AQR Capital Management: The Ominous Shapes of Strategy

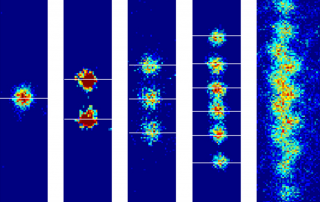

"The cave you fear to enter holds the treasure you seek." - Joseph Campbell For 12 straight years beginning Q4 2001, AQR Capital Management, LLC (AQR) - one of the great and legendary quant hedge funds of the current era - grew equity positions until peaking at 2,346 (long equity) positions by Q4 2013. Since that time, AQR's long US equity book has found an ominously consistent plateau averaging 2,140 positions. Here, in what would normally seem to be a benign factoid, lie the seeds of the story for why AQR has been suffering performance challenges of late; and, apparently, performance challenges for the foreseeable future according to co-founder and front-man, Cliff Asness. We start that story with the exhibit, below, where Alphacution presents the full 72-quarter record of total 13F (long) positions for the lineage of AQR Capital Management entities beginning Q4 2001 and ending Q3 2019. With these first shapes, we want to highlight that stocks are the dominant product class, thereby implying that there is little [...]