TD Ameritrade’s Q2 Update: To Infinity or Oblivion?

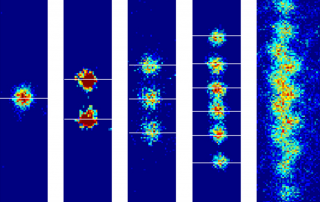

"Just when I thought I was out, they pull me back in." - Michael Corleone, The Godfather: Part III Chicken or egg? For today's story, we know which one came first. However, we may never know for sure which one was the more prominent cause of the recent sustained spike in US stock volumes: A frictionless environment brought on by a zero-commission framework or a high-volatility market brought on by a once-in-a-century global pandemic? Granted, there may be additional factors at play here. Like the gamification of market interfaces as substitution for a sports apocalypse. People need something to do. And, when confined for extended periods, they will naturally choose paths of least resistance, especially those that entertain, are addictive and tickle financial desires... This is what one of those paths looks like; notably since March 2020: Now, I made a point last week, in "Robinhood's Trailing Stop Orders: Extreme Profitability, By Design," to say that we would try to avoid seeming redundant in our topical choices, at least [...]