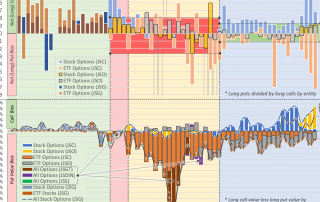

Introducing Alphacution’s Strategy Factor Library

Alphacution goes wider and deeper than ever before - as part of the research for our unexpectedly exhaustive case study on US equity option markets and option market makers - to compare trading entities based on at least 84 strategy factors from the simplest factors - like securities universe or number of positions by product class - to some of the most sophisticated comparisons that Alphacution has ever attempted. In this Feed post, we publish this list - the first version of our Strategy Factor Library - as well as a ranking of 19 option market making entities by our "shorts universe" factor...