Barclays Succumbs, Flips Options to GTS

"Sometimes it is the people no one imagines anything of who do the things that no one can imagine." - Alan Turing One by one, those willing to stand and make markets in options are - uh - taking a knee. Back in December (2019), Barclays became the latest in a long string of players - big and nots-so-big - to punt their options trading business to a willing buyer before any more value evaporated. So, we thought [...]

Tom Brady, Louis Bacon and the Game Changers

“From the point of ignition to the final drive, the point of the journey is not to arrive.” - Neil Peart New clues are emerging on the nature and pace of change... Here's the setup: Unlikely and unexpected virtuosity often serves as the catalyst for a dynastic run of success. Moreover, legend has it, that it's usually the will over and above the skill that fuels the initiation and duration of that run. While skills eventually decay, [...]

Implications: 2019 Payments For Order Flow Flat vs. 2018

"Historians study the past not in order to repeat it, but in order to be liberated from it." - Yuval Noah Harari, Homo Deus: A Brief History of Tomorrow With three quarters worth of financial reports for calendar 2019 long in the bag, it is not much of a courageous leap for us to deliver an estimate for order routing revenue - otherwise more notoriously known as payment for order flow (PFOF) - for the full year. [...]

2020 Musings: In For A Penny, In For A Pound

Somebody may beat me, but they are going to have to bleed to do it." - Steve Prefontaine "Study the art of science. Develop your senses - especially learn how to see. Realize that everything connects to everything else.” - Leonardo da Vinci Renowned columnist and author, Thomas Friedman often talks about unintended and unpredictable outcomes when tinkering with big systems. I am reminded of this thought as I drag myself, kicking and screaming, to write this next post. The [...]

A Blockbuster Year: Alphacution’s Top Stories For 2019

"Judge of a man by his questions rather than by his answers." - Voltaire To be exceedingly more terse than usual, it was a pivotal year. Thanks to so many of you who spent some of your precious attention with this work during 2019... The following Alphacution Feed posts are what you - our "congregation" - valued most during 2019 (as ranked by pageviews): Top 100 Players in US Listed Market Structure - By a factor 2x, this [...]

What Bloomberg Misses About Citadel Securities

"You can have all the transfer orders that you want, but you have to ask me nicely." - Col. Nathan R. Jessup, "A Few Good Men" On December 11, 2019, Bloomberg News editor Tom Maloney publishes an unusually illuminating article on Citadel Securities, "Ken Griffin Has Another Money Machine to Rival Hedge Fund," citing specifically that the market maker earned $3.5 billion of revenue in 2018 and "handles more than 1 of 5 shares traded in the US [...]

Ch-ch-changes: A Subscription to “Charles Ameritrade”

"If you really look closely, most overnight successes took a long time." - Steve Jobs "Speak in extremes. It'll save you time." - David Bowie "Less than 10 bucks a month..." This statement - or, some algorithmically-sanitized equivalent - is the next destination to which we're headed in the retail brokerage saga, where in our last episode, all the major players in the space appear to sacrifice hundreds of millions of dollars of commission revenue in order [...]

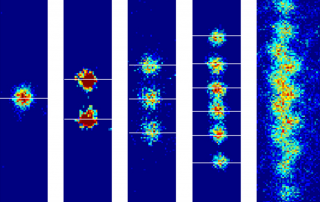

Ranking of Select US Option Market Makers

"The book of nature is written in the language of mathematics." - Galileo Galilei As we prepare to turn the page on a new year, and consider what we may want to accomplish during that year, derivatives are on the priority list. Why? Options are important for many reasons from risk management to computational rigor and signal generation. And, if you had been paying close enough attention over the course of this year, you might have noticed that [...]

Balyasny’s Book: Hiding in Plain Sight

“Even though the transformation of energy, in all of its various forms, is the very basis of all economic activity, only a tiny fraction of economists have even studied thermodynamics. And only a handful of individuals inside the profession have attempted to redefine economic theory and practice based on the energy laws.” - Jeremy Rifkin, The Third Industrial Revolution With this Feed post, Alphacution adds Balyasny Asset Management, LLC (BAM) to its growing roster of modelled trading firms. [...]

Want Better Markets? Try a Herfindahl Kiss

"Enough is a feast." - Buddhist Proverb While many of us are ramping up to gorge ourselves on the annual tryptophan bacchanal, perhaps lubricated by an appetizer of American football where - in the likely case of far fewer of us - we will watch my hometown Detroit Lions perform their annual holiday impersonation of a major league sports franchise, and I will watch my 91-year old father behave as if they haven't been disappointing him for lo [...]