@DeutscheBank: Three-Card Monte and Other Confidence Games

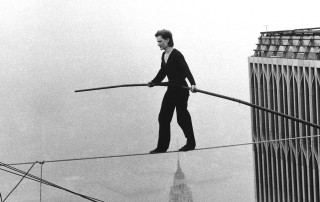

"Pay attention to what I say, not what I do..." More and more - over decades of practice - this opening statement has become the golden rule of marketing and communications, no matter if that "marcom" strategy is being applied in the context of finance, economics, politics - or, any other blood sport. Reason being: If you believe that perception is reality, then perception can have real economic consequences. However, with today's data ubiquity and resulting overload, we have the possibility of infinite perceptions and very little sense of reality... No one is truly to blame for this predicament. We have all conspired - most of us tacitly, some of us more directly - to participant in this confidence game. And so, when Alphacution picks out certain names, it is only to shed light on examples of how the game is played and not to pass judgement on the player(s) - since we are all more or less complicit... (As it turns out, Deutsche Bank is one of our best [...]