking sector – there is a significant amount of concentration among the leading global banks that causes the sector to have a unique “market shape” – which is one way to extend the accuracy of estimation and prediction beyond that of a small sample.

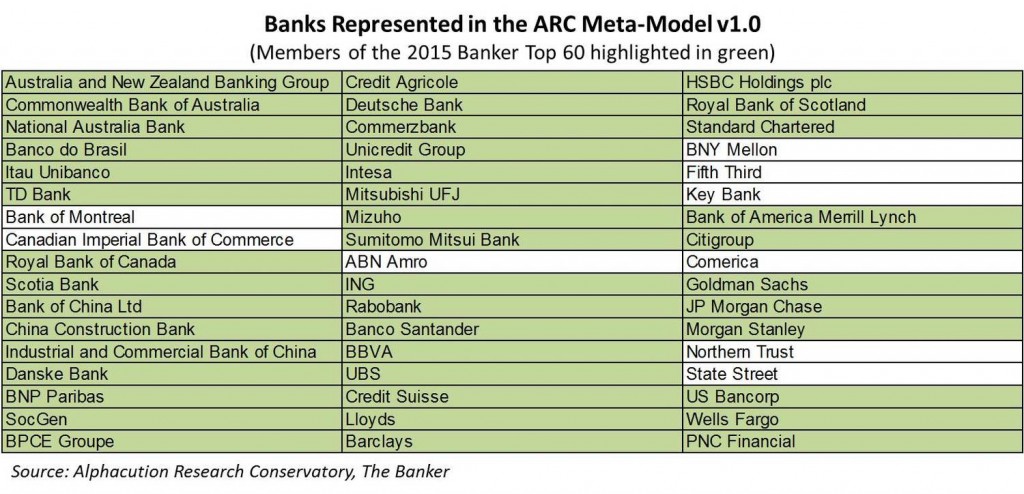

Much longer story short, I spent late summer and early fall digging through company data and regulatory filings in pursuit of what some might call lightning in a bottle: a defensible estimate of Global FSI TCO. Good news is that a fascinating picture has already begun to take shape. So far, our global TCO model consists of individual models of the following 51 global banks (over the 10 years of immediately pre- and post-GFC periods, 2005-2014):

So, without further foot-dragging, here are a couple items to ponder for now: Our current technology spending figure for the global banking sector is $202.7 billion (before counting for IT human capital costs, which will drive this figure significantly higher). In other words, this is ARC’s global non-human capital (NHC) total cost of ownership (TCO) estimate for all banks in 2014. Of course, while fascinating to some, this is just a number – and it is as much a curse as a blessing because it is really only the destination. The juicier and much more valuable intelligence here is provided by context – which is much like the ability to solve an insanely complex Sudoku puzzle. Sure, defining the boundary of the global TCO pie is one cool prize. But, providing ongoing context for the mosaic of numbers – and narratives – inside this boundary are an entirely different prize altogether.

Why is context so important? Because many of the answers to the questions we seek are unknowable. There is no real “G-FSI-TCO” figure written down somewhere by a super-galactic uber-analyst. This scenario means that, while anyone can promote their guess, the credibility of the guess is dependent upon the credibility of the guesser and the credibility of the guesser’s estimation process. This is why process is so important – which is furthermore why, if you haven’t already done so, you might consider going back to read #digitalresearch. Otherwise, stayed tuned. We will continue to follow Uncle Lew’s advice…