A sextant is an optical navigation device used by sailors starting around 1730. With practice, it can prove quite accurate in plotting courses. Though the contemporary digital equivalent – a global positioning system (GPS) – has become the mainstream tool for navigation, sextants are still in use today among a small but avid group of yachtsman, survivalists and cognoscenti.

Keep this migration in mind as we walk through today’s question: Can (digital) transformation be measured? Our answer to this, of course, is yes – however, as in most cases, the specificity of measurement is data dependent. So, the qualified “yes” to this question, for now, relates to measuring transformation at the enterprise level. This is because the necessary enterprise data is relatively easy to find in the financial disclosures of the companies in our initial target sample. There is also rhyme and reason to starting at enterprise level because it plays squarely into our long term vision to define the total value of technology spending in the financial services ecosystem – and then fill in the components of that ecosystem via additional data collection and constant triangulation for unobservable inputs.

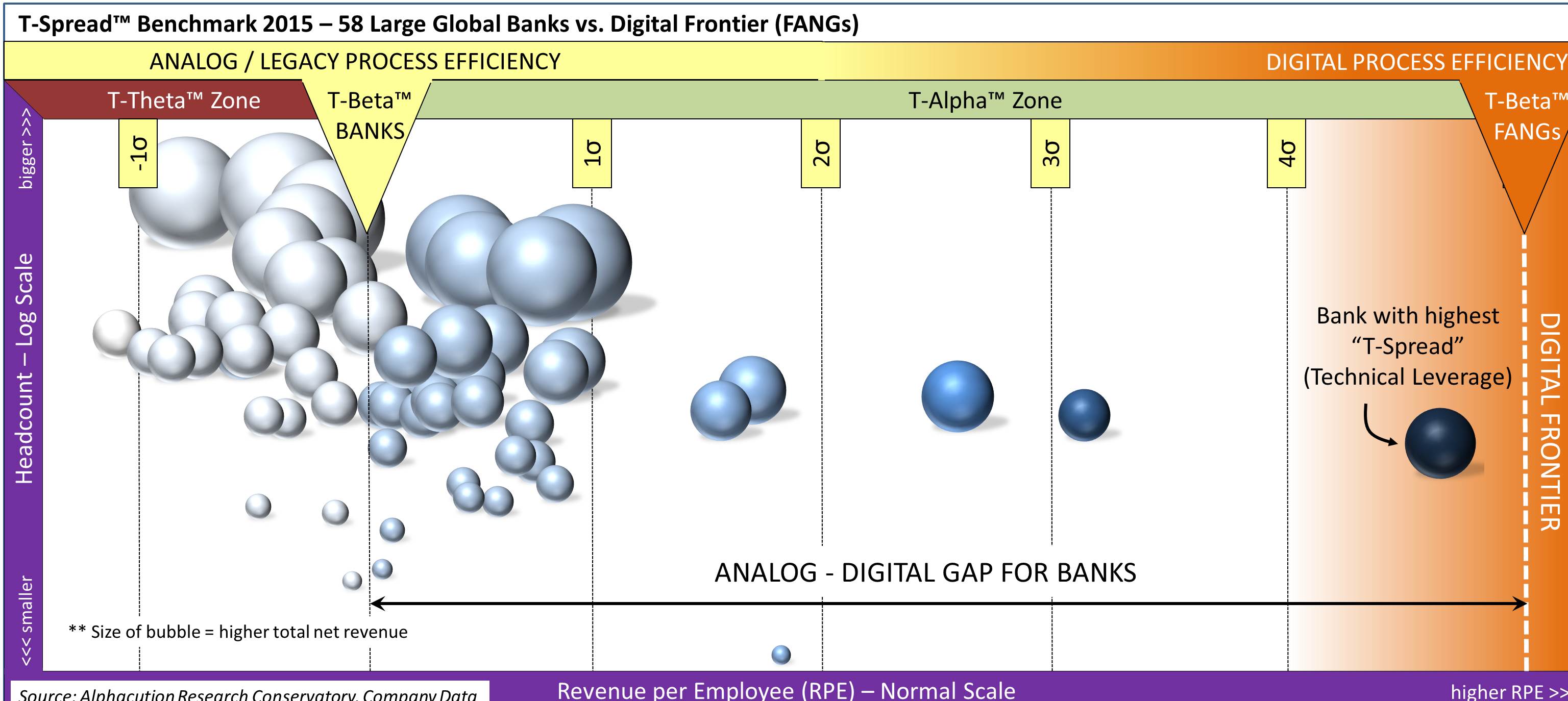

Given that setup, let’s take a step back for minute: Though various terms to describe productivity increasingly pervade the latest narratives – often using simple comparisons of revenue and operating income to quantify these terms – Alphacution has a slightly different take on the matter. We believe “technical leverage” – and perhaps more importantly, the change in technical leverage – is a better measure, but a little more cumbersome to identify.

Here’s our process… We collect only three data points: total revenue, reported or estimated total technology spending (essentially, enterprise TCO), and total full-time equivalent (FTE) employee headcount for the period in question (usually at the frequency of financial reporting; a year or quarter). Just 3 numbers per enterprise per period. We define technical leverage – what we call “T-Spread” – as the difference between revenue and TCO divided by FTEs. Using this denominator gives us a chance for a more apples-to-apples comparison because it normalizes for the scale of the enterprise.

Furthermore, our version of this productivity analytic is designed to strip away capital structure, periodic charges and other adjustments found in the more common “McKinsey” version that uses fully-loaded operating income, thereby better isolating technology and human capital as the primary engines of productivity. There are currently ~120 financial services companies in our composite model, with heavy emphasis on the largest banks for now. In other words, we have calculated technical leverage for each of a group of large banks, which, more importantly, also allows us to calculated the benchmark technical leverage for the entire sample.

From there, we use the same methodology to define the “digital frontier” of productivity by calculating T-Spread measurements on a sample of digital-era bellwethers, in this case the “FANGs” – which include Facebook, Amazon, Netflix, and Google. Finally, the difference between the T-Spreads of the “analog” sample – the banks – and the digital leaders is the “analog-digital productivity gap”.

The chart below is a visualization of this series of of calculations for 2015.

Granted, at first viewing we realize that there is a lot going on in this chart. Take a minute to absorb – and definitely reach out with questions. Of its many insights, we would point out a few key highlights:

- Technical leverage at the digital frontier is roughly 4x that of the community of 58 large global banks (currently in our composite model); or similarly,

- Productivity at the digital frontier is 5+ standard deviations from the average productivity of the top-tier global banking community; and,

- There is only one large bank in the world that is generating technical leverage in the same neighborhood as that of digital leaders. (Can you guess who that is?)

(Note: Alphacution subscribers gain access to the details behind this output.)

Clearly, there is much much more to discuss and reiterate here, such as the other analytics in our benchmarking framework (that we are setting aside for now). The most important thing at this stage is to demonstrate how these numbers and this benchmarking process are actionable right now.

Let’s now return to the sextant. Here’s the problem your enterprise faces today: You cannot chart a course without knowing where you are – and with a mix of technology and human capital being more important than ever before, you better know where you are. What’s worse, you – a bank, a broker, an asset manager, or any other distinct market participant profile – have no navigational tools for the current, radical pace of change. Sure, you know what your firm spends on people and gadgets and technical stuffing – and can deploy traditional change management tools – but not in a way that allows you to navigate with the efficiency of a digital pace.

So, like a sextant, this benchmarking framework is a way to ascertain your position on the sea of opportunities by comparing your (enterprise) technical leverage with your peers and competitors (the “celestial bodies” in this metaphor), and also sizing up your productivity relative to those on the digital frontier (the far distant horizon). Yes, like a sextant relative to GPS, this navigational impact is somewhat crude but in the absence of “GPS” – the equivalent vision for which Alphacution is executing upon over time – this initial version of the methodology still gives you sufficient “course selection” potential.

Here’s the punch line: We believe, in a vast majority of cases, banks born in the analog era will never achieve the level of high-scale enterprise productivity of the digital elite because in order to do so would render them unrecognizable from their current forms. Political and cultural constraints would need to be totally reconfigured – and by the time it takes to perform that complex surgery, if ever, digital business models would have already disrupted. We see this phenomenon already with the likes of Google or Apple or Walmart taking on roles of a traditional bank.

In the end, amping an analog enterprise to the productivity levels of those around the digital frontier is really not the point here. Most “ships” conceived and built in prior eras will never reach that horizon. It will continue to evade. However since most ships are in the same predicament, the best course is to achieve incremental proximity to a defined horizon. (For example, these increments might ultimately be measured in minutes per day – or hours per month – per FTE per workflow – and then summed to enterprise level.) Alphacution’s “sextant” represents a quantitative method for plotting this course – and given ongoing development with both data and processing – we may finally arrive at the equivalent of an enterprise GPS that is so desperately needed.