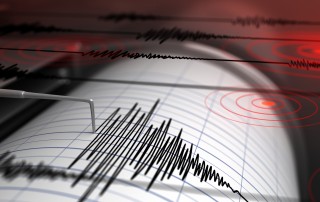

Marketquake 2020 – Volatility Update

“Do what you can, with what you have, where you are.” - Theodore Roosevelt In last week's Feed post, "Marketquake: The Volatility of Volatility," we set up a comparison of volatility levels - and duration - from the GFC with that of the current pandemic period. In that, I implied that elevated volatility persisted for 218 trading days after the initial GFC shock. In other words, it took about 218 trading days for the VIX to traverse the round trip from normal vol levels (~mid-20's) through the associated shocks and back to normal. The chart below is a picture of that path along with where we are as of today, 23 trading days into the latest market shock... Now, 218 trading days into the pandemic shock puts us into early January 2021. The problem, however, is that with the latest vol shock being faster and higher than that of the GFC - and the likelihood that there will be subsequent shocks from the combined ongoing health and economic impacts [...]