Don Dale, Chief Risk Strategist for Equity Risk Control Group, is a guest contributor to the Alphacution Feed.

I am not a funny guy. (Ask my wife…)

And yet, occasionally – when I say the quiet part out loud – I manage to get a laugh. My latest bit is an idea about how to “fight the Fed.” So, while you may enjoy a chuckle at the thought, here’s why I think things might be different this time:

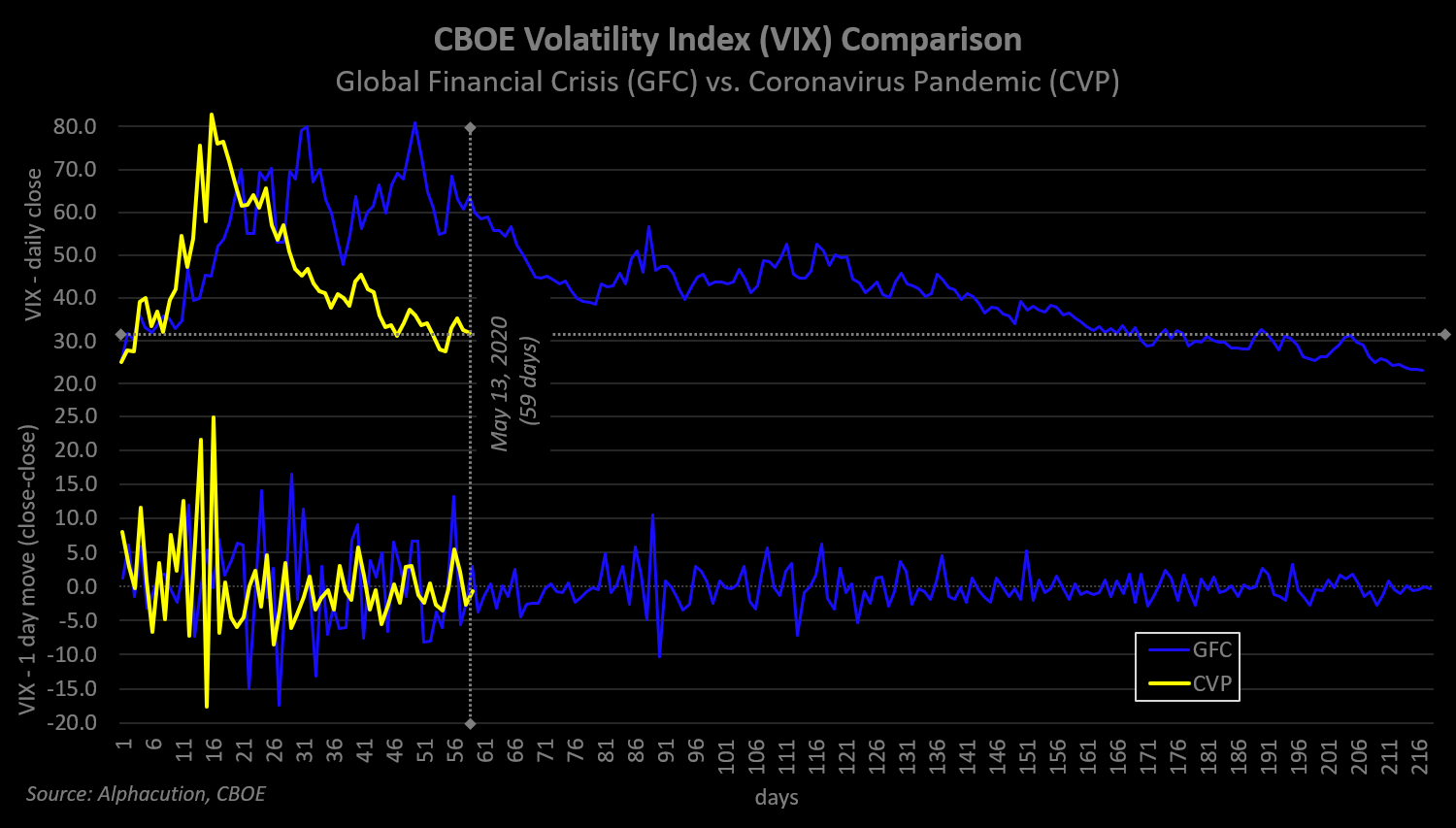

The “Fed Put” is a common reference in capital market circles – particularly since the GFC – given their increasingly likely position to backstop some asset classes. Of late, the Fed’s actions were the driving force behind the stabilization of the bond market since the March gyrations; by extension, the equity markets.

However, the primary driver for equity market performance within US indices has been the mega cap FAANGM names, given the thematic benefit of social distancing on factors like home delivery, video bingeing and all manner of online interactions. This concentration of players created much of the equity lift since the March lows.

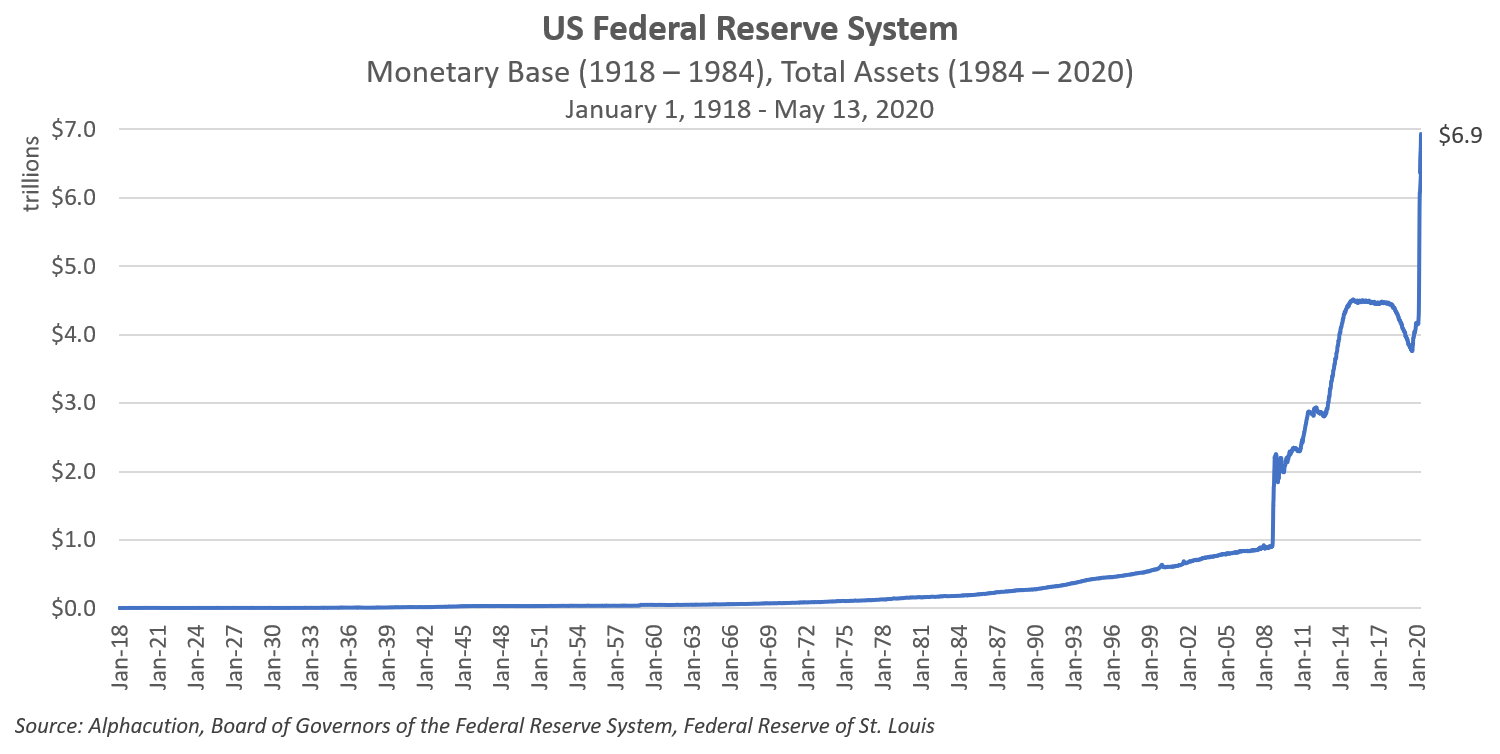

My position is that the flood of capital into these names may have created false hope for those who prefer to believe that the Fed can and will always be there to backstop all economic turbulence that might interrupt the stock market’s trajectory. Except with rates at zero, significant resistance to a negative rate phase, and an exploding balance sheet from an expansion of new backstopping programs, the Fed’s ammo may not be enough this time.

Let the expectation-trimming begin:

This past week, Jerome Powell has thrown cold water on these hopes. His statements explicitly warn of possible severe long term economic consequences regardless of the central bank’s actions. This warning should convince market participants that the strike price for this Fed Put is not at-the-money but is meaningfully lower and not of unlimited duration. In other words, no amount of capital seeking safe haven in the FAANGM’s deployed to just those small number of disrupters can carry the entire equity capital market into Valhalla.

Equity market valuations near all time highs as measured in traditional, pre-pandemic PE metrics are not going to be helpful. And, portfolio managers are going to be fixated on keeping their jobs based on performance achieved during the remainder of Pandemic 2020. Winter is coming and they know it. The calendar might say May, but PMs and allocators can feel the chill in the air…

Here’s a sample setup for a response to that chill: The SPX had a 34% selloff with unprecedented speed, and then followed with rebound of unimaginable magnitude given the status of the worldwide economic shutdown. April was up more as a percent than March was down.

Let that sink in for a minute…

This is the riddle wrapped in the enigma encased in career risk that portfolio construction specialists are grappling with right now. With that, it may be time to roll out an idea that may have a bigger payoff now because of current market structure: Stock replacement with options exposures.

I know. It doesn’t sound sexy, but let me explain why I think it might work now.

My generic suggestion is to take advantage of the market’s “misunderstanding of the perceived strike price of this Fed Put.” Recognizing the forward calendar, which includes among many other known and unknown catalysts, 1) a pivotal election in November, 2) the possible onset of a second wave of virus exposures before year end, and 3) the y-o-y judgement period most often applied to PMs and allocators. Because of these – and mass unknowns – I would target December option maturities to plant a flag.

With that flag, replace a portion of your equity exposure with broad based index options. A firm could easily take advantage of EOY lowered forwards and volatility levels since the peak during the selloff for funding the replacement. A simplistic orientation might be buying year end at the money (ATM) calls partially financed with short EOY calls struck, at the all-time highs. In addition, you could sell an equal number of EOY puts struck near the March lows. Think of this as selling a cash secured put at the recent lows, with the benefit of call spread protection if we continue an upward rebound.

This posture provides several benefits: 1) Participation in further market upside to the Feb 2020 highs, 2) it takes advantage of elevated put skew and higher than normal upside call volatility levels, and 3) lower cost of the forward for December delivery by virtue of lower rates. This idea protects losses otherwise incurred on the downside until the put strike (back at the March lows) and provides upside for the replaced exposures to the February highs. Under more normal market conditions this replacement would be more expensive…

It is an old-school idea, much like stacking fire wood. With Winter likely to come early this year, you might need a few extra ways to stay warm. Yes, there are more sophisticated ways to solve the current market positioning dilemma, but this is a good place to start.

The Fed Put is not where you may think it is…