Citadel’s Secret Special Sauce (Updated)

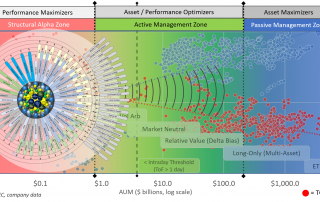

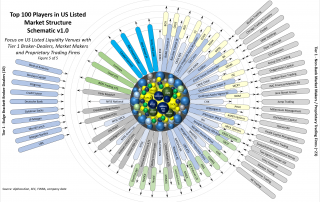

As excerpted from the case study, Deconstructing Citadel Securities Alphacution believes that Citadel’s core competitive advantage – its secret sauce – can be found on display every day, out in the open, and is not related to a specific product, asset class, region or even a specific trading strategy or temporal wave of theoretical alpha. No, the thing that makes Citadel so unique is its focus on process. You just need to know what to watch for. Everything this company does has first been disassembled and deconstructed down to its smallest, atomic parts and then reassembled with a maniacal sensitivity to details, best-practices and processing – whether that be a decision-making process or a data management process or a strategy launch process. In all activities front-to-back, this team seeks opportunities for efficiency and to catalog incremental intelligence at every step. And though the company has developed a stellar reputation for the application of technology to its workflows, it is only by virtue of the additional ingredients of culture and excellence [...]