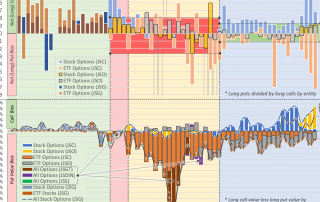

Runaway Concentration Risks in US Option Markets

“The future is a choice between utopia and oblivion. Whether it is to be utopia or oblivion will be a touch and go relay race right up to the final moment…” – Buckminster Fuller On September 23rd, the Financial Times reported, “Citigroup halts market making in retail options” in an apparent response to the challenges brought about by the era of zero-commission retail trading; an era that is swiftly nearing its one year anniversary. Among the more notable impacts of this Citi news, the fact that Morgan Stanley now remains as the sole major Wall Street bank still standing as an intermediary for retail option flows ranks high. Truth be told, it ranks second only to a backdrop of creeping concentration as bulge players like Citi and Barclays before them and Goldman before them and others before them – including those that have been winding down their cash equities businesses – have punted on their options businesses because it has become so mind-numbingly complicated and expensive to make money in [...]