Somebody may beat me, but they are going to have to bleed to do it.” – Steve Prefontaine

“Study the art of science. Develop your senses – especially learn how to see. Realize that everything connects to everything else.” – Leonardo da Vinci

Renowned columnist and author, Thomas Friedman often talks about unintended and unpredictable outcomes when tinkering with big systems. I am reminded of this thought as I drag myself, kicking and screaming, to write this next post.

The source of my reluctance is this: I don’t want to be in the prediction business mainly because the timing of the catalyst that dramatically alters the trajectory of prevailing themes is a fools errand. And, because we may be standing at such a consequential point in history that the events that await us along the journey in the months and years ahead are unimaginable.

However, I do think it’s important to start the year by reflecting out loud about the year ahead while leveraging what we have learned about those themes from the year(s) behind; and in so doing, potentially give each of you something to ponder from your own perspective on the year ahead…

We know that technology is disrupting everything around us at a pace that, in part, increasingly exposes frameworks and idealogies that are not equipped to adapt to that pace of change. Big systems – like democracy, capitalism and market structures (for goods, services and ideas) – are being influenced, as Friedman puts it, by a convergence of accelerations; technical innovation being one of them. We might even go so far as to suggest that technology is altering the nature of consciousness and the perception of reality itself.

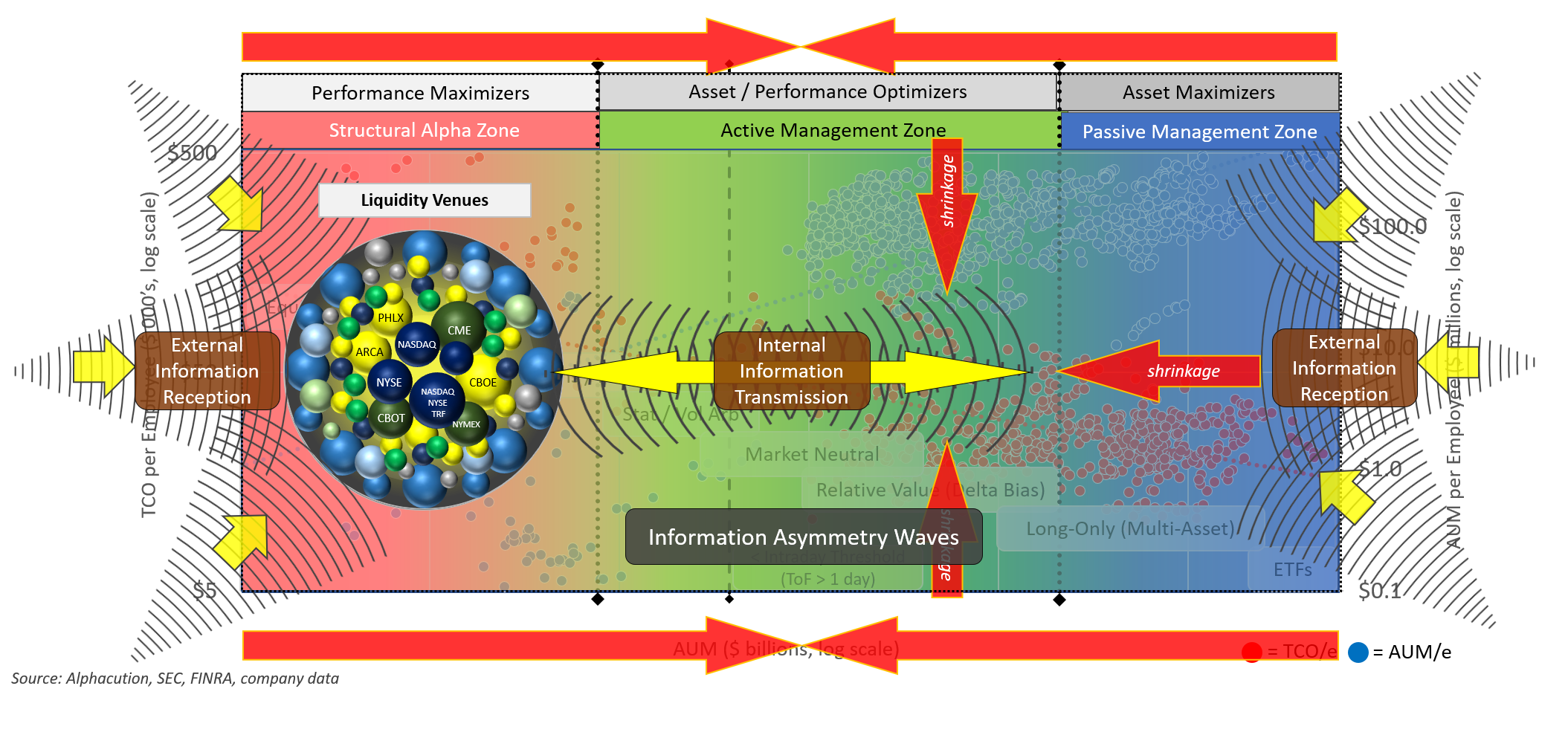

This is a sketch of the backdrop for Alphacution’s common focal point, capital markets – which, like its heart, exists symbiotically as part of an amalgamation of big systems. Today, the dominant theme of technology in capital markets is about the discovery and extraction of the value of information asymmetries (where the capacity of that value at any point in time can be roughly determined by the product of tradeable inventory, liquidity and volatility).

The dramatic impacts of this theme are to gradually bifurcate the landscape between alpha players and beta players; forge immutable incumbencies of those select players (at both ends of the alpha-beta spectrum) who wield technology with the most skill and creativity; and ultimately drive everyone else out.

Alphacution expanded on this observation and the premonitions it yielded most recently in the Feed post, “BlackRock, Bridgewater, Citadel: The Decline of Speculation at Scale.” Central to that story is this idea that leading alpha players are extracting an increasing share of the finite capacity of information assymetries to the detriment of institutional players with discretionary strategies (many of whom, like the legendary Louis Bacon, are either closing shop or white-knuckling the journey in hopes of a favorable shift) and retail players in search of reasonable returns at lower costs who are flocking to beta purveyors and their arsenal of ETFs, like BlackRock and Vanguard. The exhibit below is our initial interpretation of what that phenomenon looks like in the context of our asset management ecosystem map:

With the “capitalism” shingle still proudly and prominently displayed outside the shop door, the world’s largest national economy that is increasingly centrally-managed by the Fed while during an historically consequential election year, with a government running trillion-dollar budget deficits, and new man-made and natural hysterias flaring across the globe to heighten a ubiquitous sense of derangement, is neither going to allow free market price discovery to suddenly creep into our yield curve nor is it going to allow one of its primary tools of public psychology management – the Stock Market – to suddenly do an impersonation of a falling knife. This is the strongest economy in 1,000 years, dammit!

With the “capitalism” shingle still proudly and prominently displayed outside the shop door, the world’s largest national economy that is increasingly centrally-managed by the Fed while during an historically consequential election year, with a government running trillion-dollar budget deficits, and new man-made and natural hysterias flaring across the globe to heighten a ubiquitous sense of derangement, is neither going to allow free market price discovery to suddenly creep into our yield curve nor is it going to allow one of its primary tools of public psychology management – the Stock Market – to suddenly do an impersonation of a falling knife. This is the strongest economy in 1,000 years, dammit!

In short, chances are that historically-low interest rates and muted volatility (with perhaps an occasional exception) will remain status quo at least through the Election in 2020. And so, without much change to the perceived economic landscape, my expectation is that the technology-fueled themes that are causing increasing concentrations of incumbent alpha and beta players (and disrupted players) will also remain status quo in the year ahead. And, since – according to da Vinci – everything is connected to everything else, this also means secondary and tertiary themes, like low new hedge fund launches or high success among private market actors or flirtations with shiny objects like Bitcoin, will all continue with the status quo, as well…

Given all this, here’s a closing question: When do some of the bigger players – whether they be buyside or sellside – who are waking up to the decline of their (former) incumbencies and potential scale of their disruptions, start picking off some of the promising (yet still smallish) alpha players? Granted, the through-lines to such deals are by no means a lay up, and very few pairings would even begin to make sense.

But, there are precedents – a recent example of which we explored in depth with Two Sigma Securities. Are there more of these on the horizon? This is among the key questions and themes Alphacution will be modeling, pondering, and writing about in 2020.

Until next time…