Robinhood: Payments for Order Flow 2018, Up 227%

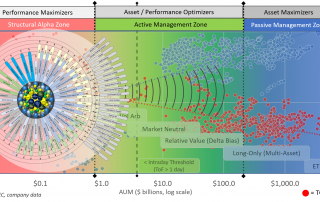

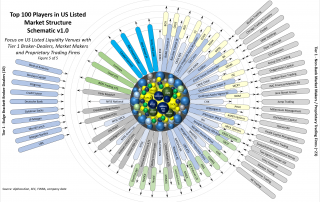

The latest figures on order routing revenue are easy to find. With the exception of Robinhood Financial - the new, no commission, retail-focused trading app for stocks and cryptocurrencies - order routing revenue is clearly disclosed by the incumbent trading platforms; namely, TD Ameritrade, Schwab, E*Trade and to a lesser extent, Interactive Brokers. However, in any case, something seems to be heating up as aggregate payments for order flow (PFOF) breaks from the range of the previous five years (2013-2017) to grow 42.3% for 2018, see exhibit below: Now, as for identifying the other side of this ledger - those who make the payments for order flow - that continues to be a bit more opaque. We know who should be on that roster because they are also likely to be a subset of our Top 100 Players in US Listed Market Structure ranking. But that doesn't mean the PFOF figures are dangling from easy-to-find places. To the contrary, they are likely comingled with other figures and obfuscated by aggregated [...]