According to D. E. Shaw, RenTech and Other Legends: Hindsight is Not 2020

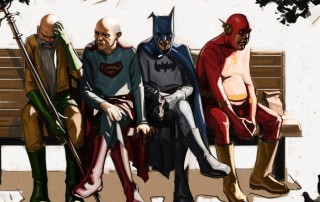

"Quality means doing it right when no one is looking."Henry Ford I couldn't find the exact reference, but sometime between about 2010 and 2015 I wrote (for TABB Group) that when the market regime eventually shifted from the core drivers of the long, low volatility period of the post-GFC era, many quant models would become disoriented and their performance would suffer. This is simply because the behavioral cues of the new chapter would not be embedded in the historical market data of the prior period upon which those models had been trained. Well, that scenario finally played out this year... So, instead of following the well-worn tradition of preparing a lengthy "Year in Review" post on market highlights and lowlights as we bring this historically bizarre and disorienting year to a close, I thought to let a series of illustrations from some of the world's most legendary players show you symbols for how their year appears to have gone (through Q3 2020) and, by implication, how broad groupings of strategies [...]