“Endurance is not a desperate hanging on but a traveling from strength to strength.”

Eugene Peterson

The Market Walks in the Shadow of the Concentrated Pain to Come

Why structurally and economically it is the correct time to act with derivatives…

I am writing this for my fellow equity derivatives practitioners and portfolio managers. My sole focus here is to ask a serious question: If the following metrics are as compelling as I believe, is there career risk in not taking advantage of that opportunity?

The opportunity I am referring to is using options to 1) hedge against recent and dramatic market outperformance, or 2) at least, hedge against significant tech sector outperformance, or perhaps 3) to apply a tactical option overlay given a) the low implied volatility and b) ultra-low skew that are being impacted by an all-time low in realized correlation…

Much of the equity landscape is being driven by unprecedented concentration in a few mega-cap stocks, as we all know. This represents potential dangers that extend beyond the influence of correlation and volatility. This level of concentration ultimately jeopardizes market stability, as I will demonstrate.

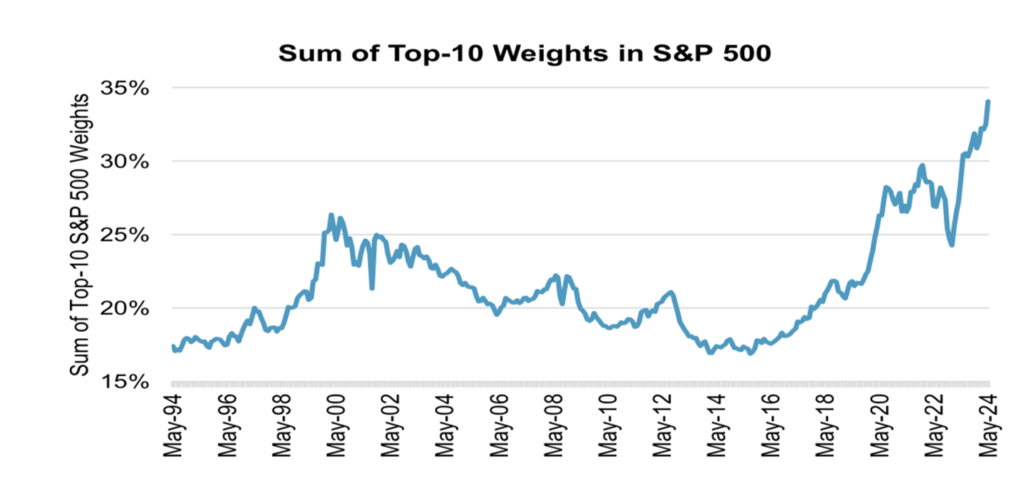

The relentless ascent of tech titans – such as Nvidia, Microsoft, and Alphabet (Google) – casts a shadow over US equity markets. Despite all-time high concentration of top 10 weighted constituents in the S&P 500, as shown below, there is a perception of calm…

Moreover, the weighting of US stocks within global equity allocations have risen to 30-year highs even with the expansion of equity capital markets geographically, as shown below…

That said, historically high levels of market concentration are not the sole motivation for this note. Central to my concern is the issue of market correlation. When a select few companies amass an outsized share of market capitalization their daily movements can become inextricably intertwined. For example, the intense thematic focus on all things artificial intelligence (AI) over the past 18 months has further exacerbated market concentration as these mega cap tech companies have continued to get bigger still; riding the euphoria of the AI frenzy. Now, more than ever, any fluctuations in these giants’ stock prices reverberate across the market.

If these reverberations were to happen simultaneously it would lead to increased correlation among stocks…

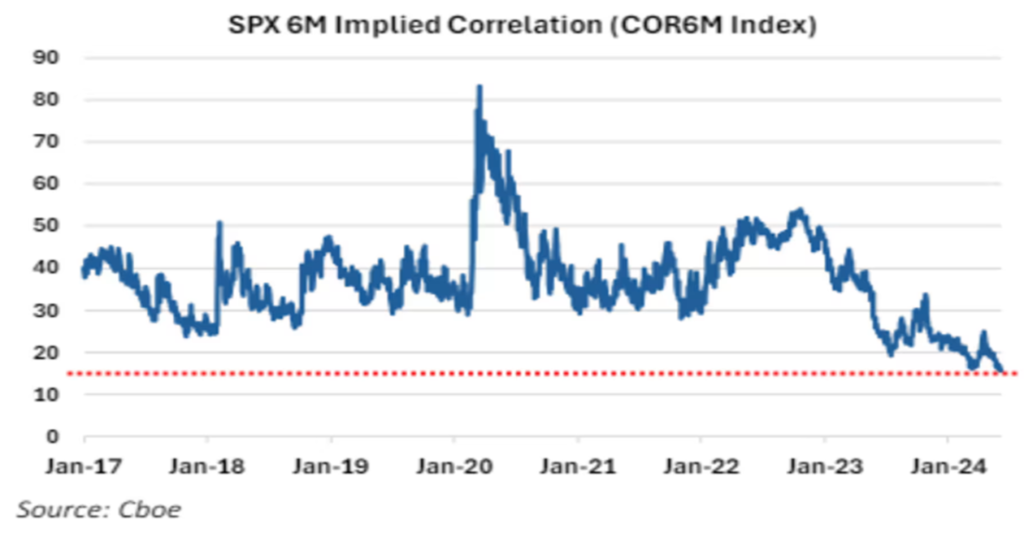

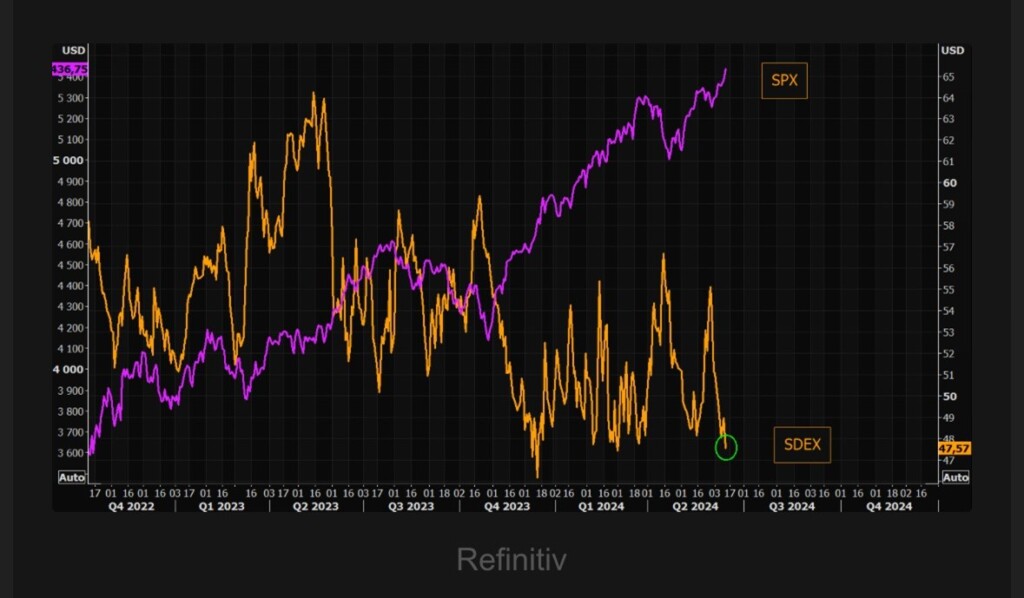

Consequently, investors face increased risk as diversification loses its efficacy, eroding the traditional buffer against volatility. Today, there has never – in the history of the S&P 500 – been this much concentration. And, the risks have been muted to an unprecedented degree because of historically low correlation, as shown below…

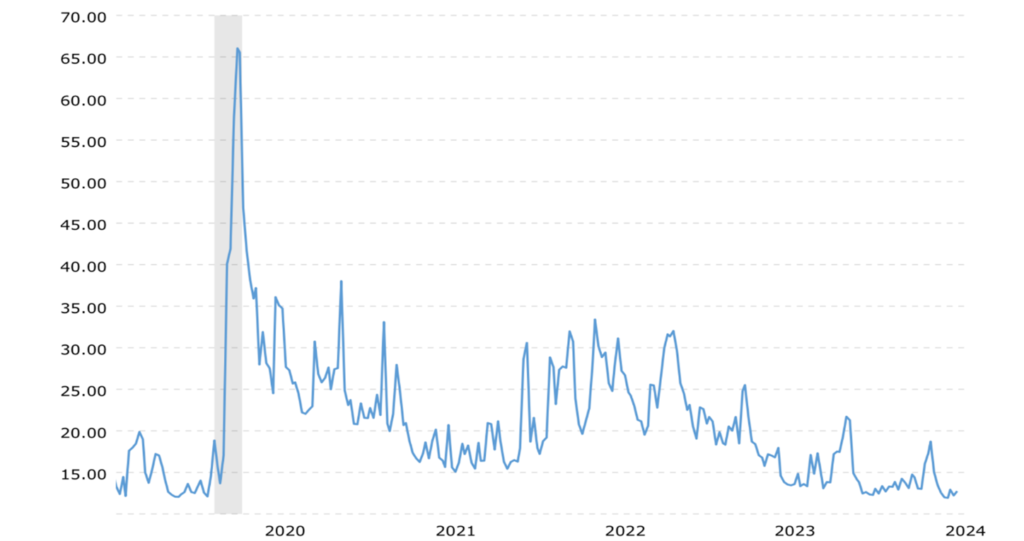

Long story short, the above creates a very low volatility environment, as shown by the CBOE Volatility Index (VIX) chart below:

The shift from abnormally low levels of correlation to just median levels will quickly elevate volatility, and an important pricing component of hedging options, skew, which will then sharply readjust to higher levels and therefore more expensive hedging costs. The magnitude of this hedging cost increase is not insignificant as practitioners are aware.

Concentrated market capitalization can amplify market volatility just as easily as it can reduce volatility when these large cap names move in opposite manners, rendering it susceptible to sudden swings and downturns. The disproportionate influence wielded by mega-cap companies magnifies the impact of their actions, be it quarterly earnings miss or regulatory scrutiny as could be the case with AI. Given this potential impact, market movements could become exaggerated, with even minor disturbances triggering cascading effects, destabilizing investor confidence and sowing seeds of uncertainty.

This increase in correlation with large cap tech names moving down simultaneously happened in October of 2018. The large cap tech sector fell almost 9% on the month which pulled the broader market down 6%…

Furthermore, market concentration exacerbates systemic vulnerabilities, as the interconnectedness of mega-cap companies deepens. Their influence transcends industry boundaries, permeating sectors ranging from technology and finance to biotech and healthcare. The advent of AI and game-changing drugs such as Ozempic illustrate the breadth of sector impacts. Any disruption within these giants reverberates across the economy, amplifying systemic risks and magnifying the potential fallout of market concentration.

Volatility Control and Risk-Parity funds could be particularly suspect to aid in exacerbating a return to normalcy in correlation. The cascading effects that might ensue from a challenged posture like October 2018 could be substantial given the glaringly overt potential for some mean reversion in both correlation and then volatility. It has been estimated recently that Volatility Control funds have roughly $360 billion in AUM and given their nature to rebalance quickly to adjust to elevated risk on environments, you can clearly see the potential…

Additionally, a little known (outside of capital markets pros) market structure calendar issue – the “stock buyback blackout window” – is fast approaching. This is the date range that encapsulates most large equity constituents that are about to enter a “quiet period” before their respective earnings release dates. During these blackout windows the companies are not permitted to engage in corporate actions with their own equities, such as buying back their own stock. This continues for a brief time after earnings release as well. I bring this up because of the proven stabilizing effects of corporate stock buybacks. The lack of ability to buy their stock during these windows should in theory remove some support if turbulence were to arrive. This blackout window should begin roughly now and extend just past the earnings release dates.

Let me recap here to review the metrics mentioned that drive my thesis:

- Substantial recent positive performance of broad-based US equity indices since January 2023 of 40%

- Mega cap concentration of market near all-time highs of 35% (top 10)

- Realized correlation moved down to historic low creating compressed realized volatility in broad market

- Given the above, severely compressed implied volatility AND skew in options creating advantageous costs to deploy options

- Risk Parity and Volatility Control funds will need to meaningfully adjust exposures in broad market tech from elevated overexposure because of mega cap concentration weightings and thematic stock chasing by anticipatory earnings growth as correlation normalizes and volatility rises

- Imminent blackout window for corporate stock buybacks not supporting equities

To be very clear, I am NOT suggesting the broad equity market will correct in the immediate future; however, I am suggesting the cost to deploy options defensively or even tactically seems to be as compelling as I have seen in my career in equity derivatives…

So, to my question, is there career risk in NOT acting now? I say definitively YES.

I understand the rise of tech giants has reshaped the stock market landscape and fueled unprecedented wealth creation. It has also ushered in an era of exposure to heightened correlation and volatility risk which could become systemic. By acting to address this issue now with the recognition that the cost to deliver a proactive risk reducing/profit capturing (or even tactical deployment) can only be viewed as prudent. The dangers inherent in concentrated market capitalization warrant taking measures to deal with the inevitable pain that will result from this ultra-high equity market cap concentration.

Never be a man who knows the price of everything, but instead be a man who knows the value of something…

Happy hedging.

Don@CurvedEdgeStrategies.com