The primary goals of this ongoing series of research are to quantify – in increasing detail – what the members of the financial services industry (FSI) ecosystem spend on technology (including hardware, software, data and IT human capital) – which is sometimes referred to as (enterprise) total cost of ownership (TCO); develop benchmarks and analytics that help describe the absolute and relative nature of these spending patterns; and then, use the findings to confirm, deny, expand the prevailing (or introduce new) narratives in the space.

The first phase of modeling has focused on the largest IT solution buyers, a selection of over 50 of the world’s largest banks – plus a few others whose purpose, for now, is to help us place this initial sample of FSI players in proper context. (More on this shortly.) Subsequent phases of modeling will incrementally build upon this foundation with the addition of other constituencies in the FSI ecosystem until a comprehensive view is maximized.

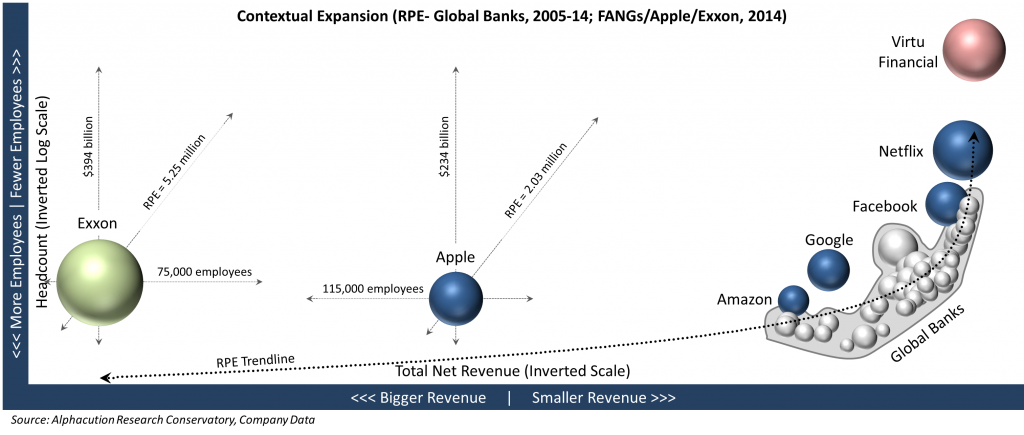

With this as a backdrop, we have been focusing on analytics that normalize spending patterns relative to scale. For this piece of the proverbial puzzle, we have defined “scale” as headcount (or full-time equivalents – FTEs). Certainly, there are other denominators that could be used, particularly as we get into granular segmentation of needs, use cases or workflows. But, for now, we remain fascinated by what can be accomplished by a team of people at the limits of scale, both at the largest end and the smallest end – and everywhere in between. Like the mechanical amplification of human capabilities brought on by the Industrial Age, the electronic amplification which is central to the Information Age – now known by the more contemporary label, Digital Age – provides “technical leverage” that influences revenue per employee (RPE).

Before we move on to exploring – and benchmarking – the “spread” between RPE and technology spending (or TCO) per employee (TPE), we wanted to establish the context of RPE’s for the largest banks with that of other “digital darlings” and others known for extremes of innovation. Some of this we have already done in a prior post (#DigitalFrontier: Guiding Lights for the Analog Galaxy – November 24, 2015) where we added the likes of Facebook, Amazon, Netflix, and Google (otherwise known as the “FANGs”).

In the Exhibit below, we go a step further with the addition of select extremes – Apple and Exxon – that certainly stretch our interpretation of what a team of people can accomplish at the limits of scale.

While there is much to say about the expansion of our RPE sample, the one point we want to make here is where the #digitalmythology comes in. For good reason, we have become captivated by new capabilities, and potential for disintermediation in several traditional banking and financial services business lines. Examples like peer-to-peer lending, mobile payments, and “robo-advisory” services are just a few that come to mind. And, while these developments are worthy of our attention and ongoing focus, we must keep perspective that digital functionality is not the same as digital enterprise. Moreover, just because a business is deploying a new technology does not guarantee its status as a special enterprise. Chances are that many fintech unicorns will end up yielding mundane RPEs as they scale.

In other words, a digital enterprise is an entirely different class of innovator than a number of new blockchain companies. And finally, while it may be a little unfair to include Exxon in the sample – due to unique and uncorrelated factors in the energy market – we are somewhat in awe about what Apple has achieved with a sizable team of 115,000 employees (as of 2014) and therefore, where it currently lives in our “RPE constellation” relative to the other members of the sample, particularly the collection of banks. We look forward to your comments and ongoing debate on this new view of the FSI ecosystem.