“Study the science of art. Study the art of science. Develop your senses — especially learn how to see. Realize that everything connects to everything else.” — Leonardo Da Vinci (~1500)

“Hedge funds — there are too many of them and most of them are lousy.” – Stevie Cohen (2016)

The highest Sharpe Ratios – which, for the uninitiated, is a measure of risk-adjusted returns for specific strategies and financial portfolios – now live behind a declining roster of gilded gates. And the impacts of this “privatization of alpha” are enormous for the asset management industry and its stakeholders. Alphacution expects additional consolidation, concentration, re-engineering, disruption, disintermediation, and exits to be on the menu for this group along the road ahead.

Here’s the setup:

Continuing on the overarching and transformational theme for how information technology impacts the constellations of strategies, players and markets in the financial universe, Alphacution has been leveraging its growing model library to focus on the development of a comprehensive asset management ecosystem “map” to demonstrate, along with many other known and yet-to-be discovered facets, that the capacity of alpha is finite – and that there are significant impacts from that constraint. Soon, we will add that the capacity of alpha is also elastic and provide supporting thoughts and illustrations for some of the factors from which alpha capacity expands and contracts. Ultimately, we will get into the weeds about how the capacity of alpha can be measured.

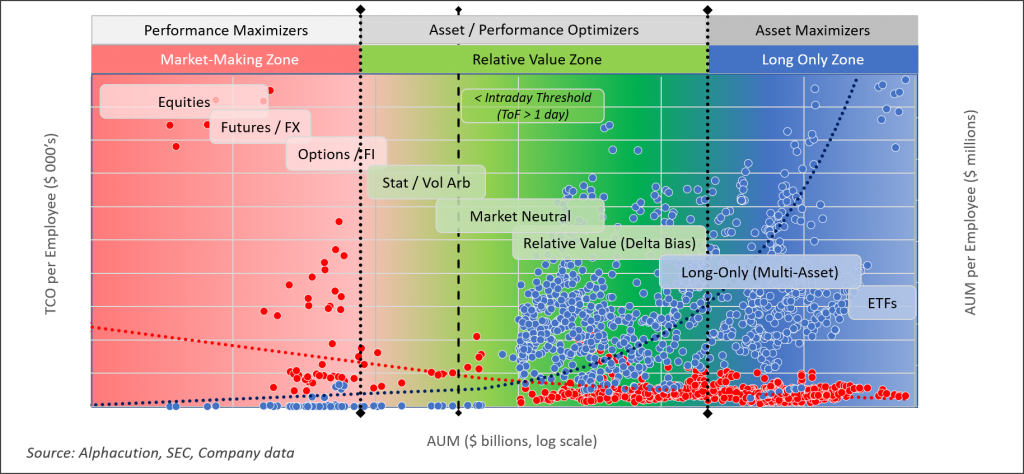

With confidence that the outline of this map is in place, we have begun to explore its various segmentations more deeply, with recent emphasis on market makers and the “market making zone” (most notably in the post, When Market Makers Ate Their Own) and on hedge funds and the “relative-value zone” (in the post, When #HedgeFunds Ate Their Own). In an upcoming post, we will extend this theme to encompass traditional asset managers and the “long-only zone” in a post tentatively titled, When ETFs Ate the Beta…

The illustration below, first published in April 2018, showcases this segmentation and labeling (among other features that we invite you to set aside for the time being as we will be dedicating specific space to the various components of the map separately):

Now, as a very brief review, and to make sure everyone is on the same page for what follows, we have risked becoming a bit tedious by imposing some rigor on the semantic rules around the language of alpha with this simple grammatical algorithm: While it is fine to couple whatever adjective you prefer with the term “alpha,” the verbs to be used in this context are quite specific.

As a starting point, your perspective needs to adapt to perceive sources of alpha as already existing out in the “wild.” And, though these sources can shift in nature – as a result of technology upgrades, new products, new data sources and new regulatory initiatives – legitimate information asymmetries and structural inefficiencies are already existent in the market ecosystem at each point in time – and savvy players can find ways to exploit these types of opportunities – temporarily, accidentally, or consistently – to outperform passive market returns, or beta.

Therefore, you can discover alpha and then capture alpha (in that order), but never generate alpha because “generating alpha” implies creating something at will that didn’t already exist (with the exception of cases when you are doing something hinky, such as leveraging a source of inside information – INCLUDING INSIDE INFORMATION ABOUT THE THROUGHPUT CAPACITY AND OTHER SPECIFICATIONS OF MATCHING ENGINES – or other prohibited information asymmetries). Synonyms are acceptable in all cases, like finding and harvesting alpha, for instance.

Why is specific language and variance of perspective so important?

First, a sensitivity to precise language, effective communication and flexibility of perspective are always important in all aspects of life. There is a philosophical as well as a technical exercise going on here – somewhat like the polymathic discourse of a Socratic Seminar. 😉

However, in this case, if the capacity of alpha is finite at each point in time, then the players and strategies they deploy will display and be constrained by interdependencies. And wherever there are interdependencies, relatively clear pictures about the inner-workings of the system can be drawn from incomplete information. (The opposite perspective – where alpha is unlimited – is to suggest that there isn’t an underlying rationale to explain competitive forces.)

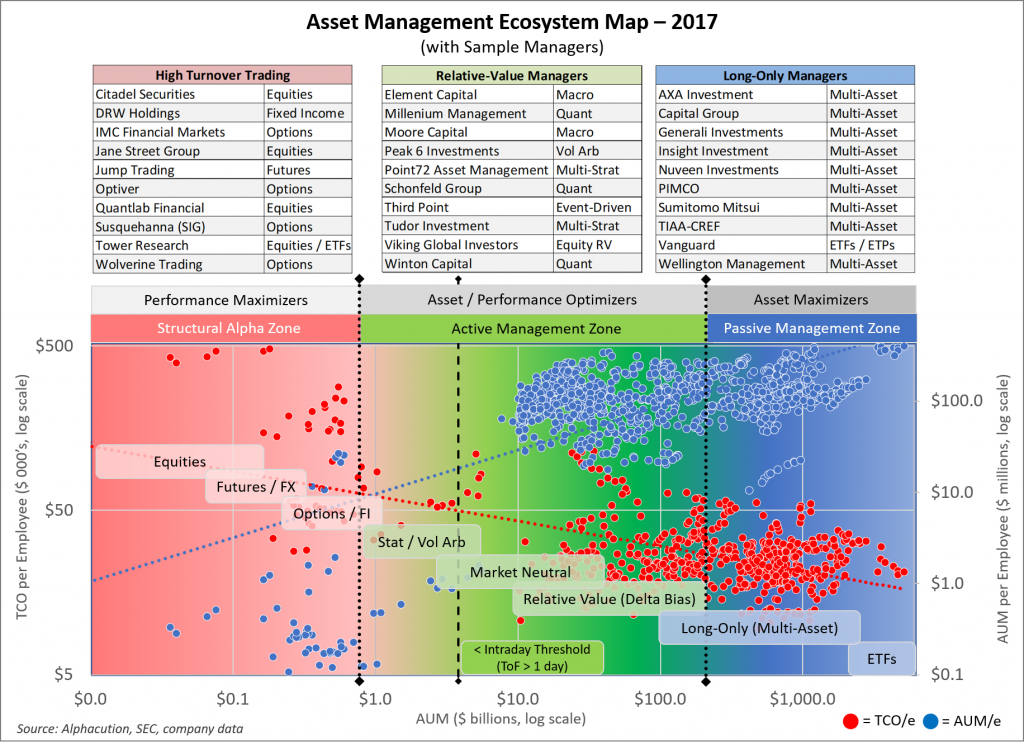

Anyway, this is where we get to the crux of the next layer of analysis – and some additional alpha modifiers: By defining the asset management ecosystem broadly to include hedge funds, market makers, and proprietary trading firms (or, “prop shops”), Alphacution is able create a framework that includes all asset managers in the world (within capital markets). This is because we think we have captured the “edges,” the extremes. As we like to say, everyone between Virtu and BlackRock.

As we alluded to above, the first factor we have used to segment this map is simply the manager’s assets under management (AUM). However, it turns out that AUM also provides a rough approximation for the kinds of strategies likely to be used by those managers because many strategies have capacity constraints, including ALL active strategies best known to capture alpha. Plus, beyond a certain level all managers become multi-strategy, multi-asset, and/or multi-temporal anyway, precisely because of this constraint.

AUM and strategy together provide empirical evidence to segment the map into 3 primary zones, now re-titled as structural alpha (formerly, market-making), active management (formerly, relative-value), and passive management (formerly, long-only) – with the combination of these last two including within them a spectrum of alternativeness.

Putting these and other tweaks into effect, the exhibit below is an expanded version of Alphacution’s initial construction of a comprehensive asset management ecosystem map that was first published in the post, What Does Citadel* Spend on Technology? from our study, The Context Machine: Estimating Asset Manager Technology Spending. It is based on a dataset including 158 managers with AUM >$10 billion (with the exception of the market makers and their proxies). Using minimal data points – namely, headcount and AUM – a subset of the sample managers in this exhibit were showcased to illustrate tactical, out-of-sample use cases for this framework, and therefore, are not part of the study’s core dataset.

Returning to our analysis-to-date on the structural alpha and active management zones, we have written that they have both become more concentrated, here and here. In the market making and highest-speed trading strategies, the concentration of players has become severe of late. However, when viewed with a wide lens, this is only the tail end of a long term evolution. After decades of slowly consolidating floor traders (locals and brokers, alike) into mainly “upstairs” electronic prop shops and then those players being disrupted by faster and smarter quant shops, the past few years have given rise to a massive shakeout in this zone.

Today, we are at a point where only a few of the fastest, smartest and most resilient players remain competitive, with further distinctions by product class; another small grouping with viable technology being absorbed by these and nearby players; and, the rest decaying and ultimately exiting the space. XTX Markets, for instance, is a very rare new entrant to this zone, being founded in 2015.

The active management zone has shown similar signs of consolidation and disruption of late with 6 of the top 10 largest hedge funds by AUM for 2017 (according to Institutional Investor) now being quant-related and a few other notable quant shops not far out of this league. This is against a backdrop of the top 100 hedge fund managers now being home to more than 50% of the estimated $3.2 trillion allocated to hedge funds.

Note: Winton Research published a whitepaper in December 2017 that provides an alternate estimate and perspective on the more commonly sited AUM estimate for the “hedge fund industry,” summarized as follows:

“Restricting what might constitute a hedge fund to those that charge fees of 2&20 or more, with other widely-assumed features of such firms, leaves a collection that manage approximately $850bn. One thing, therefore, is clear: an industry managing $3 trillion − one that is lightly regulated and characterized by a 2&20 fee model, low transparency, illiquidity, and extensive use of leverage – does not exist.”

Meanwhile, a different group of hedge fund titans – those based largely on less automated, fundamentally-based strategies – have earned renewed fame for their struggling performance, notable declines in AUM, and outright exits. Alphacution has developed a hypothesis that these two major themes in the loosely defined hedge fund world are, like two sides of the same coin, related to the same underlying cause: the successful use of strategy automation for the persistent discovery and capture of scarce and finite sources of alpha.

Moreover, because the active management zone of the map still remains home to several thousand hedge funds – the Hedge Fund Association currently estimates as many as 10,000 active hedge funds – we can say that the concentration of alpha discovery and capture among the top players – and the ensuing consolidation, disruption and exits of the laggards to follow – is still in its relatively early stages. As these top players figure out how to expand the capacity / performance balance of their various strategies, this concentration will become more pronounced.

The primary pushback to this trend that we see is the fact that most active strategies are dependent upon a healthy diversity of players and strategies. In this sense, the whales always want a steady source of chum at the tables, as they much prefer that scenario than the one where they go head-to-head with other whales. One thing’s for sure: The golden age of hedge funds is over, particularly now that some of the biggest traditional players are launching fund products, effectively marketing their access to the “alpha” and “smart-beta” arenas – which is a paradoxical euphemism for the small bits of leftover alpha, and in some cases, outright phantom alpha, that is not already being captured by upstream players known as hedge funds, prop shops and market makers who are much closer to the source of it all.

Is the future of this segment of the asset management industry foreshadowed by the fate of the market making and high-speed trading world? Or, will some unknown, unpredictable catalyst of market shifting or product innovation reflate the general sense that the capacity of alpha is big enough to dissolve concern over how it is rationed? Certainly, the crypto-fanatics believe they have found a new and bountiful source of emerging alpha.

With all this as prelude, we return to where we started: All (of the best) asset managers would much prefer to follow Invictus – “I am the master of my fate, I am the captain of my soul.” – by charting their own course with maximum secrecy, subject to lighter regulation, as some form of prop shop. Though investors can provide lots of fuel for growth and financial glory, they also come with tons of headaches, and more so now as regulations and investor requirements have become heavier and more pervasive.

He’s a dubious character – and, he maintains specific distinction as my all-time strangest interview; sitting there in his personal office’s gymnasium – like an antechamber – as I sat there at the leg press machine in my Armani suit and him, as Tom Wolfe wrote in A Man In Full, eventually breaking out in “saddlebags of sweat” on his spin bike as we chatted. That was 1994 – and I did not get the job. Anyway, Stevie Cohen recently took his $11 billion or so private, resurrecting SAC as Point72.

Consider the aggregate wealth of the top hedge fund founders and their key executives. A very small group. For shits and giggles, lets call it 100, maybe 200 guys. Consider what this sum looks like in 10 years – and whether outside investors, themselves big institutional allocators, gradually get pushed to the sidelines.

Anyone care to wager how much of the scarce and finite capacity of alpha comes off the top as a result of these movements? This is, at the very minimum, a risk for the increasing privatization of alpha and the growth of dominant, #winnertakeall market characteristics (as seen in other digitized industries). It’s well worth paying attention to because it represents a series of dominoes that impact just about everything else in the ecosystem. Alphacution’s work in this arena helps quantify, illustrate, explain and predict these phenomena.

No matter what happens next, it’s likely a good time to allocate more of your attention and physical resources to the cultivation of personal alpha – where the capacity is not finite…

As always, if you value this work: Like it, share it, comment on it – or discuss amongst your colleagues – and then send us feedback@alphacution.com.

As our “feedback loop” becomes more vibrant – given input from clients and other members of our network, especially around new questions to be answered – the value of this work will accelerate.

Don’t be shy…