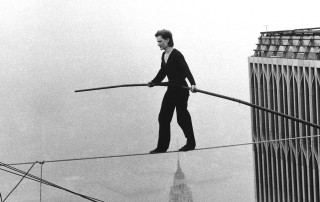

Trick Shot: Robinhood Underwrites MEMX

“Principles for the Development of a Complete Mind: Study the science of art. Study the art of science. Develop your senses - especially learn how to see. Realize that everything connects to everything else.” - Leonardo da Vinci If there ever was a time to see how things are connected to other things, it is now. This is particularly true in places where something that is "free" is interpreted to be "without cost." After all, like "free" drinks at the casino, human nature tends to regress to its most lizard-like tendencies when presented with a frictionless environment... When will we ever learn that "free" is never the best price? Anyway, without becoming distracted by a rant about the true cost of Facebook, et al, let's take a brief look at the impact of "commission-free" trading on the macrostructure of the US market ecosystem over a very short window since October 2019: Thanks, in large part, to the popularity of retail broker, Robinhood Financial, LLC ("Robinhood) - the upstart financial [...]