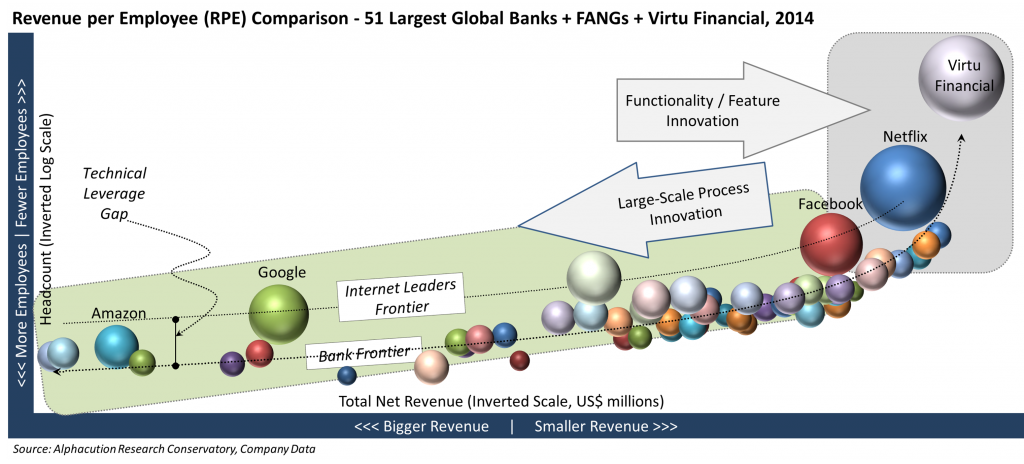

Before everyone heads off to worship at the Altar of Tryptophan for a few days, I wanted to share some updated analysis: (I promise to keep it as short as possible, but unfortunately no less dense than usual.) In a recent post, #Technical Leverage: Can You Defy Your Scale?, I added Google’s (and Virtu Financial’s) RPE (revenue per employee) analytics to our core assembly of the 51 largest global banks. Given Google’s stand-out RPE of US$ 1.23 million (2014), I developed a hypothesis that this was a common theme among similar Dot.com / Internet-related leaders; that perhaps there was a pattern that would help us better describe and understand the nature of the digital revolution.

Before we go to the visual, it is often the case in the search for meaning in new mega-drivers that there is a refinement of language and labeling exercise that needs to take place. After all, if we are too cavalier about the definition of new mega-drivers – if “digital” is in fact new at all – then we risk conflating scenarios that are not actually the same.

We all remember the collective struggle that went on around big data before a consensus around “volume, velocity, and variety” emerged. I think the same phenomenon is going on around all things “digital.”

- Does digital = new?

- Does digital = automated?

- Does digital = agile?

- Does digital = efficient?

- Does digital = radical innovation (vs. status quo)?

- Or, does digital = all, some or none of the above?

First, I think that digital is a symbolic label that needs to be tethered to the idea of radical change (and radical innovation), thus distinguishing it from common evolutionary change. But, from there, we get to a fork in the road, since radical innovation is not only about features and functionality but also about process innovation (from workflow automation to collaborative efficiencies).

If we consider the so-called “digital transformation” that is occurring in financial services – and most profoundly amongst the G-SIBs (global systemically important banks) – it is clear that the adoption of new “fintech” and/or “disruptive” technologies is and will continue to be a critical component of their transformation. However, this only explains a portion of the story, since most impacts of the latest radical innovation occur in isolation rather than in the collective (with few exceptions).

In other words, Infrastructure-as-a-Service (IaaS) solutions, mobile payments and distributed ledger technologies (to name a few of the usual suspects) are not going to cause mass transformation of banks with headcounts of 50,000 or 100,000 or 200,000 or more anytime soon. Sure, headcounts – and skills mix – will change, but likely only at an evolutionary pace. Large enterprises need to harvest the dividends of process innovations as much or more than they need to move with the flow of new tools and technologies. (Of course, process innovation is heavily dependent on new technologies but also with a significant component of behavior modification as well – which is always the most challenging variable.)

In the exhibit below, the “digital frontier” illustrated by a small selection of internet-related leaders – which is the trend line of the RPEs of Amazon, Google, Facebook and Netflix (also known as the “FANGs”) – exposes a “technical leverage gap” with that of the largest global banks. Though not necessarily statistical significant due to the small sample, this gap represents an RPE of about US$ 1 million. In other words, where each bank employee (or full-time equivalent – FTE) generates an average of about US$275,000 in revenue per year, each employee in the internet leader sample is generating 4-5x that amount. Bear in mind, these figures are intended to be illustrative of the productivity of employees within would-be “digital” leaders vs. that of large global banks.

Finally, the point here is not to suggest that large banks can transform to the level of operational performance (at least based on RPE) of a Google or Facebook. But, if banks can harness technical and process leverage that delivers RPE improvements in increments of say US$10,000 or US$20,000 per head, that progress will soon turn into real money.