“But how do we know when irrational exuberance has unduly escalated asset values?”

Alan Greenspan

By now, everyone – and I mean, EVERYONE – knows about how “GameStop (GME), [the] hedge funds’ most-hated stock, was targeted by an army of retail investors who marshaled forces against short sellers in online chat rooms. In the Reddit forum “wallstreetbets” with more than 2 million subscribers, rookie investors encouraged each other to pile into GameStop’s shares and call options, creating massive short squeezes in the stock,” according to a synopsis of the saga by CNBC.

In short – so we’re all on the exact same page – there’s been an epic short squeeze off the back of a classic pump-and-dump scheme. Period.

But, what makes this particular short squeeze notable in the history of all short squeezes is that it was fueled – and ultimately, turbocharged – by leveraging social media tools, like Reddit and the Robinhood trading app – among other trading platforms like Interactive Brokers (IBKR) and Webull – and has been “successful” enough to inflict serious damage on certain hedge funds, like Melvin Capital Management and Maplelane Capital. In a fit of what-goes-around-comes-around, where small retail traders are typically the victims of short squeezes inflicted on them by larger, professional traders, there is a veneer of justice that has been performed here.

One other key difference with this short squeeze is that it appears to be fueled by more than simple greed. Like the kamikazes of World War II, many participants seem to be hurling themselves into this effort with the primary purpose of causing chaos.

THAT is definitely new…

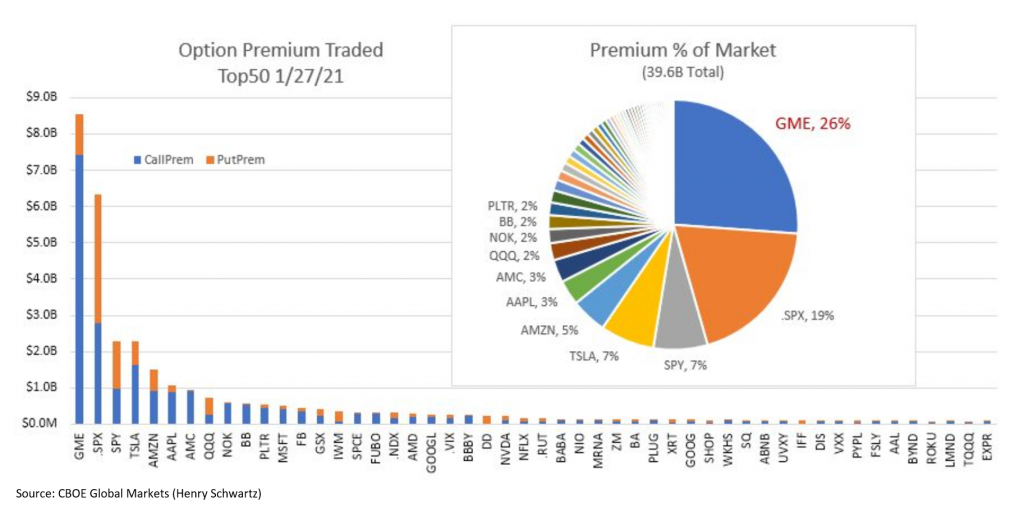

Anyway, the best sense of the impact of this short squeeze is captured in the chart below, from our friend Henry Schwartz at CBOE Global Markets, where a measure of option premiums traded for GME are greater than that of all other securities, as of Jan 27.

Oof! That’s gonna leave a mark…

Now, the mechanics of option markets is the thing that has the potential to cause a series of dominoes to fall, starting with this:

Option markets are a zero sum game in the sense that for every option asset (long call or long put) there is a corresponding option liability (short call or short put). No matter how many options are in existence, the aggregate P/L of the option market nets out to zero. Typically, customers (retail and institutional traders and investors) are net long options while option market makers – the groups that create, or “write,” option contracts – are net short options. Furthermore, in order to hedge the risk of being consistently short options, market makers will buy and sell the underlying stocks. This is known as delta hedging. (For a more detailed discussion on delta hedging, Bloomberg’s “Odd Lots” podcast with Joe Weisenthal and Tracy Alloway, “How SoftBank And Robinhooders Added Fuel To The Stock Market Boom” from September 2020 is worth a listen.)

It turns out, the GME scenario is similar to the Nasdaq Whale trade of 2020, where Softbank was suspected of purchasing huge call positions to force a market melt up in their favor (at a time when they were intent to fill a hole of losses caused by their position in WeWork). In the GME case, sudden and sustained demand in a relatively thinly traded stock can cause a “melt up.” However, since GME had become a favorite short position of hedge funds, significant additional demand to buy GME stock was forced on those hedge funds in order to mitigate the crush of losses on their short positions. Since Jan 13, GME has traded from a low near $20 to a high (today) of $483.

Today, in a move that would seem to snatch defeat from the jaws of victory, Robinhood put trading restrictions on certain stocks, like GME, to curb the mania – and then reversed itself by loosening some of those restrictions. New lawsuits have now been added to their portfolio of challenges…

You can read more details about this saga elsewhere: WSJ, NYT, FT, CNBC – even The Atlantic has a piece out tonight on it. However, the lasting effect of this event is – at least, should – cause a debate, because it represents a new type of problem for capital markets stakeholders – or a more severe version of an existing problem having to do with market structure. And, since Alphacution has developed a unique reputation for tracking and quantifying Robinhood’s business model, the secretive world of market makers, and the thing that binds them together – payments for order flow (PFOF) – before it became mainstream, I wanted to share a few thoughts that are not likely to be found elsewhere…

People need something better to do.

We have forsaken each other in the name of short term profits gradually over the past few decades, and now the playing field has become so absurdly tilted that the masses who feel that they have been left behind – with dwindling hope for purpose; dignity of work; a better future – are using the tools of the modern era to conjure (and attempt to sustain) alternate realities. The Capital Siege and the Epic GameStop Short Squeeze of 2021, among many other incendiary and extreme phenomena, are connected to a much bigger driver in our society. It is the idleness, boredom, hopelessness, economic stress, and general lack of better options for their time and attention, that a growing mass of people have been zombified into willingly seeking distractions from the thing that has become ubiquitous and always nearby. Their phones…

“Free” is rarely, if ever, the best price.

Frictionless and highly gamified environments ignite the basest instincts of human nature. Lubricating people to forego whatever discipline and self-control that they might otherwise have is the intended goal of these environments. And, with sustained exposure comes indelible impacts. We are finding out what happens when we animate our inner Neanderthals in order to eat whatever and whenever we want, play as often as we want, say whatever we want as loudly as we want to whomever we want, trade as much as we want, print as much as we want, spend as much as we want, and borrow as much as we want. In the end, FREE! may be destroying us…

We don’t know the real price of anything anymore.

With the tools of the modern era in hand, we are all witnessing a series of tests for how long alternate realities – no matter how extreme or offensive – can be sustained. If enough people pretend that a fantasy is the truth, can it eventually become the universally accepted truth? Now, the only way that this happens is if there is a force that becomes dominant and immovable in a market, whether that market is a market for ideas or a market for goods and services or a market for securities. Market structures are universal in this sense. A dominant market force can bully all other market stakeholders into accepting that force’s view of what is true. The U.S. Federal Reserve is one of a few market forces we know of that has become dominant enough in capital markets to sustain a manufactured version of truth over an indefinite period of time…

Now, I’m not looking to create a Jerry Maguire moment here – nor am I interested in being labeled as that sanctimonious get-off-my-lawn guy down the block. Far from it. If you’re entertained by pissing your time and money away at the casino or in some online fever swamp, knock yourself out. I’ll be at the bar with a bourbon and a cigar, if they’ll let me.

My goal is simply to point out that aspects of our market micro- and macro-structures have wide ranging consequences – and that the tools of our digital era have forged a level of interconnectedness where we can now see and measure those consequences in ways that could never be contemplated with nearly as much accuracy before. This is how Alphacution’s research into the capital markets ecosystem framework may eventually expand to include a broader economic framework model. Hopefully, there’s a stronger case to be made for modified frameworks that allow “life, liberty and pursuit of happiness” to be within reach of more of us…

But in the meantime, certain things are clear: The Fed is in a terrible pickle that will not end well. The level of moral hazard that started with Alan Greenspan and continues to get worse straight through to this very moment, has thoroughly polluted our markets – and our minds. As a result, the real price of everything is distorted by unreal money and the unreal cost of money, interest rates. And, those markets and the broader economy are dominated by too few players; an incumbency of incumbents who have grown so wealthy and become so perfectly sealed in such luxury and privilege as to become drunk on – and addicted to – their own impunity. In turn, many of those on the outside of this exclusive bubble are literally starting to revolt in ways that may be perversely entertaining to some, but nevertheless are becoming increasingly deranged and violent…

Sadly, I expect the referees – the regulators – have been bought, and therefore, unable or unwilling to do anything bold. We shall see with a changing of the guard in DC. I’m hopeful, but won’t be holding my breath. In any case, if there’s a magic wand to be waved, adding some economic friction (back) into many of these social platforms could minimize certain conflicts of interest and establish a few guardrails. Intermediary concentration risks in listed markets should be measured and minimized. Eliminating labor arbitrage across regions via tariffs or taxes would incentivize local job replenishment thereby starting to give people something better to do than get high and play video games. And, applying our national “super power” – creativity and innovation – to the development of new industries to soak up remaining human capital capacity would each and all go a long way towards rehabilitating what currently seems like its heading towards something dystopian…

Food for thought, until next time…