Having a hunch is one thing. Quantifying that hunch is another thing entirely.

Since its launch, Alphacution’s primary hunch – and a factor that drives its mission – has been that measuring the impact of information technology investments within the financial services ecosystem is 1) super important, and 2) not something that firms currently do very often.

Of course, we are nearly 2 years into an ambitious modeling and framework development exercise based on far more than hunches. There has been a steady flow of evidence and support. Early adoption and consumption of our output by marquee clients and a growing network of prospects, seasoned advisors and friends provides ongoing resources and intellectual nourishment to keep building.

However, on the back of our first webinar – hosted by partner, Aite Group – it was gratifying to ask direct questions to and receive direct answers from a broad and diverse audience. While helping to further galvanize the initial hypothesis, this evidence also speaks clearly to the vast spectrum of players in the financial services ecosystem who potentially haven’t thought about the issues in this way.

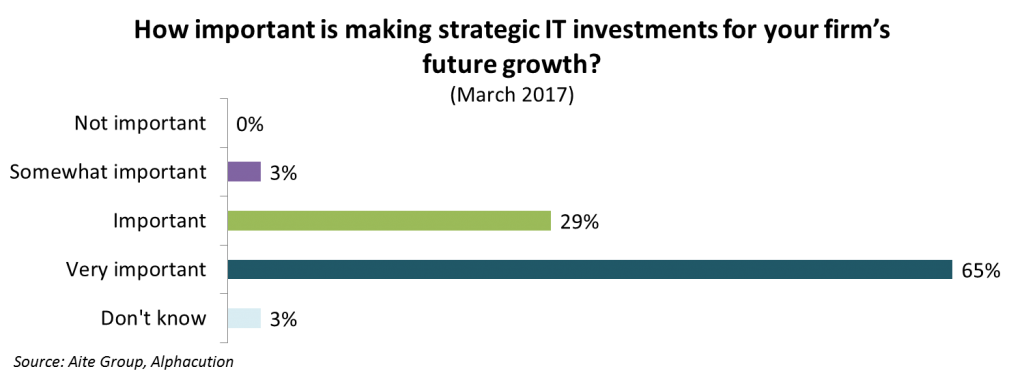

Here’s our interpretation of the results from polling during that webinar: 94% of respondents believe that making strategic IT investments is important for future growth (see Exhibit below).

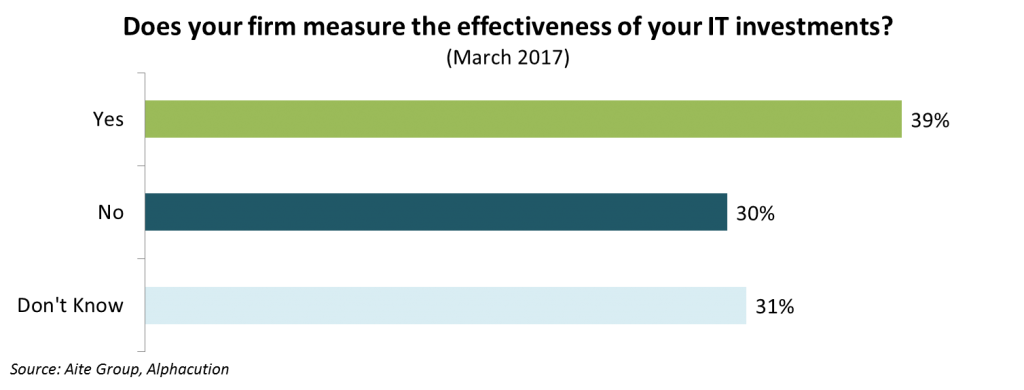

However, in contract to this, only 39% of respondents are confident that any measurement of the effectiveness for IT investments is currently being conducted (see Exhibit below).

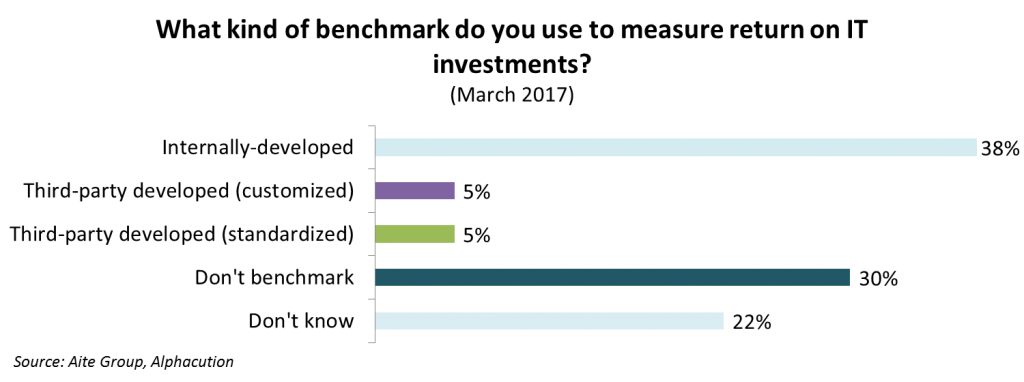

And, most importantly, only 48% of respondents are confident that any benchmarking of return on IT investments is being conducted at all. Of those, a substantial majority (38% of respondents) are currently relying on internally-developed benchmarking frameworks (see Exhibit below).

There is clearly a disconnect here. To us – and our partners and stakeholders – it is a significant unmet need.

Sure, firms can respond to the importance of IT investments with internally-developed measurement tools. This is absolutely a step in the right direction. Inversely, it can also be seen as an indication that banking, financial services and insurance companies are in the early stages of embarking on their own version of lean, “six sigma” methods that require far more measurement of operational data.

That said, one of the pitfalls of internally-developed benchmarks is that 1) they are far less likely to result in comparisons beyond a single enterprise over time (which is a severely constrained sample size), and 2) definitely don’t represent nearly as much potential to become a standard framework within a community of market participants.

Alphacution’s modeling and benchmarking efforts are designed to address these pitfalls, both in terms of sampling and the potential to represent an ongoing standard. The webinar recording below (and also accessible here) is like a tutorial for why and how we are developing this service: