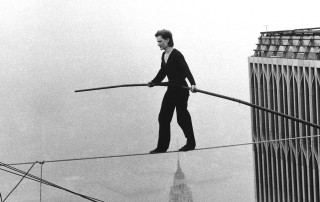

Morgan Stanley: Taking the Trade Out of E*Trade?

"What you do speaks so loudly that I cannot hear what you say." - Ralph Waldo Emerson On Thursday, February 20, Morgan Stanley (MS) announced its acquisition of E*Trade (ETFC) for $13 billion in a brillaint move that simultaneously 1) responds to the recent move to $zero commissions in retail brokerage; 2) responds to Charles Schwab's recent announcement to acquire primary ETFC competitor TD Ameritrade; 3) boosts MS's position in coveted wealth management channels; 4a) takes greater control of coveted retail order flows - and thus, (4b) away from competitive market making firms, like Citadel Securities and Virtu; 5) takes the last of the major independent discount retailed brokerage platforms off the proverbial table - sorry, Goldman; and 6) arguably completes a dramatic arc of industry evolution and consolidation that began with Schwab's acquisition of CyBerCorp in early 2000 and Citi's acquisition of Lava Trading in 2004... As trick shots go, this one is a doozy! Given that, I wanted to extend some thoughts around recent modeling that we [...]