“Whether you think you can or you can’t, you’re right.”

Henry Ford

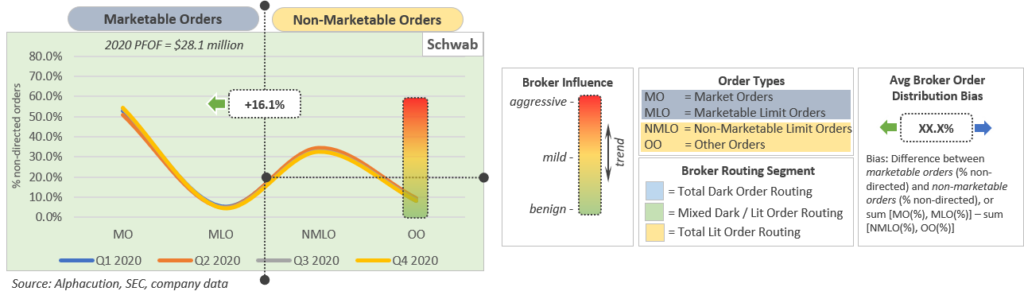

In Part I of Alphacution’s case study on payment for order flow (PFOF), we focused mainly on the rates paid by wholesale market makers to retail brokers under a full range of securities categories and order type scenarios. Here, in Part II, we turn to focus on a concept called broker personas. Alphacution’s working hypothesis on this topic is that each retail broker – in fact, all order flow intermediaries – have a unique persona. This persona – a unique pattern formed by order type distributions – is a distillation of client trading behaviors. It can be detected in regulatory data – and supported by operational and financial data – from those retail brokers.

Now, a large part of broker persona results from investor demographics. Generally, older and wealthier retail investors can be detected from analytics such as larger average account sizes. Younger and beginner investors can be detected this way, as well. But investor demographics – average account sizes, average order sizes, and the like – do not explain the entire scope of broker persona. Since all – or, at least, a vast majority of – retail investors now interact with U.S. listed markets through broker-developed trading platforms, retail brokers can influence client behaviors – level of trading activity, level of trading sophistication, security selections, order type selections, etc. – via software design and educational tools. Alphacution is calling this factor broker influence; making it another key component of broker persona…

In this presentation, Alphacution begins by showcasing the timing of the transformational shift in U.S. retail trading activity. Prompted by the growing success of Robinhood, the move by TD Ameritrade and other leading retail brokers to a zero-commission framework in early October 2019 fuels an explosion in retail trading activity months ahead of the pandemic lockdown in March 2020. A sample of leading retail-oriented brokers – including TD Ameritrade, E*Trade, Charles Schwab, and Interactive Brokers (which is geared more towards individual professional traders) – all display unprecedented increases in trading metrics beginning Q4 2019. [Note: With the acquisition of E*Trade by Morgan Stanley and the acquisition of TD Ameritrade by Charles Schwab – both of which close in mid-2020 – specific data output from the acquired companies end in June 2020 and August 2020, respectively.]

From there, we get into a detailed comparison of order type distributions for our sample of 11 retail-oriented brokers across the 3 securities categories found in Form 606 reports – S&P 500 stocks, non-S&P 500 stocks, and options. This order distribution by broker analysis culminates in three detailed dashboards, representing each of the securities categories, a sample of which – and the legend to interpret – is as follows:

What we find in this analysis is illuminating. With limited exceptions (including, and especially, Robinhood), broker order type distributions are remarkably internally consistent through the four turbulent quarters of 2020. And yet, there is a range of variances between each of the broker order type distributions in the sample. In other words, they each seem to display unique personas. Alphacution believes that these personas are partly due to investor demographics (including demographic targeting) and partly due to broker design…

Furthermore, when we broaden our perspective to consider that retail brokers are now compensated for trade flows largely by their wholesaler counterparts, we see a clearer picture of how desired outcomes could be manufactured. Robinhood pioneered, and ultimately perfected, this approach to such an extent that they’ve had to eliminate certain gamification techniques – no more confetti bombs! – while the aggregate impact of all retail brokers adopting a similar frictionless revenue model has created a new juggernaut of retail trading forces in U.S. listed markets that all other (primarily institutional) players are now scrambling to adjust to it…

The question (from Part I) remains: To what end?

The full presentation is available to premium subscribers here.

Until next time…