Here’s a quick jolt of provocative thought, just in case your brain – like mine – has become a little soft over these summer months:

Talk of AI and various other forms of process automation have reached a fever pitch. With that phenomenon comes a flood of new intelligence – and also a heavy dose of mythology. Sometimes the difference between the two is not immediately obvious. The idea that automation has a tendency to kill jobs is one of those if-then statements that is rarely if ever questioned.

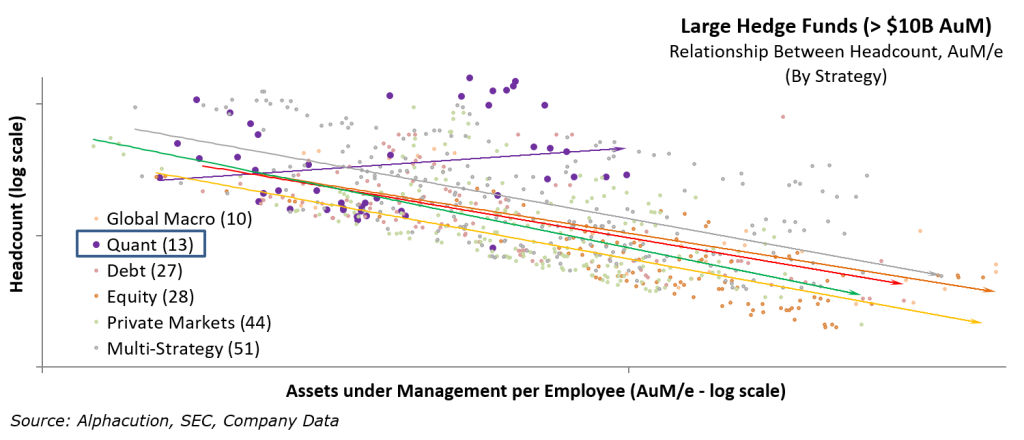

In the world of trading, quantitative (aka – automated) strategies have earned a reputation for becoming incredibly successful with few employees, thereby supporting the prevailing wisdom. Well, it turns out that “quant shops” just might scale headcount relative to assets under management (AuM) differently than other managers with other trading strategies – and not in a way that is supported by prevailing wisdom…

Alphacution just sent a completed draft of its first major asset manager study over to the editor. This is a study based on initial modeling of more than 200 large hedge funds and asset managers. Some of the findings are fairly eye-opening – and worth sharing, even if a bit on the hasty side.

Basically what we did here is build on top of a hypothesis we formed in December 2016 – and kicked off with a post entitled, “Top Hedge Funds: AuM per Employee = Trading Strategy?“. Since then we collected a ton of new data – in large part with the help of data scientist, Ian Rayner at Rayner Gobran, LLC – conducted a ton of new modeling, and came up with some compelling conclusions supported by the output of the modeling.

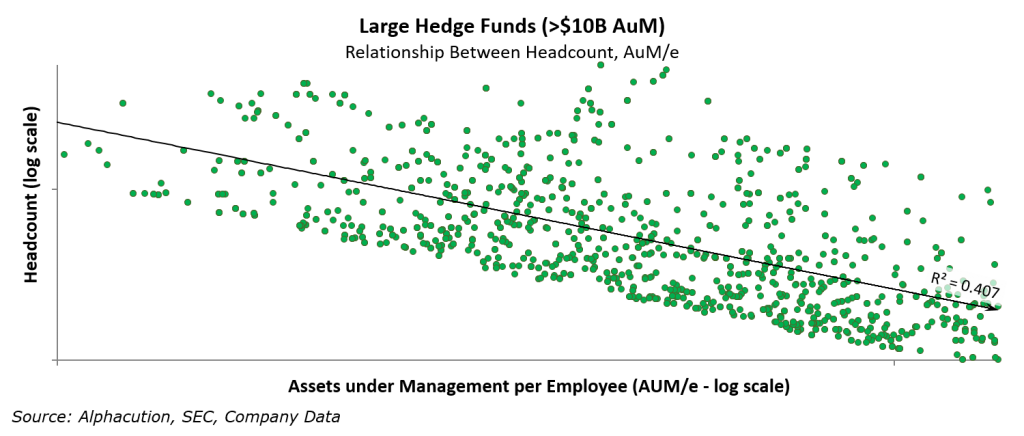

One such key finding starts with the exhibit below where more than 1,700 records based on more than 200 hedge funds and assets managers (over about 5 years) is aggregated to visualize the relationship between headcount and assets under management per employee (AuM/e).

Clearly, the relationship between these two factors is inverse. In other words, as headcount increases, AuM/e declines. But, there is one exception: As automated strategies scale, increasing headcount may be required (see Exhibit below). Translation: As all other strategies demonstrate the potential to manage more AuM with smaller headcount, quant strategies stand out in the opposite direction – in order to manage more money, quant shops need to continue to add bodies. Now, of course, we have buried the numbers and the details behind these findings. (We ain’t running a charity here.) But, even without those numbers and details, the implications for this conclusion could be quite profound as the entire global asset management industry seeks to implement more and more quantitative methods.

Now, of course, we have buried the numbers and the details behind these findings. (We ain’t running a charity here.) But, even without those numbers and details, the implications for this conclusion could be quite profound as the entire global asset management industry seeks to implement more and more quantitative methods.

Stay tuned – and we look forward to your comments and questions…