“Tug on anything at all and you’ll find it connected to everything else in the Universe…” – John Muir

One of our favorite trends to track around here is the pace of change in workflow automation for trading and investment management processes. It is likely the one monumental driver of change that few are paying attention to (as a measure of success) – and even fewer are developing methods to quantify…

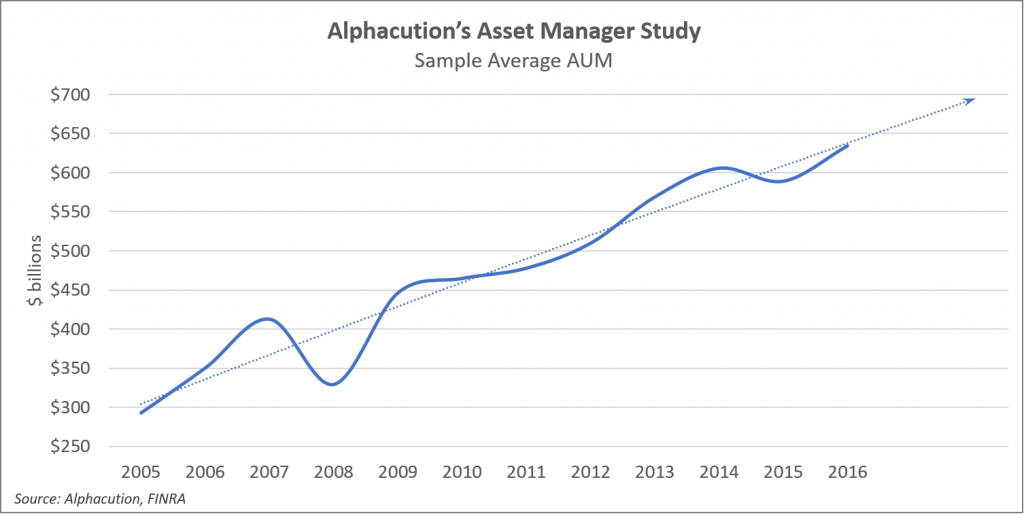

So, several months ago, when FINRA (the Financial Industry Regulatory Authority) published its very first “industry snapshot” – the eponymous 2018 FINRA Industry Snapshot – we decided to see if we could use it to enhance any of the components of the broader financial ecosystem that we had previously modeled. After all, Alphacution’s initial asset manager study (April 2018) had already highlighted a very healthy 7.3% 11-year CAGR in assets under management growth since 2005 for the sample of 60 large managers in that study (see below)…

… and, we had already made some fairly clear rumblings prior to that – almost exactly 2 years ago – about our views on the robo-advisory trend in the article, Investors Beware: Robo-Blindness Ahead.

Now we are here with new data from FINRA that represents additional signals about 1) the vast asset gathering network that feeds much of this AUM growth while sitting in the crosshairs of an inevitable automation juggernaut (i.e. – robo-advisory and other mechanisms) and 2) the raw material that ultimately fuels all the fancy trading strategies that we pay such close attention to in our research about market makers, prop trading firms, hedge funds and their stakeholders…

So, here’s what we think the new FINRA data adds to the picture where the global harvesting of market alpha and market beta are subject to the same overarching driver of workflow automation:

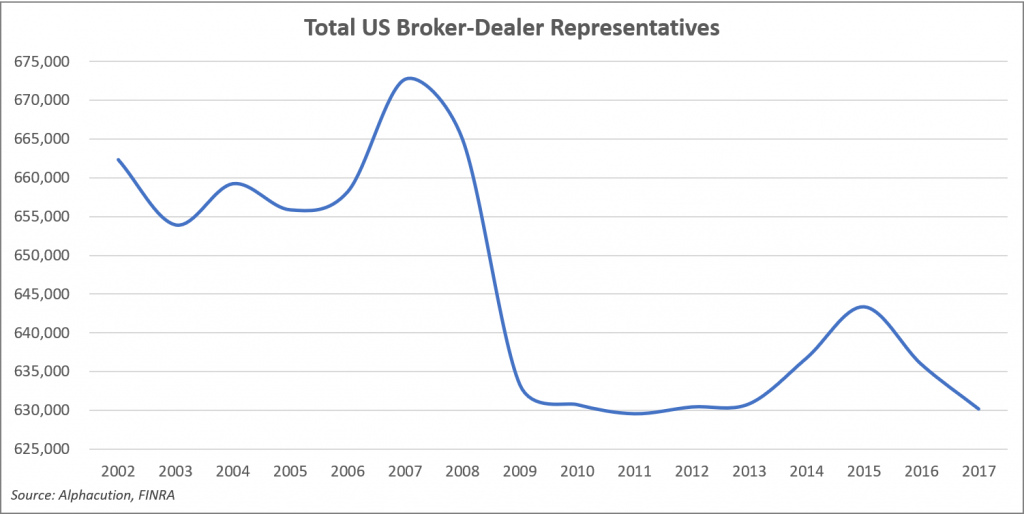

After peaking at about 673,000 total registered representatives in 2007, these ranks shrank (rather predictably) to about 630,000 by the time of the 2009 hangover of the global financial crisis (GFC). However, what seems somewhat inexplicable is the lack of further declines from this level over the 8 years since (from 2009 to 2017). In fact, the 2014-2o16 period saw a temporary growth spurt from and back to these post-GFC levels around 630,000 registered reps; a level which, as of November 2018, still stands in the neighborhood of 634,000.

See the full trip in the chart of total US broker-dealer (BD) representatives, below…

Our read of this wiggly line is as follows: Despite the expanded spectrum of mechanisms for gathering retail-oriented assets to include more technology-enhanced, lower-touch and other DIY services, there is still a significant component – maybe call it a set of “demographics” – within the wealth management market that still prefers a higher-touch offering. It is the continued resilience of this demand that temporarily prevents further penetration of lower-touch services, and therefore, any further declines in the roster of BD reps.

That said, however, Alphacution still expects these figures to eventually continue their decline since the evidence shows that broker-dealer firms are in a longer term mode of consolidation, and that the success of this consolidation trend will be to implement tools and other process automations to the traditional financial advisory workflow.

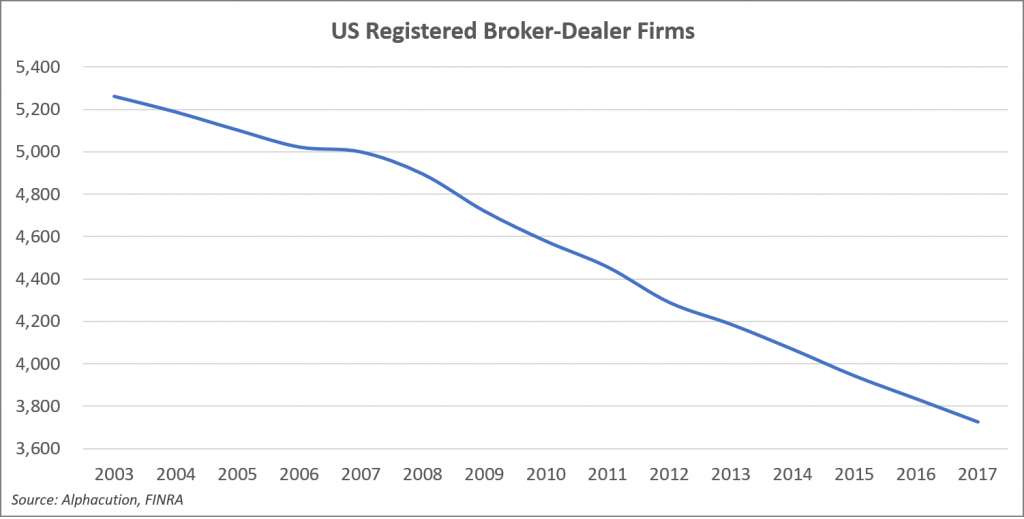

In the chart below, we see how the total number of US registered BD firms has steadily declined in each of the 14 years from 2003 to 2017, a total 29.2% decline. As a result, reps per firm have increased a total of 36.1% from 124.3 in 2003 to 169.1 in 2017.

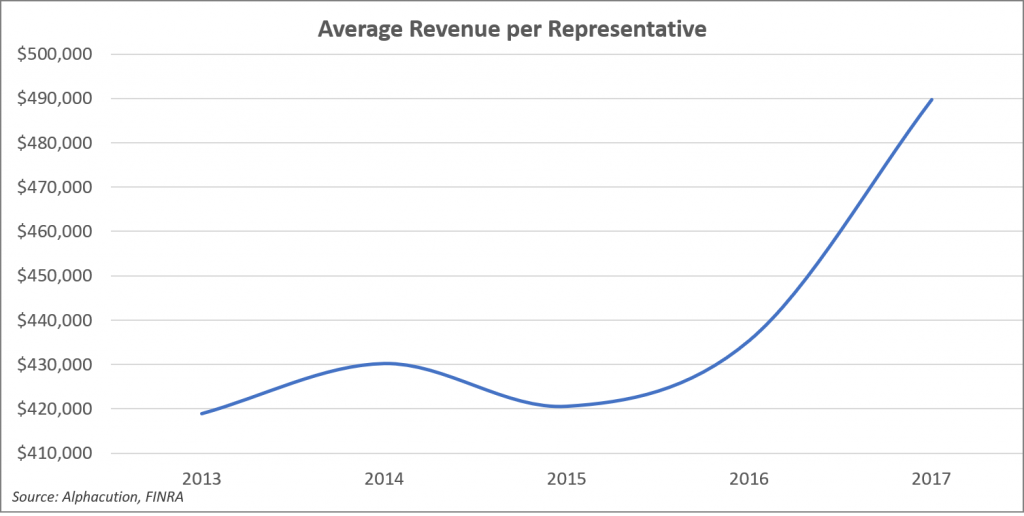

But, as suggested above, the implementation of tools and other process automation mechanisms – in a bid to foster a new kind of hybrid hi-lo touch offering – has caused a spike in average revenue per representative of 16.4% from $421,000 to $490,000 just in the last 2 years of the sample data, since 2015 (see below).

The key findings in this additional dataset fits in well with the working hypothesis we see for the entire industry: Automation – whether by quantitative methods or process re-engineering that requires less dependence on human capital and offers greater technical leverage for scaling – is washing over the entire financial ecosystem. What we have seen in the evolution of the market making and proprietary trading segments of the asset management world over the past 2-3 decades (with floor locals consolidating to larger upstairs and automated operations) foreshadows the equivalent of what is and will continue to happen (yet faster) in the hedge fund and traditional asset management segments of that same asset management world.

Those firms that can harness the smarter-faster-stronger aspects of technological prowess ahead of their competition should be expected to capture a disproportionate share of the spectrum of opportunities that remain in global capital markets. However, one significant caveat to this are the components of the ecosystem that are resistant to behavior modification.

Asset gathering from those baby-boomer era demographics that prefer higher-touch advisory services is one such area that will remain resistant to conversion to lower-touch services. Wealth managers focused on balanced, hybridized hi-lo touch services should be expected to transition most successfully as investor demographics shift over the longer term. In this sense, there is simply no way to avoid the adoption of new tools, technologies and methods.

Alphacution is here to distinguish itself as a source of navigational intelligence for that journey…

As always, if you value this work: Like it, share it, comment on it – or discuss amongst your colleagues – and then send us feedback@alphacution.com.

As our “feedback loop” becomes more vibrant – given input from clients and other members of our network, especially around new questions to be answered – the value of this work will accelerate.

Don’t be shy…