Are you not entertained?!!

Is this not why you are here?!!”

– Maximus Decimus Meridius (Russell Crowe)

Executive Summary

The chart that follows represents the content to be covered in this post, and foreshadows a core focus of Alphacution’s research calendar for the weeks and months ahead…

Furthermore, at the end this post, I am also going to ask you to support this work (in exchange for certain content benefits), like this:

(INLINE SUBSCRIPTION FUNCTIONALITY DISABLED.)

Note: Business credit cards and bank accounts can be used via our PayPal payment portal.

So, with that in mind, you can opt to bounce right now…

Or, support right now…

Or, learn a bit about our opening chart, see what it means and how it relates to what we have coming up in the research calendar, and then make your support decisions…

It’s your call.

My job is this:

Have I captured your attention yet?

We live in an attention economy now. All manner of professional and personal consumerism is specifically designed – with some of the most sophisticated algorithms ever built to hack into what you may still believe to be your secret inner-most tendencies – to tug at your relatively inelastic supply of attention.

So, if I fail at grabbing some of your real jewels, I might as well fail at everything that comes thereafter – which is all the important stuff I’m trying to deliver. This is another way of saying that the tools of provocative imagery, clever twists of language, deep and technical subject matter expertise, flexibility of perspective, artful assembly of data, or even a respectfully thrown elbow at a fellow hockey fan are all being brought together purposely seeking to hook your attention. The song and dance, the references and metaphors, and the (attempted) humor are merely the bait to draw you a step closer. It’s simply the way this game must be played these days to do something new and be effective…

Anyway, it seems that there has been some success along those lines. To be exact, we have managed to hold your attention for what appears to be an average of 1:33 minutes per session over 35,119 sessions to date. Now let’s see if we can take some additional steps together. My goal with this platform is to present the data, be transparent about what we can tell about those pictures (and be corrective when we make mistakes), and then offer some guidance on how best to navigate from there. Like a puzzle, meticulously assembled from disparate pieces of evidence, our read of the landscape and guidance for the future should fit within a framework hypothesis based on empirical data. At least that’s the vision for how we will continue to provide value…

With your indulgence of this setup as prelude – and as we sit here together (virtually) on a weekend morning, hopefully with a fresh hot cup of coffee or tea – here’s a brief synopsis of what we’re cooking up and where we’re headed so that you can assess its potential value to you and your organization:

Pre-emptive disclaimer: I know there are many of you on the periphery – service providers and traditional players and those far afield from the front office – who find some of this deep diving into trading jargon a bit tedious, if not, irrelevant. I have one reminder for you:

“Study the science of art.

Study the art of science.

Develop your senses — especially learn how to SEE.

Realize that everything connects to everything else.”

— Leonardo Da Vinci (~1500)

Learn! No matter where you sit, this information is relevant to your seat…

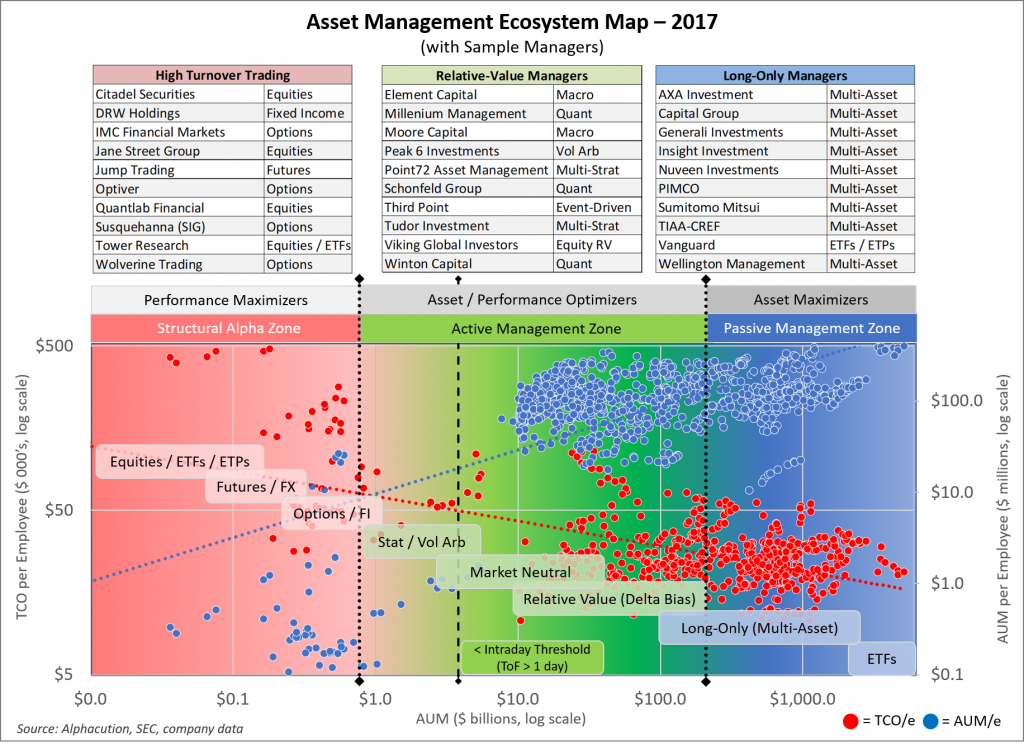

Here we go: There’s a broad continuum in the trading and asset management world where strategies, assets under management (AUM), headcount (and skills mix), technology spending and workflow automation are all highly correlated. You may have seen us present this hypothesis on several previous occasions, but it continues to evolve, and therefore, continues to require emphasis and exposure.

As a reminder, the illustration that follows is Alphacution’s interpretation for how the combinations of these key factors manifest themselves into players on the playing field:

If you are interested in additional refreshers, these are the posts that set the stage for Alphacution’s asset manager ecosystem map, key characteristics and sample players for the zones within this map, and how the primary driver of workflow automation is influencing the composition of the landscape captured on this map:

- What Does Citadel* Spend on Technology? (This one includes the download of a comprehensive executive summary for the study, The Context Machine: Estimating Asset Manager Technology Spending, which formed the genesis of the AM ecosystem map. It remains available for purchase.)

- When Market Makers Ate Their Own…

- When #Hedgefunds Ate Their Own

- When #ETFs Ate the Beta

- The Privatization of Alpha

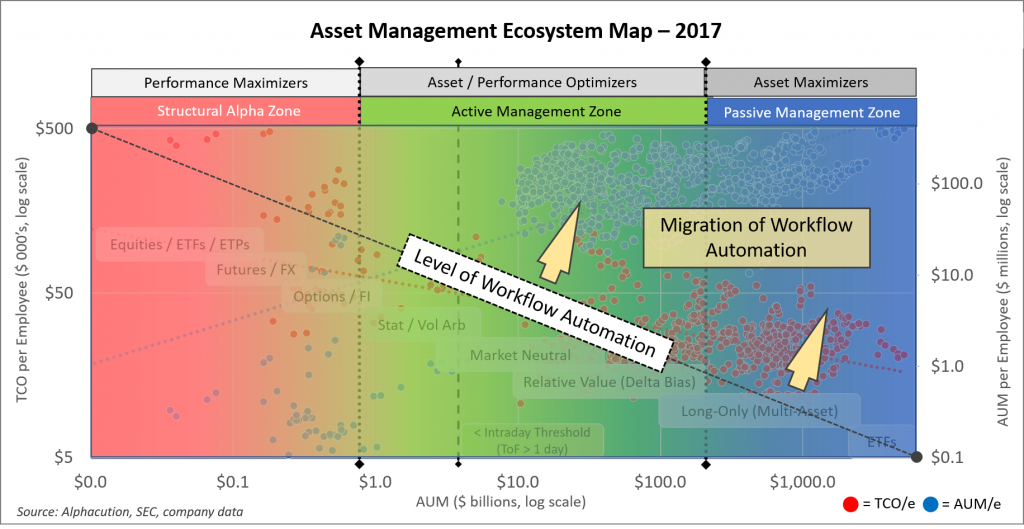

Bottom line: There is a wave of workflow automation rolling over the trading and asset management world, and its disruptive powers – Remember pits and floor traders? – are as great as any that we have ever seen…

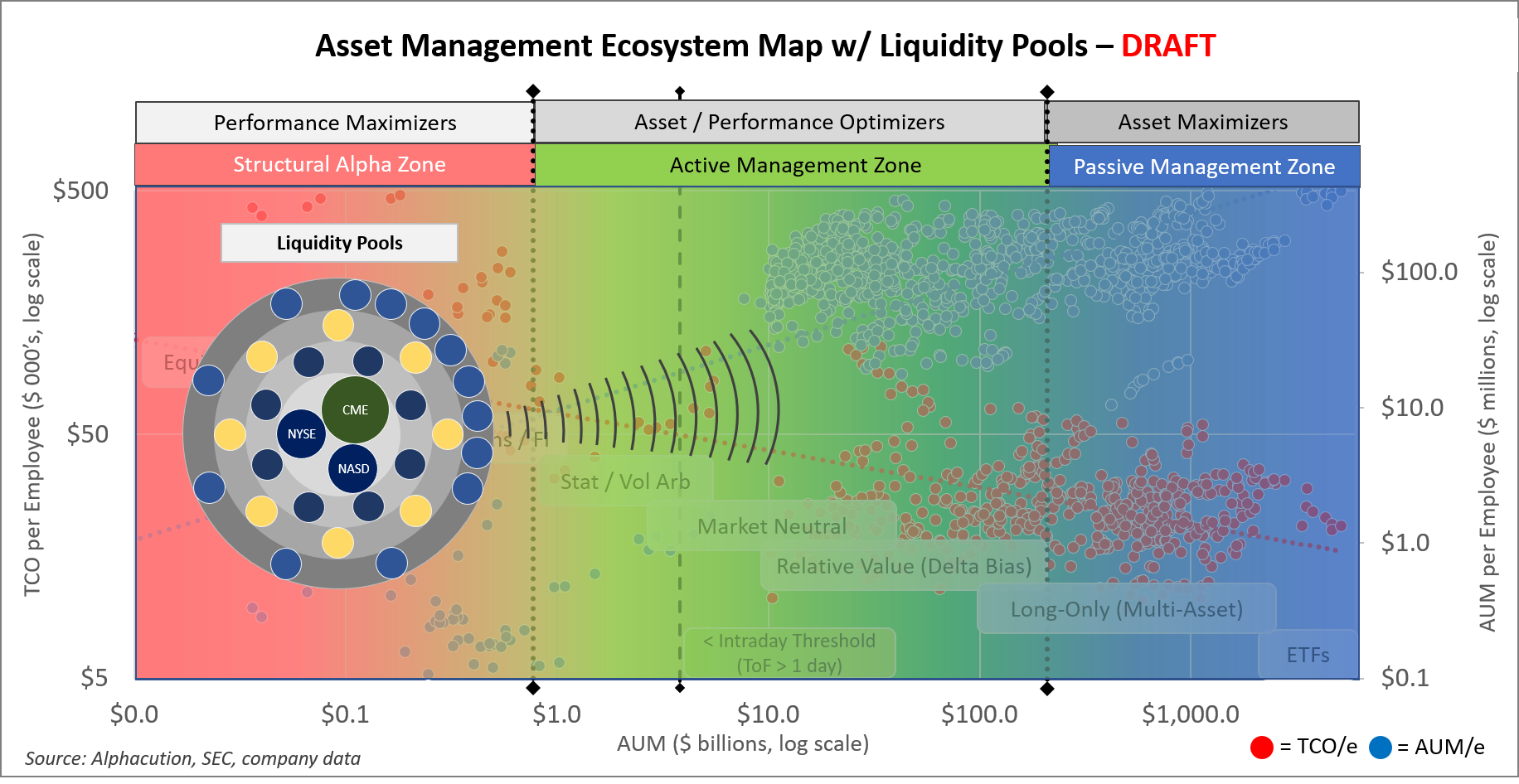

… and since this wave has started in closest proximity to the sources of liquidity, this is where we must place our focus – and modeling – if we are going to properly understand the timing and impacts for how that wave crashes over the contiguous zones of our map. In other words, it turns out that we need to place an emphasis of focus on modeling the players and liquidity pools that make up Alphacution’s structural alpha zone before we can fully understand what that means for the players, products and strategies that make up our active and passive management zones.

Here’s how we will begin to build the next layers onto the map, with the addition of a constellation of liquidity pools and the players that operate closest to those market mechanisms:

Now, before anyone gets bent out of shape – at CBOE or TMX or the entirety of Europe – that this liquidity pool schematic doesn’t perfectly represent all of those players, just chill for minute. We will get to that, likely in excruciating detail. For now, this is a conceptual placeholder.

Side note: In the digital era, everything happens so fast – especially if you are trying to do something new and different – there is no time to disappear for 3 months, get everything all lined up and as close to perfect as possible, only to return to find you have lost everyone’s attention. Remedy? Develop a thick skin, be courageous, be iterative, fail fast, adjust fast, repeat… I will trust that someone out there will tell me when my fly is open or there is schmutz on my chin…

Anyway, what is so incredibly fascinating about the development of our “Hiding In Plain Sight” series – which will occasionally get shorthanded to #HIPS going forward – is that we can now conduct absolute and relative analysis of the most advanced players in the entire ecosystem. The self-comparative and competitive analysis brought about by the 13F dataset is worthy of stopping to focus on those models right away.

And, since all market makers and most proprietary trading firms are also registered broker-dealers the combined illumination brought about by 13F and annual X17a5 reports is something I’m looking forward to perhaps more than anyone else. Until recently, these are like critical puzzle pieces that were thought to have never existed, except we now know that they are hiding in plain sight.

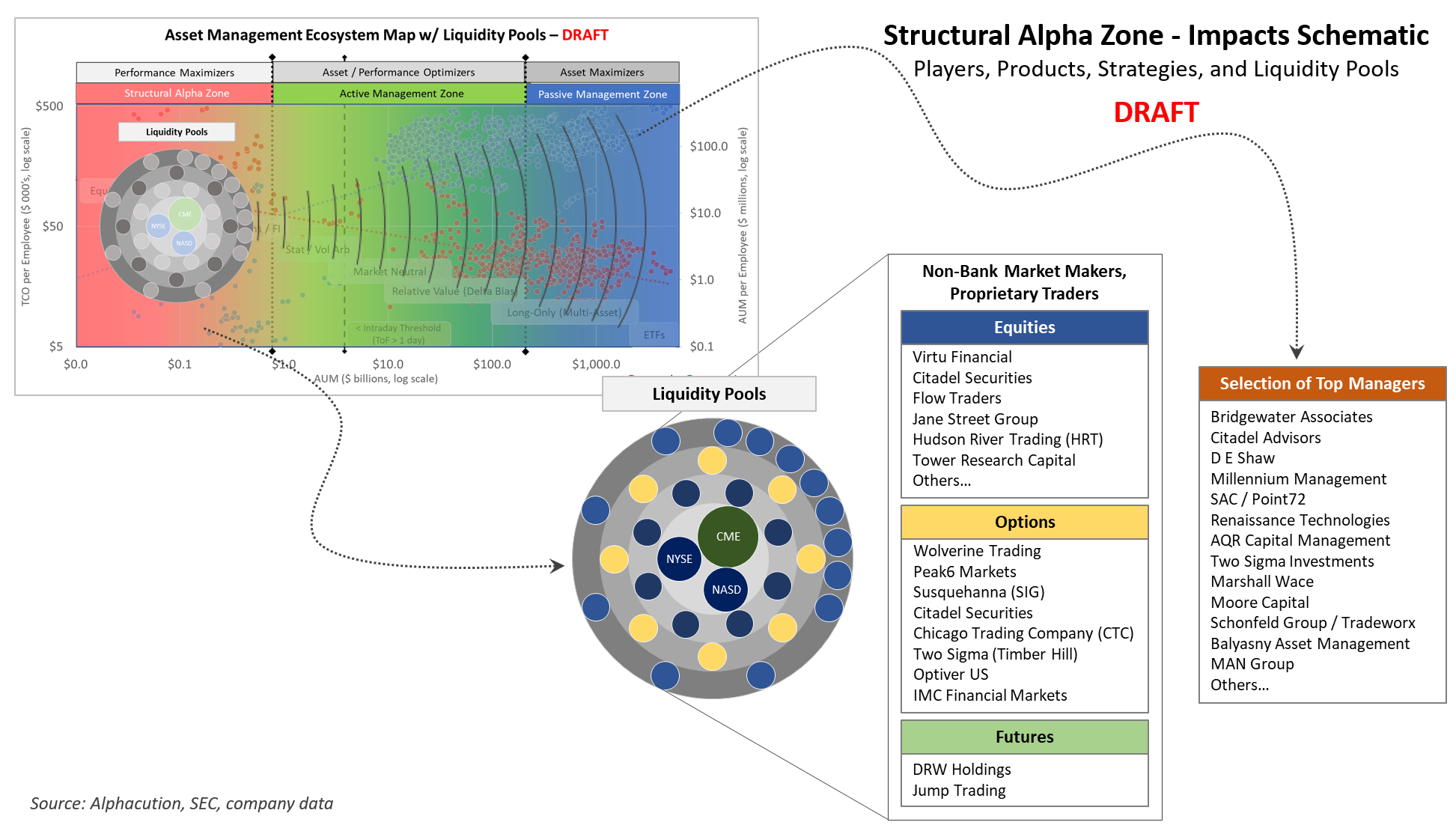

So, this brings us back to where we started. In the chart below, Alphacution presents its initial impacts schematic for the structural alpha zone, along with a representative list of the 30-40 buyside trading firms that will become the subjects and targets of a bulk of our upcoming research production: (I am keeping it in DRAFT-mode for now, allowing for inevitable iterations while the ink dries.)

Note that this is not an exhaustive list. This is merely an opening salvo. There are some up-and-comers that are worthy of some attention and analysis. The exchanges and other liquidity pool sponsors will certainly enter the regular flow of analysis. The sell-side market makers will also eventually become an increasing component of the modeling and analysis, perhaps sooner rather than later. And, of course, we will look to make this whole package a lot less US-centric over time, thereby expanding our near-term focus list well into the top 50-100 players in this space, not counting all the various stakeholders and service providers.

Throughout, what I want us all to remember to keep our eyes on is the potential for the active and passive management zones – where hedge funds and traditional asset managers live, respectively – to exhibit increasingly noticeable shifts in roster. I want to get to that monitoring quickly, however the structural alpha zone foundation needs to be established first.

In closing, as promised up top, if you are even the tiniest fraction as geeked as me about the research we have on deck, then it’s important for you to support it at some level – whether that be individually by clicking a couple buttons (above or below) or as a firm by setting up a discussion to design a custom package. This content may have been impersonating the illusion that it is free up until now, but I can assure you that the experience and effort that has been assembled to create it has come at an extraordinary cost…

As important, and I mean this sincerely: If what we are doing here doesn’t strike a cord with your needs, please don’t hesitate to excuse yourself when the next newsletter comes around. The unsubscribe link is always at the bottom of the emails, or just shoot me a note. No harm, no foul…

As always, thanks for your ongoing attention, encouragement and support.

It’s your move now…

(INLINE SUBSCRIPTION FUNCTIONALITY DISABLED.)