Success in any endeavor requires single-minded attention to detail and total concentration.” – Willie Sutton, bank robber

Alphacution has been writing untold stories about the most secretive, mythological and successful trading firms, hedge funds and asset managers in the history of the global markets ecosystem for the past couple years. What originated as our “Hiding in Plain Sight” series has come to life based on an accidental cocktail of messy data and an experiential overlay made up of a maniacal curiosity for puzzle solving, the joy of storytelling, and a potent dash of personal circumstance.

Dozens of these companies have found themselves in our sights, many of them the subject of these Feed posts – some more than once – and, many of them modeled but yet to be written about. And, since there is so much secrecy around proprietary trading strategies – and rightly so – most folks have responded without responding, except for their ongoing readership, and the network effect.

Yes, a small minority of our subjects have reached out directly – with calls and emails – but that list can be counted on one hand. And, within that short list, there is one team that consistently speaks with purpose through the same point person.

Now, for those who have been following along here regularly, it should come as no surprise who this is (beyond the delicately nuanced title above). We’ve written about them numerous times (including as the subject of our first major case study) – in part, admittedly, because they attract attention – but, mainly because their role in the ecosystem is, in our opinion, so consequential – which brings us to the point of this unusually unusual post:

Why does Citadel (Securities) go to any lengths to make sure that Alphacution gets the story straight? Of course, we are not the only ones who receive this treatment; far from it. We may be unique, but nonetheless we are still a boutique player relative to other more mainstream channels, like Bloomberg News or Crain’s Chicago.

No one else communicates with us in nearly the same manner.

Yes, the sell-side players seem too big to care or notice what we’re saying. Plus, they’re simply too many folks writing and talking about them to respond to all those fires. And, most prop firms and hedge funds typically have no mechanism in place to influence the record – as long as performance is good and most reporting outlets are fawning over billionaires and their collection of toys…

Here’s the thing: Unlike any of their peers born on the buyside, it is clear that Citadel – along with everything else they are building – is focusing an immense amount of energy on building a brand.

And, when you’re building a brand – like, building a world-class trading platform, that may one day become the central engine for a world-class investment bank or merely remain disguised as the gold standard in global market making platforms – you need to foster a culture thoroughly infused with a maniacal sensitivity to detail. Because, much more than everything you say, it’s important to operate as if everything you do carries with it the potential to speak volumes, too…

The following update is the result of our latest interaction with our friends at Citadel, expanded and reposted for your illumination and enjoyment:

“Citadel Punks Blackstone – Part 2”

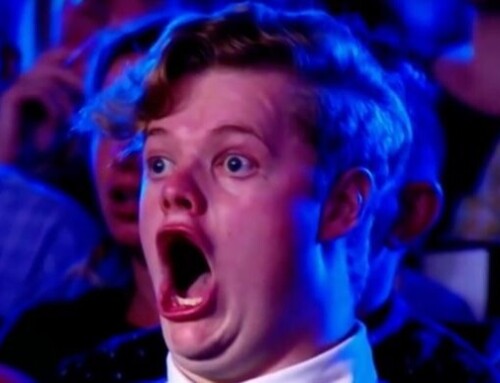

As for how Russell Brand peeked into the title image of this post, I have no idea. I can’t understand a word he says.

Until next time…