Nasdaq and the Case of the Missing Market Data

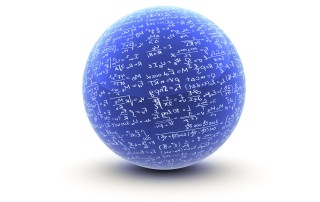

In late April 2017, we noticed a new string of dominoes falling at the fast, automated end of the trading spectrum: With Virtu about to gobble up KCG - not to mention additional consolidations of principal trading groups like RGM Advisors (to DRW), Timber Hill (to Two Sigma) and Chopper Trading (to DRW), among others - it seemed pretty clear that one of the next dominos to fall would be in the direct-feed market data space. The question was: To what degree? (See: "Nasdaq Under Virtu Market Data Axe," April 28, 2017) And yet, when we went back to look - via updating our Nasdaq model - this picture showed up: As Paul Harvey used to say: "...And now the rest of the story..." Obviously this trajectory is the opposite of what was expected. Better yet, in a dictionary somewhere is this chart - at least, of late - next to the words, "fairly smooth sailing" or "strong growth." Over the last few years, data products (and the growth in [...]