“I’m watching intelligence.” – Jeff Daniels (May 20, 2019)

Alphacution is in the process of “making a market” for intelligence about some corners of the financial ecosystem where there has historically been very very little. Most of what can be learned about the companies we focus on – market makers, prop trading firms, and quant hedge funds – is anecdotal. Hearsay. Rumor. And, of course, the occasional sensationalistic newspaper riff about gargantuan pay days and trophy purchases of real estate, art and toys that float…

Sure, our friends at Hedge Fund Research and Hedge Fund Alert do a great job of keeping track of performance, key executive movements, and even develop strategy indices relating to many of the most fascinating players in this ecosystem – and yet, no one is tying the broader landscape together the way that Alphacution is doing it.

Now, in most cases, these types of firms would greatly prefer to remain as quiet and invisible as possible mainly because information leakage can expedite the inevitable decay of valuable competitive advantages. (And they certainly aren’t soliciting attention from us, in most cases.) But, they can’t remain completely quiet for two reasons: regulatory reporting requirements and recruiting.

Unfortunately (or fortunately – depending on your perspective), regulatory reporting requirements do tend to cause a data trail. Which makes things all the more puzzling to know that surprisingly few have ever tried to assemble a data trail that – as we like to say – is hiding in plain sight and open for anyone to play with.

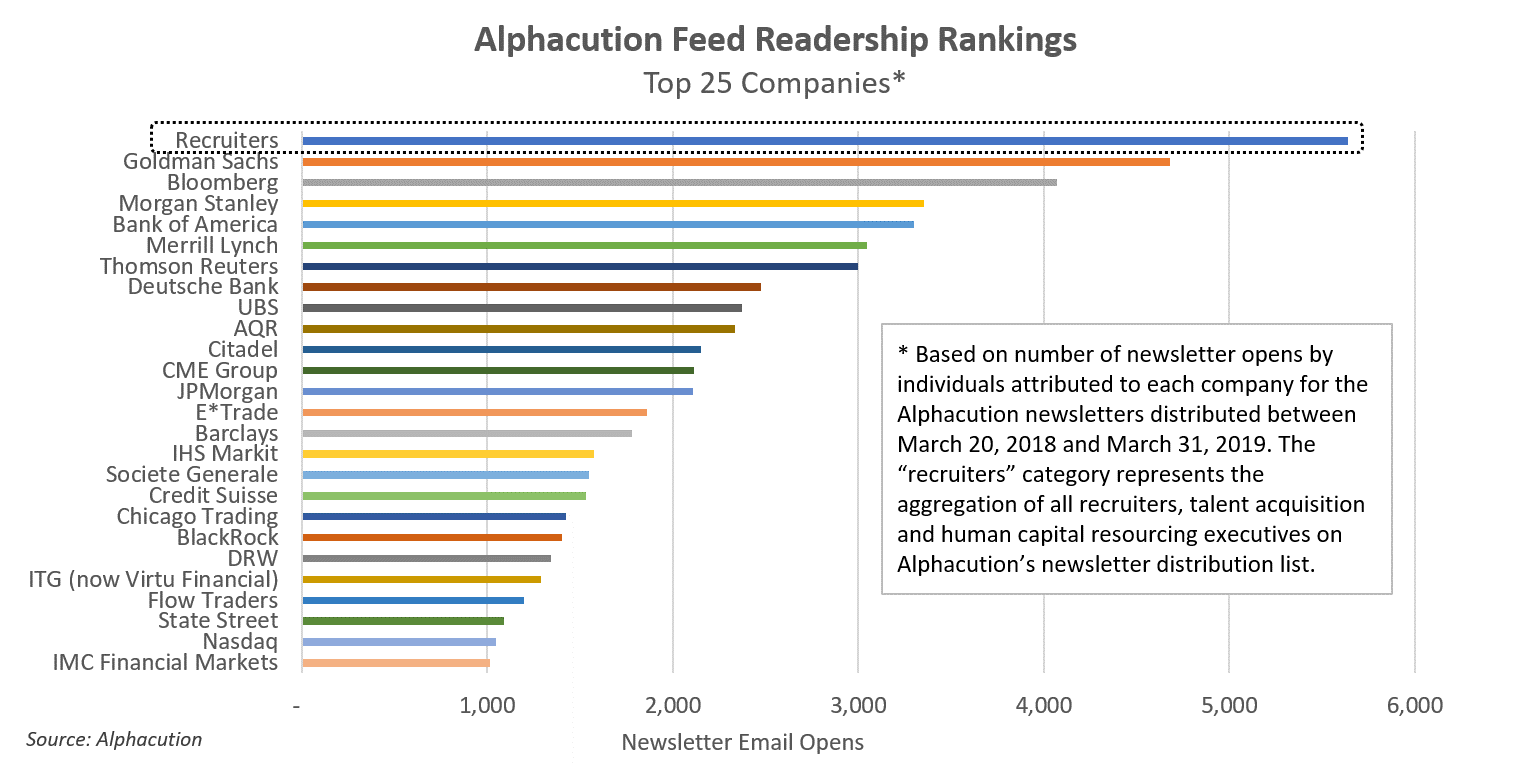

And, the only reason many of these firms engage in any type of marketing is to attract scarce talent. Yes, we must confess, the ping-pong tables, nap rooms and free snacks do tend to grab you where you live, but there does seem to be a longing for something more – which is why we thought our readers would find the picture below illuminating:

Recruiters: Expect a special weekend edition coming up soon.

As for the rest of you: It seems you are all in quite good company.

In all seriousness, thanks for your attention and support. Please keep it up. We are just getting started…